Quick View: March U.S. CPI – Three times makes a trend

Head of U.S. Fixed Income Greg Wilensky discusses the implications of stickier-than-expected inflation on both the trajectory of monetary policy and financial markets.

4 minute read

Key takeaways:

- Driven by wage-sensitive core services, March U.S. inflation data again exceeded consensus expectations.

- While a rate-cutting cycle is likely delayed, we believe that the Federal Reserve (Fed) remains intent on easing restrictive policy to better position the economy for a soft landing.

- Just as the market enthusiastically interpreted the Fed’s dovish rhetoric at the end of 2023, we believe the backup in shorter-dated Treasury yields has now become detached from the more likely path of policy rates, even if inflation takes longer to fully normalize.

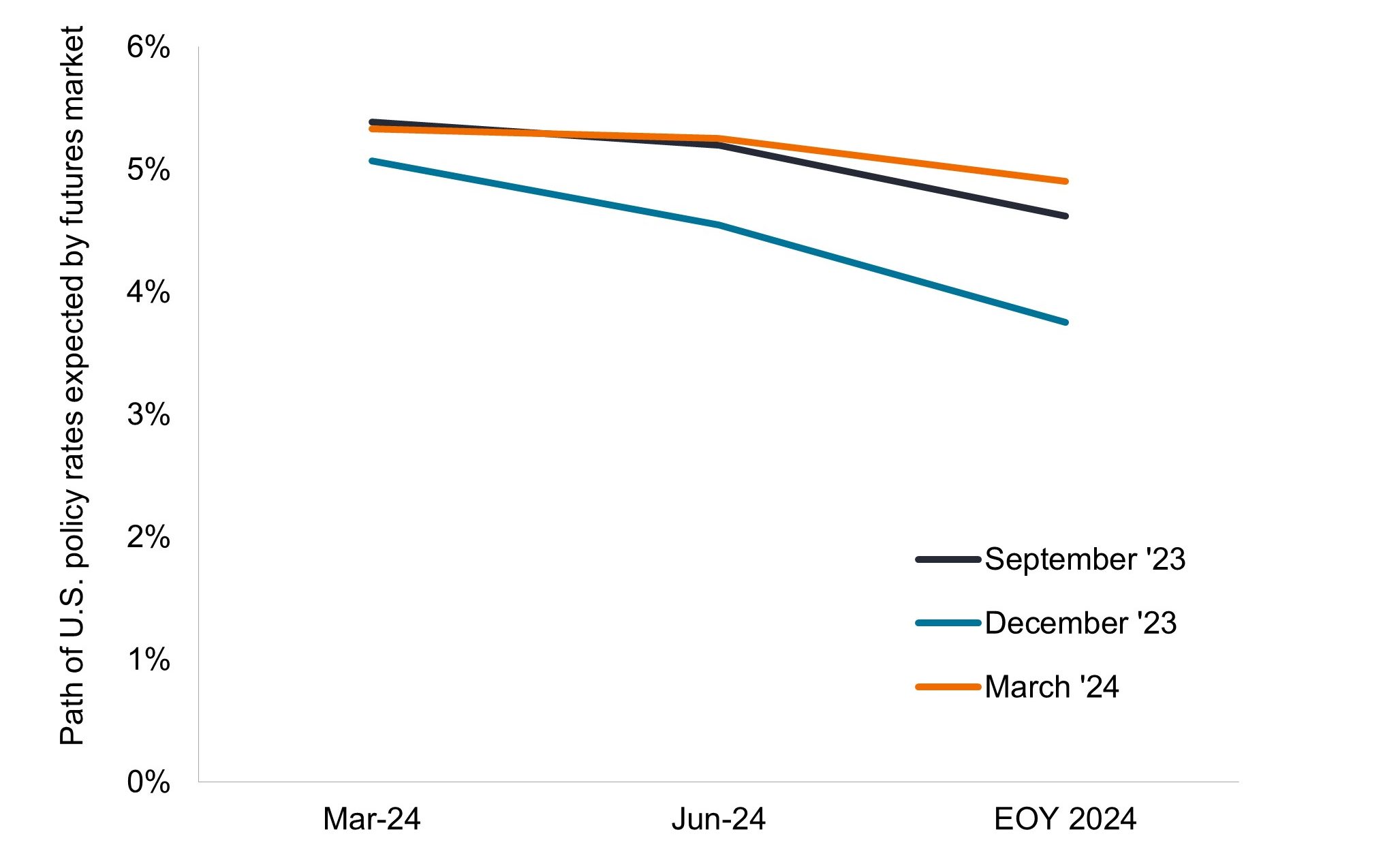

Recent caution by the Federal Reserve (Fed) – and the market – proved merited as U.S. inflation data once again surprised to the upside. With declines in consumer prices seemingly stalled, the market recalibrated its expectation for the cadence of future rate cuts after aggressively pricing in a more dovish scenario at the end of last year.

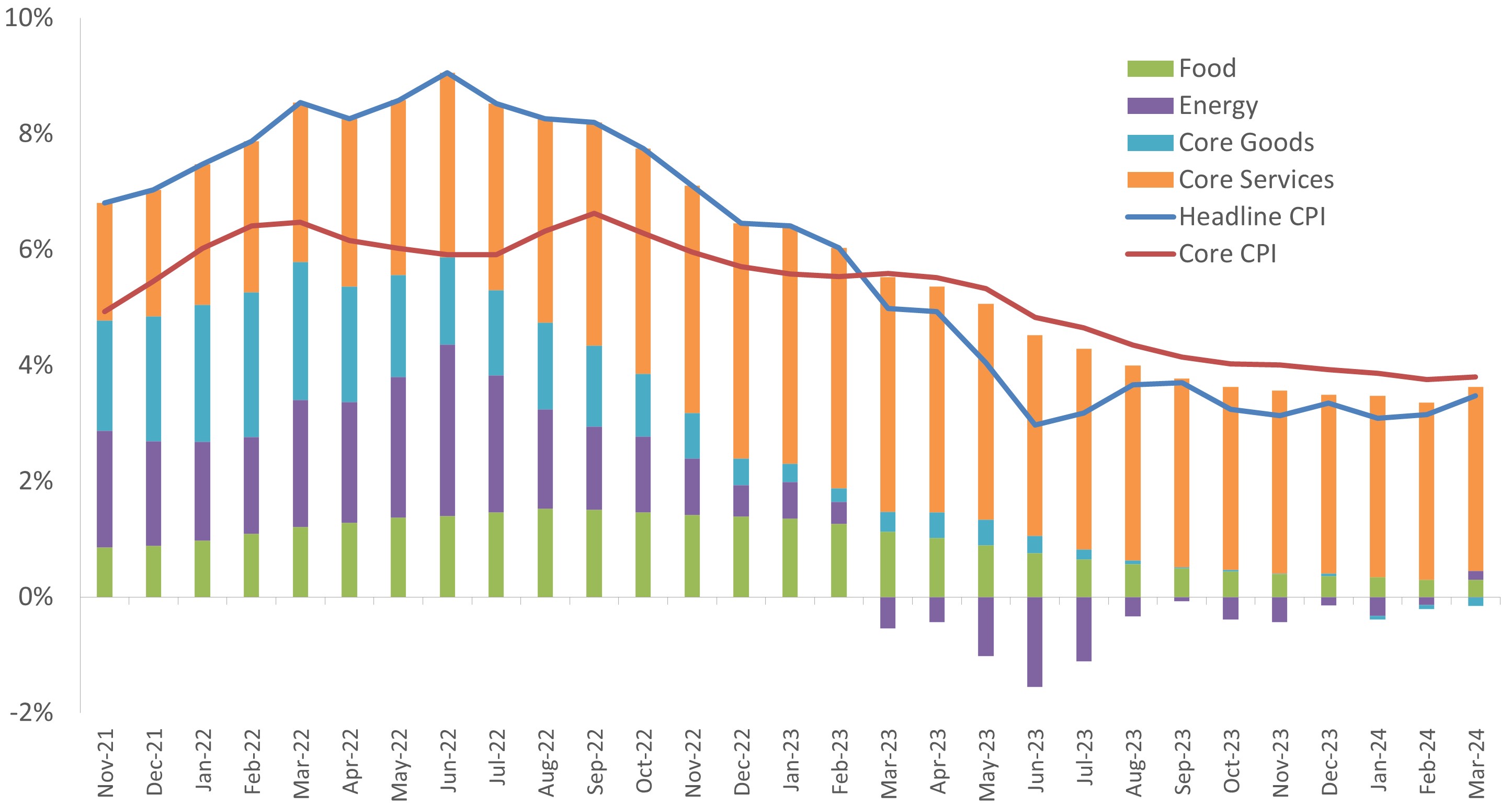

March’s U.S. consumer price index (CPI) data showed inflation coming in only modestly higher than what consensus estimates had expected, but it was more meaningfully higher than what the Fed and market wanted. Core prices – excluding food and energy – rose 0.36% on seasonally adjusted basis. While this print only barely rounded to the 0.4% headline grabbing number, the succession of upside misses was a wake-up call for those that had still been expecting a rate cut at the Fed’s June meeting.

Looking under the hood, the most disappointing data for those in the “inflation is moderating” camp include continued gains in the core services ex shelter bucket, which was driven by high motor vehicle services and medical services, and a snap back in the food away from home category. Reflected in each of these categories is evidence of a resilient labor market as workers are still able to exercise a degree of leverage when seeking to extract higher wages.

JHI

A silver lining for the Fed – if one can be found – in an overall disappointing release is a return to modest deflation in core goods after last month’s jump. Another positive is moderation in the shelter categories finally coming to pass as the well-documented lags in these data finally feed through.

Breakdown of U.S. CPI

Yes, the typically volatile categories of food and energy rose, but the trend likely commanding the Fed’s attention is the degree to which wage-driven services prices have proven sticky.

Source: Bloomberg, as of 10 April 2024.

In our view, while investors should not completely rule out a June rate cut, they should not be expecting one, either. It seems like the most likely remaining path to a June cut is one that involves a geopolitical event or shockingly bad labor data. In this respect, investors cheering on the continuation of a rally in riskier assets should be careful what they wish for.

Not so fast

Forward-looking markets had been too enthusiastic in welcoming the Fed’s December dovish pivot, but in the ensuing months, both investors and the central bank have dialed back expectations in the wake of slower-than-expected progress on inflation.

Source: Bloomberg, as of 10 April 2024.

Source: Bloomberg, as of 10 April 2024.

This release will undoubtedly disappoint the Fed. On the other hand, it will serve as validation for the U.S. central bank’s recent circumspection as the ghost of the premature pivots of the 1970s hang over it. Importantly, while recent developments will likely delay the timing of the first rate cut, we do not believe this changes the narrative that the Fed is looking to become less restrictive – and we consider 5.5% restrictive by any measure – by lowering rates as soon as it feels it is appropriate, and that it is well positioned to act aggressively if the economy falters.

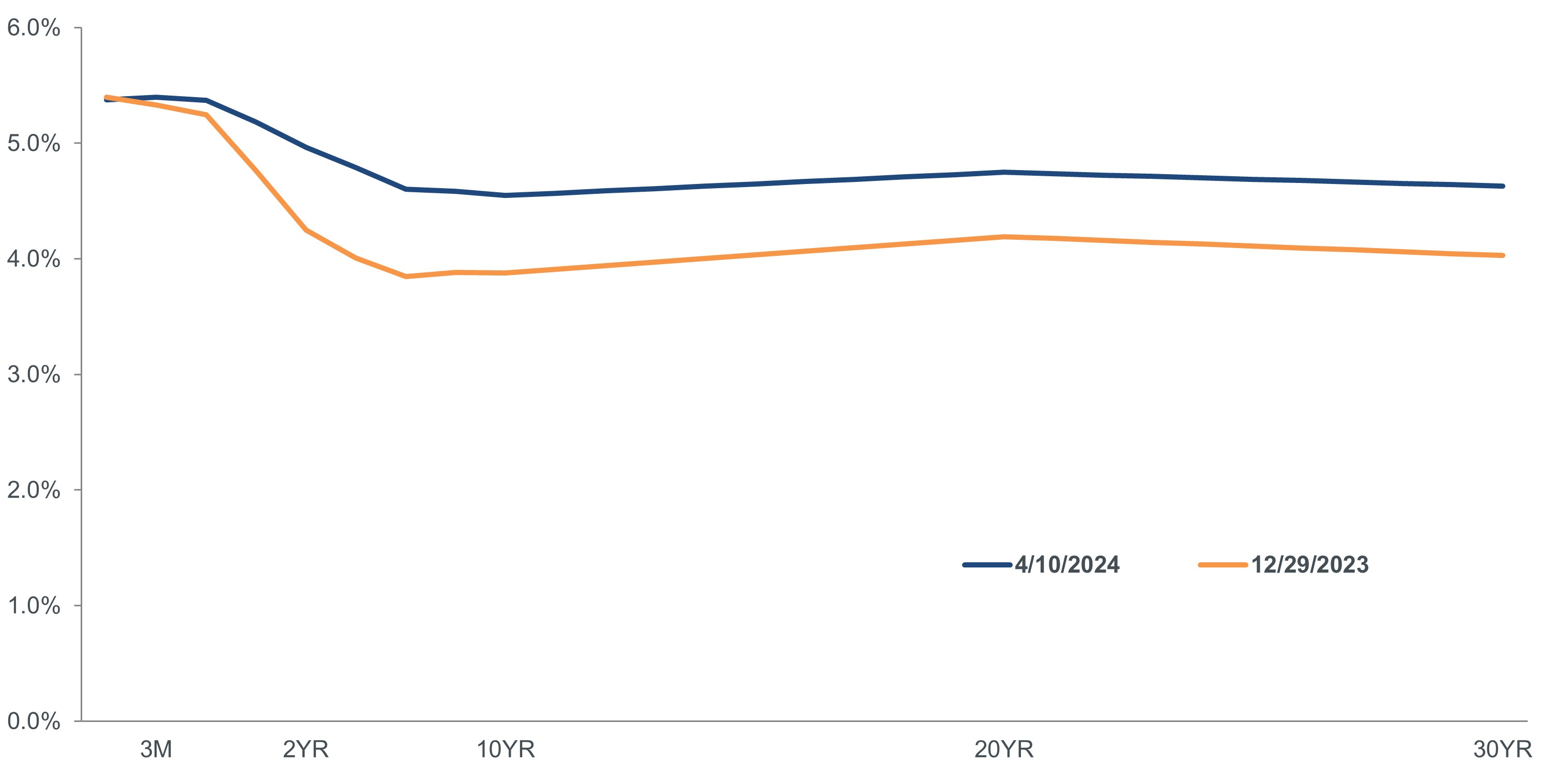

We are not surprised by the market’s reaction of substantially reducing the odds of an initial 25 basis-point (bps) rate cut in June. Nor do we think it’s impractical to downwardly revise expectations for the total number of cuts expected in 2024 to just two. That said, we do consider Treasury yields’ massive year-to-date upward move (with that of the 2-year note trading near 4.97%, up 0.23% today and 0.7% since year end) a moderate overreaction. Underpinning this view: Both Core CPI and the core personal consumption price index (the Fed’s favored gauge) are already materially below the federal funds rate. The former increased 3.8% in the last year, and the latter will likely show less than a 3% increase. Monetary policy is restrictive, and, in our view, it is a matter of when the Fed starts easing, rather than if.

An overreaction?

The backup in U.S. yields in 2024 has been notable, but the yield on the 2-year note – at just under 5.0% – may be hard to justify given the more moderate reading seen in the Fed’s favored inflation gauge.

Source: Bloomberg, as of 10 April 2024.

Source: Bloomberg, as of 10 April 2024.

Certain segments of the bond market have been quicker to price in a delay in rate cuts. Being closer to what we would consider to be fair value, we believe that increasing exposure to higher-quality, shorter-dated issuance could be merited in a diversified bond portfolio. Also, the longer policy rates stay above 5.0%, the greater the chances that the economy could eventually falter. Notably, U.S. securitized products are doing a better job of pricing in the possibility of these economic headwinds manifesting than are corporate bonds.

2-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 2 years from the date of purchase.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.