Those who cannot remember the past are condemned to repeat it.

-George Santayana

We are not implying that the renowned Spanish philosopher was specifically speaking about monetary policy in 2025 when he penned the statement above, but given the unfolding economic environment, it could be seen as a heads up to the Federal Reserve (Fed).

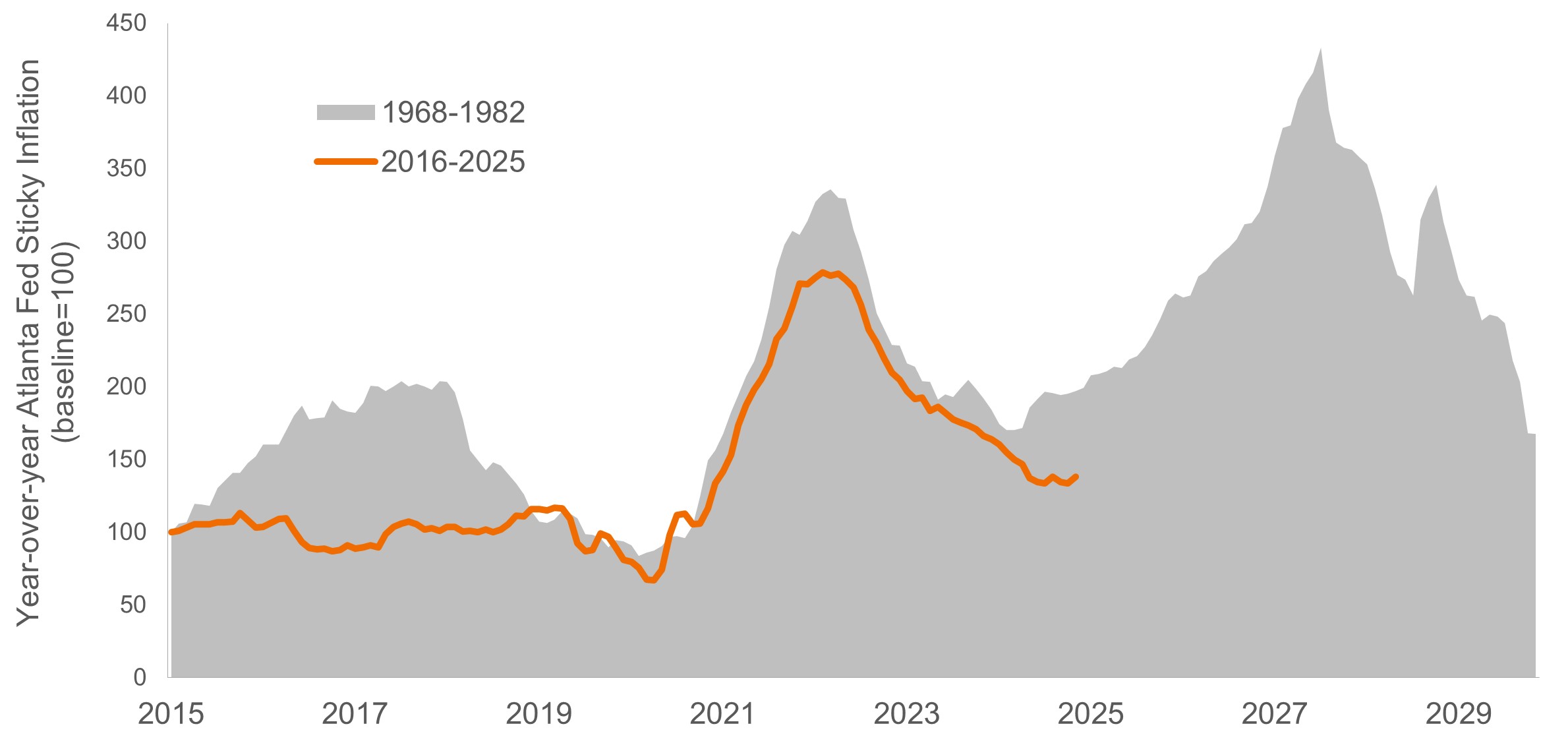

Ever since the federal funds rate reached 5.50% in response to generationally high inflation, we’ve expressed concern about the risk of policy error should the U.S. central bank blink by prematurely easing policy before the inflation threat is fully vanquished. As seen in the chart below, this is what occurred during the 1970s when the Arthur Burns-led Fed – either through miscalculation or losing its nerve – lowered rates before the job was done, thus unleashing a second, even more fierce, inflationary wave.

Sticky U.S. consumer price index 1973-1980 compared to current trajectory

Current path of sticky inflation eerily mirrors that of the 1970s, when the Fed committed a historic policy blunder.

Source: Bloomberg, Janus Henderson Investors, as of 18 July 2025. Note: The Atlanta Fed’s designation of “sticky” inflation are those categories whose price levels are slow to change based on their frequency of price adjustments.

As far back as mid-2022, we have identified policy error as a tail risk that could potentially upend the trajectory of a surprisingly extended economic cycle. Importantly, this was before the threat of tariff-related supply distortions emerged. It was also before rumors began circulating about President Trump potentially replacing Fed Chair Jerome Powell with a more dovish successor. These developments – should they unfold in the least favorable manner – would likely make a left-tail, or downside, outcome all the more costly.

What’s at stake

Significant progress has been achieved in the Fed’s battle against inflation once they recognized, and corrected, their transitory blunder. But while headline inflation as measured by the Consumer Price Index (CPI) stands at 2.7%, sticky inflation – an amalgamation of categories that change slowly and account for roughly 70% of CPI – resides at a more worrisome 3.3%.

Within this context, the argument that the fed funds rate – at 4.5% – has considerable room to drop becomes more tenuous. Based on sticky inflation, the fed funds rate is already within striking distance of the level of inflation that matters. Targeting the lower – and noisier – headline could lead to consumer prices ricocheting, resulting in the second major miscalculation of this cycle.

An untimely convergence

The pandemic-era inflationary surge was ignited by supply-chain disruptions and then exacerbated by massive fiscal stimulus. The previously unforeseen impetus for a second wave of inflation could be supply disruptions brought forth by Trump’s trade war.

Meanwhile, a more dovish Fed in 2026 could release a credit impulse in the form of lower rates, potentially spurring demand even as global supply chains and pricing remain in flux. It should be noted that the Fed is governed by a committee, and switching chairs may not result in greater accommodation. But the rhetorical assault on the U.S. central bank is hard to ignore. The potential convergence of supply and demand pressures means both the kindling and matches necessary for a second wave are in place.

An error-driven second wave would back the Fed into a corner with no good choices. Keeping policy accommodative – for whatever the reason – would likely cement inflation expectations at unwanted levels, distorting the important mechanism of price signals across the economy. It would also destroy the Fed’s credibility. The lone alternative would be for the Fed to raise rates – as it was forced to do in the late 1970s and early 1980s – to levels that would almost certainly cause a steep economic downturn.

About that balance sheet

A $6.7 trillion Fed balance sheet only increases the fragility of this uneasy equilibrium. The amount of dollars in the system means that it could only take a relatively minor disruption in supply to spur all those greenbacks to start chasing a finite amount of goods. Should that transpire, we would likely be haunted by the words of another 20th century luminary:

Inflation is always and everywhere a monetary phenomenon.

-Milton Friedman

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.