Chart to Watch: Monitoring low levels of systemic risk in U.S. equities

We view the lack of systemic risk priced into the market as the culprit for correlations among U.S. equities being near historic lows. An increase in systemic risk could result in investors demanding a higher risk premium.

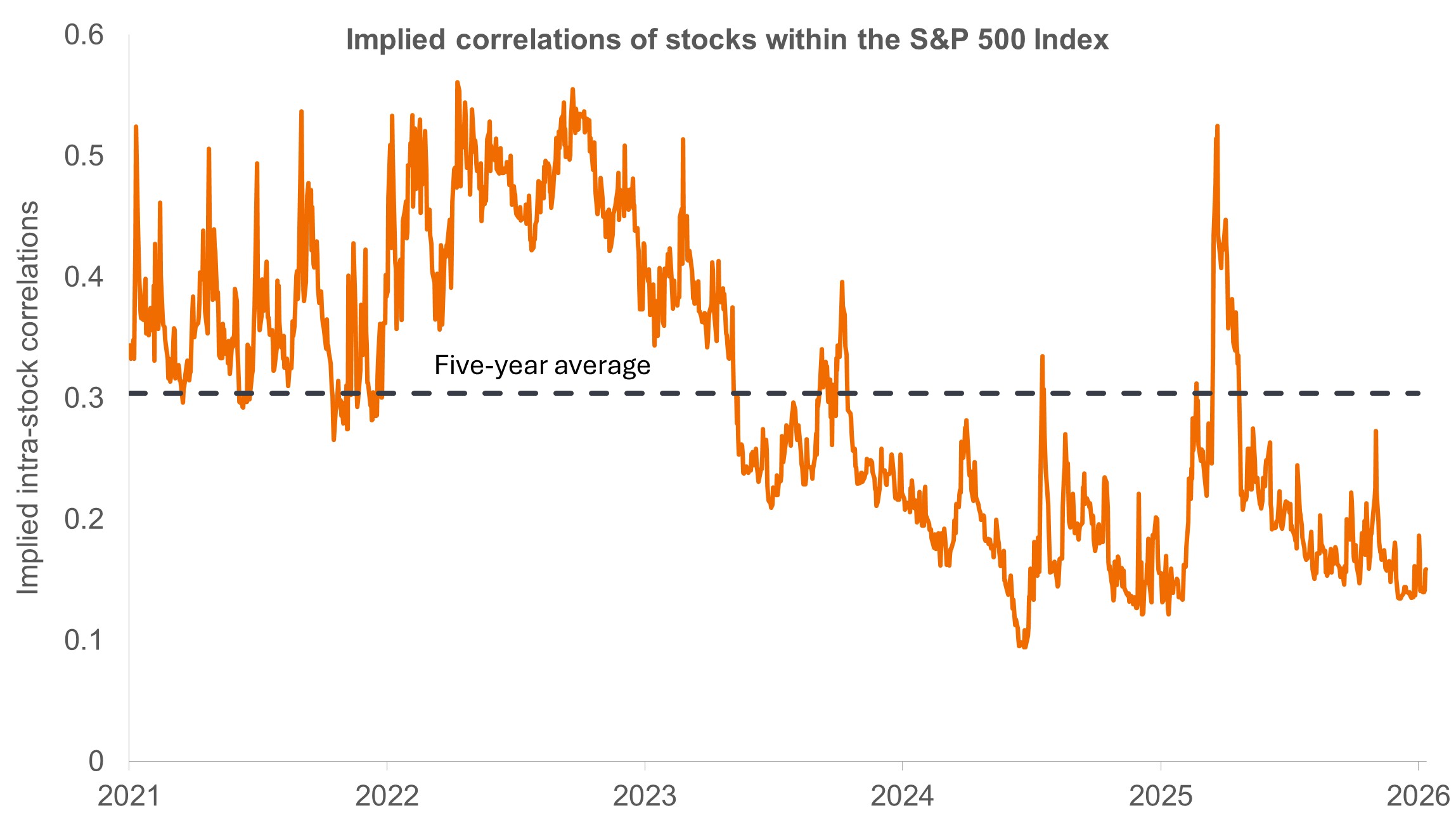

Given that it is widely accepted that correlations among individual stocks can only fall to 0, the current level of 0.17 is notable, as it resides well below its 5-year average of 0.30.

Source: Janus Henderson Investors, Bloomberg, as of 20 January 2026.

"Low correlations mean that U.S. equities are behaving like a ‘market of stocks’ rather than a ‘stock market’. Rising correlations – likely due to the market reflecting an increase in systemic risk – could put downward pressure on earnings multiples, thus becoming a catalyst for a market drawdown.” -Ashwin Alankar, Ph.D.

Key takeaways

- Implied correlations among U.S. equities are near historic lows, indicating a high level of idiosyncratic risk and, thus, peculiarly low levels of systemic risk.

- Mean reversion in systemic risk could lead to investors demanding additional compensation for being exposed to non-diversifiable risk.

- With much of 2025’s rally driven by multiple expansion, the demand for a higher equity risk premium could lead to an equities drawdown as valuations compress.

We view the lack of systemic risk priced into the market as the culprit for low correlations. Aware that rising systemic risk could impact a portfolio, investors would demand additional compensation in the form of a higher risk premium. In practical terms, this would likely be expressed through compressed price-earnings (P/E) ratios.

Equities follow earnings and the demand for risk premiums. Identifying changes in these variables – in this case, possibly higher levels of systemic risk – may help enable investors allocate accordingly, thus allowing them to stay invested while potentially reducing the risk of extreme drawdowns. Once systemic factors are accurately reflected, investors can then reallocate back to less-defensive stocks to potentially take advantage of more favorable risk premiums.

Systemic risk is a source of price volatility in financial markets that cannot be diversified away by holding a larger number of securities.

Idiosyncratic risk is a source of price volatility that is specific to an individual security meaning that much of this risk can be diversified away by holding a large number of securities that tend not to be correlated with each other.

Multiple expansion describes the valuation metric – e.g. the P/E ratio – of an equity increasing, meaning that an investor is willing to pay a higher amount to purchase a security.

Earnings Multiples are a category of valuations attached to security that indicate how much a buyer is willing to pay per a unit of earnings. For example, a P/E ratio of 14 means the market assigns a value of $14 dollars $1 of earnings.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Past performance is no guarantee of future results.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.