Public real estate: the window is still open

Through an analysis of public and private real estate data, the Portfolio Construction and Strategy Team highlights the current opportunities within the public property sector.

5 minute read

Key takeaways:

- The current underperformance by public REITs suggests that a lot of the negative news over the past 12 months has already been priced in.

- With the end of central banks’ rate tightening efforts seemingly in sight, forward-looking real estate valuations may be close to their low point in this cycle.

- In a higher-interest rate environment, having less debt can materially increase the stability of REITs. Those REITs with less debt may be able to capitalize on buying opportunities.

In their latest mid-year review, the Janus Henderson Global Property Equities Team discussed their outlook for the listed properties sector. We share the team’s constructive view and see opportunity in REITs going forward.

We base our case on three reasons, namely:

1) Public REITS continue to trade at a high discount to NAV and have historically enjoyed much stronger performance following periods of steep discounts.

2) The move towards the end of the rate rise cycle materially benefits REITS.

3) Debt levels are now materially lower now than the average over the previous decade.

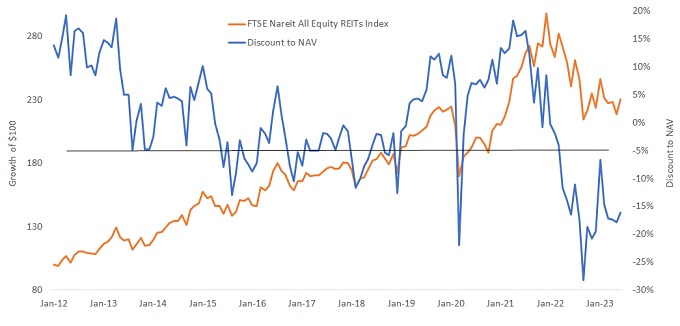

High discount to NAV = the opportunity

Over the past 10 years, REITs have on average traded at par to the Net Asset Value (NAV) of assets held. There is no doubt that this relationship has been volatile, showing a premium half the time (averaging c.9%) and a discount the other half (averaging c.7.5%). The discount posted by REITS on 30 June 2023 was 16%, well in excess of the historical average. This is despite a significant improvement from a discount of 28% at the end of 2022.

If this discount continues to shrink, in line with what we have seen in previous discount periods, we believe that REITs offer attractive opportunities at current valuations.

Exhibit 1: The discount to NAV on public REITs remains close to a decade-long high

Source: Morningstar Direct, Public REITs: FTSE Nareit All Equity REITs TR USD, 31 January 2012 to 30 June 2023. Discount to NAV data from Green Street Advisors (at 30 June 2023). Past performance does not predict future returns.

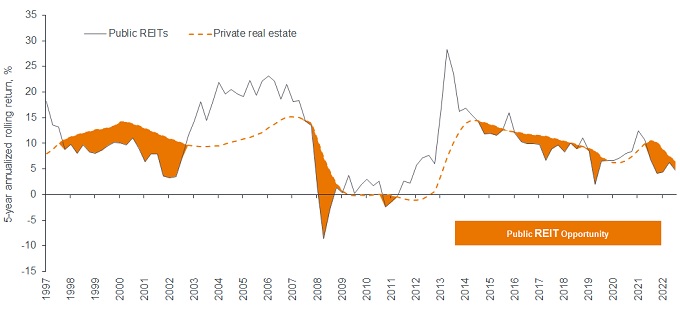

In our previous article, titled “Public versus private real estate: similar assets, different prices”, we highlighted that over the longer term, public and private real estate assets produce similar performance. However, in the shorter term, the return streams will diverge. This is usually because the traded value of public REITs adjusts daily to reflect market expectations and conditions, whereas private real estate is lagged (by up to 18 months).

Exhibit 2: With public REITs currently trading at a 16% discount, we see potential for outperformance

Source: Morningstar Direct, Morningstar returns for FTSE Nareit All Equity REITs and NCREIF Fund ODCE, 1 January 1990 to 30 June 2023. Discount to NAV data from Green Street Advisors. Past performance does not predict future returns.

The current underperformance by public REITs suggests that a lot of the negative news over the past 12 months has already been priced in.

Exhibit 3: The window is still open…

Source: Morningstar Direct, Public REITs: FTSE Nareit All Equity REITs TR USD, Private real estate: NCREIF Fund ODCE, 1 January 1995 to 30 June 2023. Past performance does not predict future returns.

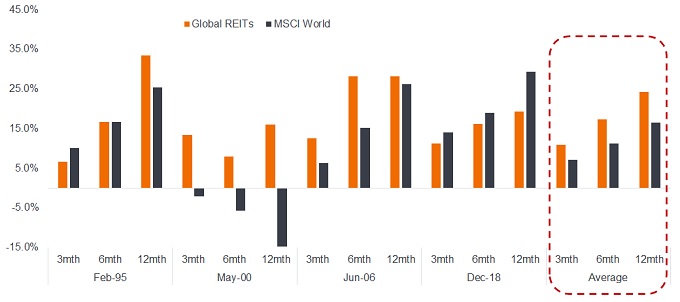

Rate rise cycle nears its end: performance beckons?

As we write this in the third quarter of 2023, most major central banks around the world seem to be either at or near the end of the rate tightening cycle.

The real estate sector is highly sensitive to interest rate movements. In most cases, the higher the interest rate, the lower the expected valuation. As we approach the end of rate rises, forward-looking valuations for real estate are likely closer to their low point in this cycle, if they have not bottomed already.

History suggests that there may be opportunities in REITs following the end of rate rise cycles. As Exhibit 4 shows from previous cycles, REITs have outperformed equities in the months following a US Federal Reserve (Fed) pause.

Exhibit 4: REITs vs global equities after a Fed pause – 3, 6 and 12 months

Source: UBS, Datastream, Janus Henderson Investors Analysis, as at 31 December 2022.

Note: Global REITs: EPRA Developed; Global Equities: MSCI World. Data from 1991.

Past performance does not predict future returns.

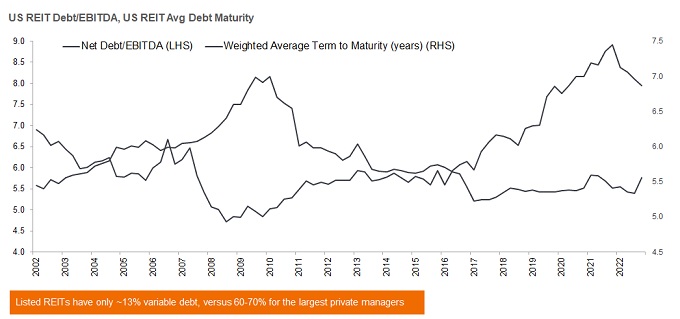

Is lower leverage leading to better opportunities?

The current scenario of high financing rates and higher-than-average vacancy rates mean that assessing the quality and fundamentals of REITs is very important. Overall, we have seen leverage on listed REITs trend down and lower debt levels than the historical average going back five years and longer. In a higher-rate environment, having less debt can materially increase the stability of REITs.

While expectations are increasingly turning towards interest rates cuts, this is not likely to occur until well into 2024. In the meantime, we would expect that some highly levered REITs (both private and public) suffering from higher financing costs may be forced to sell assets. The likely winners would be REITs with lower levels of debt, which we would expect to be better positioned to capitalize on buying opportunities.

Exhibit 5: Less levered REITs with longer debt maturities can benefit during periods of higher funding costs

Source: NAREIT, S&P Financial, Green Street, Janus Henderson Investors Analysis, 1 January 2002 to 31 March 2023. Citi Research for Variable Debt, as at 13 December 2022.

REITs within a portfolio

During our portfolio consultations, we find that clients have no or very low exposure to REITs. This is despite it being an asset class that can provide diversification benefits, as well as unlocking alpha potential. However, REITs are not all equal. Quality matters, probably more than it has in the past decade. Thus, assets in attractive locations, in attractive and energy efficient buildings, and with sustainable financing costs, are likely to be winners over time. As the price of some of these assets have aggressively and overly corrected, we believe current valuations still offer attractive entry points.

—–

Important information:

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

Alpha compares risk-adjusted performance relative to an index. Positive alpha means outperformance on a risk-adjusted basis.

FTSE Nareit All Equity REITs Index tracks the performance of the US real estate investment trust (REIT) market.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.