In last year’s outlook, I spoke about the shift “From Moral Imperatives to Financial Materiality” – a transition from aspirational ideals to a more practical, results-driven approach to environmental, social and governance (ESG) integration. This transition is now well underway.

Looking ahead to 2026, we anticipate responsible investing practices will continue to balance short-term and long-term outcomes, emphasizing financial and practical implications alongside social and environmental goals.

Janus Henderson believes three macro drivers will shape markets: Geopolitical realignment, demographic and lifestyle shifts, and the higher cost of capital. Responsible investing is no longer divorced from economics; instead, we see clear indications of convergence between ESG trends and broader societal and economic realities.

The impact of geopolitics: Rethinking what is “responsible”

Headline events in 2025 have driven renewed focus on certain sectors. Military escalation and increased defense spending – especially in Europe – have prompted a re-examination of historical aversions to this sector. Similarly, energy security concerns and increased demand driven by the acceleration of AI and datacenters have led to renewed interest in nuclear energy and natural gas. Tariffs have sharpened the focus on efficiency, competitiveness, and national security.

Many asset managers have responded by rescinding broad exclusions in defense and energy, causing some consternation among clients and asset owners. This raises a philosophical question: If what’s considered “responsible” can change so dramatically, where does that leave ESG-focused portfolios?

Financial materiality aligns with sustainable growth

At Janus Henderson, our global approach remains rooted in financial materiality. We recognize the high-risk nature of defense and energy sectors but believe with thoughtful analysis and engagement to ensure adherence to humanitarian standards and effective risk management, companies in these sectors can contribute to social and economic resilience for sustainable growth. We assess each company on its own merits through deep fundamental research and engagement, rather than implementing blanket exclusions1 or divestment policies. As urgency around rearmament and energy security grows, evaluating companies on financially material ESG risks becomes even more critical.

Historically, the defense sector has faced issues of bribery, corruption, and concerns over weapon sales to countries violating human rights. More recently, the development of autonomous weaponry has raised new ethical questions. These risks must be balanced against the fundamental importance of defense to national security.

The energy sector is vital for economic stability and growth but carries its own set of ESG risks. Key environmental considerations are emissions, water usage, and land degradation, while social considerations include community impact, labor practices, and environmental justice. As self-sufficiency and national security concerns drive investment flows into energy, particularly nuclear and natural gas, it is essential to assess companies’ readiness to manage these risks and their commitment to credible transition plans.

We conduct proactive research and engagement with companies in both sectors, evaluating how well they manage these challenges and whether their approaches align with portfolio objectives. Engagement enables us to assess the financial implications of ESG risks on investment cases and drive improvement within these industries.

The impact of demographic and lifestyle shifts: health and wealth disrupt consumer preferences

Demographic and lifestyle changes are profoundly reshaping the healthcare and consumer sectors. Generational shifts, reinforced by regulation, technology and social media, are driving new behaviors around food, diet, and health management. The rapid adoption of weight loss drugs and heightened awareness of ultra-processed foods are redefining the fight against obesity. Governments are responding with legislation to address the economic strain of chronic diseases.

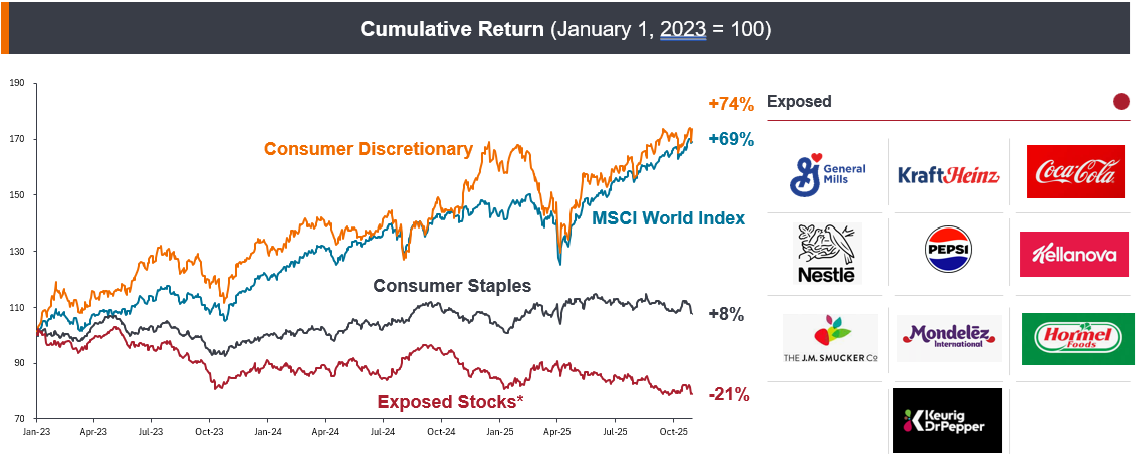

Technology has elevated access to information, and the social media visibility of “ideal” lifestyles is influencing both aspirations and actions. Consumers are increasingly seeking healthier, cleaner, and more sustainable choices, upending historical patterns in food & beverage, and wellness. Forward-thinking companies are adapting to meet the demands of the “conscious consumer,” creating winners and losers in the marketplace. This has typically led to significant underperformance for companies most exposed to the downside of these trends (Exhibit 1).

Exhibit 1: Financial materiality – stocks are reflecting changing consumer trends

Source: Bloomberg, Janus Henderson research. Past performance does not predict future returns.

Note: Exposed stocks represent an equally weighted basket of exposed companies within the consumer staples sector.

Our Responsible Investment & Governance Team collaborates with Janus Henderson’s investment teams to analyze these shifts and engage with companies to understand long-term impacts. We expect this area to remain in the spotlight, as highlighted in our 2025 thought leadership event: “From Cravings to Conscious Choices – Reshaping Sustainable Investment in the Wake of a Consumer Revolution.”

The impact of costs: Pivot to real action in regulation, climate, and biodiversity

Geopolitics, tariffs, and the higher cost of capital have renewed an emphasis on the competitiveness, efficiency and resilience of companies, prompting a more practical assessment of ESG factors. As ignoring these considerations could lead to a mispricing of securities, asset managers and owners are now approaching climate and biodiversity with a focus on measurable impact to a company’s financial performance and value.

At Janus Henderson, we’ve always prioritized research and engagement to understand the risks and opportunities related to climate change and biodiversity, focusing on their impact to cash flows, valuations, and the cost of capital. Our active engagement encourages companies to address climate and biodiversity risks with a financial materiality lens. The Janus Henderson x Berkeley Insight Collective reflects our commitment to direct education for portfolio managers and analysts, helping them build portfolios that address both opportunities and risks. Janus Henderson and the UC Berkeley faculty have co-developed a curriculum tailored for our portfolio managers and analysts, with a strong focus not just on the scientific concepts concerning climate change and biodiversity, but how investors can implement this enhanced understanding into their investment decision-making.

We have developed our own Climate Transition Assessment, a structured framework to assess companies’ transition readiness. Companies without credible transition plans face mounting exposure to business disruptions, regulatory pressure, reputational damage, and the risk of stranded assets. Our multidimensional framework enables investors to move beyond superficial commitments and identify genuine alignment with climate goals and economic resilience.

Janus Henderson Approach

At Janus Henderson, we believe consideration of financially material ESG factors is vital to long-term risk-adjusted returns and is consistent with our fiduciary duty to clients. Integration is increasingly important given the scale and extent of disruptive megatrends, such as climate change and the rise of artificial intelligence. These challenges represent substantial long-term financial risks and opportunities for investor portfolios.

Our approach to responsible investing remains practical, thoughtful, research-driven, and forward-looking – consistent with our investment philosophy over the past nine decades. We welcome a return to economic-based views.

As we look ahead to 2026, responsible investing trends are converging with broader economic realities. The focus is shifting from aspirational ideals to practical, financially-material considerations. Our commitment to rigorous research, active engagement, and thoughtful integration of ESG factors supports our aim of ensuring clients’ portfolios are resilient, competitive, and positioned for long-term success in a rapidly changing world.

Environmental, Social and Governance (ESG) integration is the consideration of financially material ESG risks and opportunities throughout the investment process.

Stranded assets: Assets that suffer unanticipated or premature write-downs, devaluations, or conversions to liabilities due to climate change-related impacts.

Tariffs: A tax or duty imposed by a government on goods imported from other countries.

Valuation metrics: Metrics used to gauge a company’s performance, financial health, and expectations for future earnings, e.g. P/E ratio and ROE.

IMPORTANT INFORMATION

1Janus Henderson maintains a firm-wide exclusion policy on controversial weapons. Preferences for defense and energy-related investment can differ based on regional and client-specific considerations. Some clients may wish to exclude direct or indirect exposure to defense, and we are able to accommodate this through our range of strategies that use varying exclusion criteria, depending on alignment with the fund’s strategy and investment principles. Our teams are also able to implement bespoke exclusions by working with Investment Compliance to support individual client demands.

Use of third-party names, marks or logos is purely for illustrative purposes and does not imply any association between any third party and Janus Henderson Investors, nor any endorsement or recommendation by or of any third party. Unless stated otherwise, trademarks are the exclusive property of their respective owners.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.