Tennis is a sport of precision, agility, and strategic thinking. When investors aim to build a thematic investment, a strategic and thorough approach in terms of portfolio construction is key to success. Thematic investing presents equity investors with the unique opportunity to gain exposure to forces that are rapidly reshaping the global economy, with technology, healthcare and real estate expected to provide attractive opportunities and an enhanced long-term return potential.

The Portfolio Construction and Strategy (PCS) Team at Janus Henderson uses their expertise and advanced technology, specifically the award-winning Janus Henderson EDGE™, to highlight key considerations when putting thematic investing into practice. Reading the court Just as tennis is an exciting and fast-paced game to watch or play, our world is constantly changing, and financial markets with it.

At Janus Henderson, we have been navigating change on behalf of our investors for more than 90 years and we believe there are currently three instrumental macro drivers, as part of the structural change and thematic narrative, that are leading to seismic shifts in geopolitics, demographics and the availability of capital.

Exhibit 1: Global challenges combined with societal shifts leads to structural change

2025 has seen shifts in political leadership globally, intensifying social unrest and reshaping international relations. This realignment has led to new alliances, increased tensions, and escalated conflicts, profoundly influencing trade and global supply chains. The implementation of unprecedented tariffs by US President Donald Trump and the initiation of his “new era of American foreign policy” within his first 100 days solidified this trend. It transformed global trade for the foreseeable future and necessitated strategic recalibrations among existing trade and geopolitical alliances.

Navigating change requires differentiated insights, expert analysis and proactive investment strategies to capitalise on opportunities. In recent years, ‘thematic investing’ has grown, both in use and in terms of investors’ awareness. This is partly due to the recognition of how incorporating themes into portfolios can potentially benefit performance. Another reason for thematic investing’s apparent ubiquity is the concerted marketing effort by many asset managers to rebrand existing strategies as ‘thematic’ to attract flows going into the space. Given the scale of interest, investors need to be aware of the benefits and the challenges.

In both tennis and (thematic) investing, consistency, strategy, and adaptation to evolving conditions are crucial to success. Each decision impacts the next, and a well-considered plan, executed with precision and adaptability, often leads to achieving the ultimate objective, be it winning the match or realising your investment targets.

Game, Set, Match

In tennis, games create a set, and sets create a match. Identifying transformative themes that reshape societies and economies is akin to winning the points to win that set and match. These themes represent the potent forces behind companies poised to disrupt industries and potentially become the next Google or Apple.

From a portfolio construction perspective, the potential for alpha is significant, as are the diversification benefits of integrating a themes-based framework into an allocation process. Furthermore, the successful identification of winning themes could potentially generate returns irrespective of a market or economic cycle. With respect to identifying themes that can deliver on expectations (or winning matches), there are several considerations:

Breadth: Some themes can be quite narrow, both in definition and in the range of available securities. This presents risks, namely concentration and liquidity. Alternatively, other themes may be so broad that the link between the theme and return is tenuous. The most effective thematic strategies lie somewhere in the middle.

Placement: Thematic investing does not naturally fit into the traditional approach to portfolio construction, where investors typically start with regional and sector breakdowns. A theme can cover multiple sectors, meaning effective portfolio construction requires close examination of each holding to determine the optimal mix to achieve the desired exposure.

Timing: Theme timing is as impossible as market timing. Therefore, just as one would do when constructing a portfolio of individual securities or funds, investors need to prioritise diversification to increase the chances of hitting their objectives.

What is the difference between a thematic and a sector fund?

At a high level, a theme is the structural change occurring in society. A thematic fund can be focused solely on that theme. As we explain later, this can have benefits but in our view many that we see are too narrow in focus.

In contrast, a sector fund may have exposure to a range of themes. Or simply be a collection of holdings from across a sector chosen with no reference to overarching themes.

All-court player: A diversified approach to constructing a thematics portfolio

Wimbledon is one of the four prestigious tennis tournaments known as the ‘Majors’ or ‘Grand Slam,’ along with the Australian Open, French Open, and US Open. What differentiates the four tournaments is their court surface – the Australian Open and US Open use hard courts, whereas the French Open uses clay, and Wimbledon uses grass. This difference significantly impacts the speed, bounce, and overall play style of each tournament.

A world class champion has a diversified game that adapts to different conditions in the same way that a successful portfolio has a diversified set of exposures and opportunities to increase the chances of success.

Correlation benefits

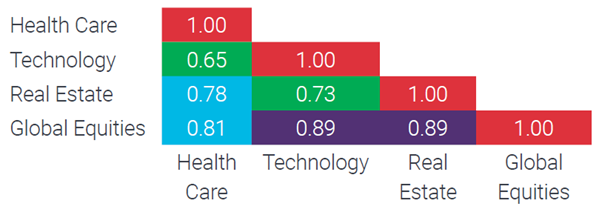

Regardless of fluctuations in economic or market cycles, thematic investing – if utilised well – should be capable of generating long-term positive returns. By using a series of MSCI sector indices as benchmarks, we can observe the substantial risk mitigation and diversification advantages that thematic strategies can integrate into an existing equity allocation.

Exhibit 2: Correlations among sector equity indices are lower than for global markets

Source: JHI Edge™, Global Equities = MSCI ACWI NR USD, Healthcare = MSCI World/Health Care NR USD, Technology = MSCI World/Information Tech NR USD, Property = S&P Global REIT NR USD, as at 30 March 2025. Past performance does not predict future returns.

Long-only equity strategies often exhibit relatively high correlations with one another. Healthcare, as a sector with more defensive characteristics, shows lower correlations to growth-oriented themes, such as technology, and the broader equity market, which can lead to improved downside protection. Therefore, reducing these correlations not only enhances the diversification benefits within an equity allocation but also across a broader multi-asset portfolio.

Active investing can play a crucial role when defining the winners and losers

Active investing allows portfolio managers to adjust holdings based on changing market conditions, company performance, and economic indicators, thereby potentially reducing risk and enhancing returns. By spreading investments across various sectors, asset classes, and geographical regions, investors can mitigate the impact of poor performance in any single area.

Furthermore, active management includes rigorous research and continuous monitoring of market trends and company fundamentals, which is vital in making informed decisions that help safeguard investments against unexpected market shifts. This proactive stance in portfolio management can be pivotal in navigating through market uncertainties and helping investors to achieve long-term investment goals.

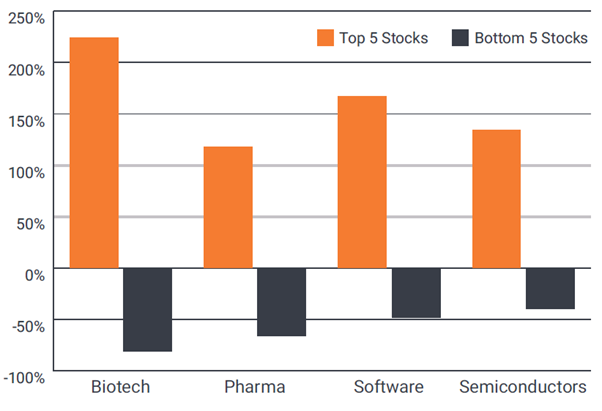

For example, the disparity between the winners and losers in the healthcare sector is significant (Exhibit 3), leading to a significant opportunity for stock selection. Similar opportunities arise from active management in other sectors, such as software and semiconductors, where the difference between the top and bottom performers is high.

Exhibit 3: Healthcare has the biggest returns disparity between winners and losers

Source: Wilshire 5000 Index, 2015-2024. December 2024. Past performance does not predict future returns.

The need to blend… appropriately!

We believe value can be derived by blending multiple individual themes into a broader portfolio. In the same way that timing the market is an unreliable strategy, perfectly timing the entry and exit of particular themes is equally a fools’ game. To do this effectively, the underlying component strategies must be clearly related to the themes the investor wishes to blend. In this respect, the investor can control the exposures on a look-through basis. A benefit of this approach is keeping the name overlap to a minimum and, thus, increasing the likelihood that the theme – rather than the broader market – is the primary driver of performance.

Keeping an eye on the ball

Our approach to thematic investing is focusing on how investors can incorporate those themes in their strategic asset allocation and how they can benefit from their return potential. When effectively deployed, thematic investing has the potential to generate excess returns over long-term horizons. We have seen a lot of marketing effort over the last couple of years by many asset managers to rebrand existing strategies as ‘thematic’ to attract flows going into the space. But we urge clients to keep their eyes on the ball and focus on the compatibility of their long-term investment objectives, return and risk constraints when it comes to potential thematic strategies to invest in.

About Janus Henderson’s Portfolio Construction and Strategy Team

Janus Henderson’s Global Portfolio Construction and Strategy Team has analysed more than 25,000 model portfolios based on consultations with 6,500 financial professionals. The team’s goal is to help investment professionals make sense of what’s happening in the market, understand the implications for portfolio construction, and create and adjust portfolios for future success.

Active investing: An investment management approach where a fund manager actively aims to outperform or beat a specific index or benchmark through research, analysis and the investment choices they make. The opposite of Passive Investing.

Alpha: Alpha is the difference between a portfolio’s return and its benchmark index, after adjusting for the level of risk taken. The measure is used to help determine whether an actively managed portfolio has added value relative to a benchmark index, taking into account the risk taken. A positive alpha indicates that a manager has added value.

Correlation: How far the price movements of two variables (eg. equity or fund returns) move in relation to each other. A correlation of +1.0 means that both variables have a strong association in the direction they move. If they have a correlation of -1.0, they move in opposite directions. A figure near zero suggests a weak or non-existent relationship between the two variables.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Tariffs: A tax or duty imposed by a government on goods imported from other countries.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.