JH Explorer in Phoenix: Autonomous driving on a progressive path to commercialisation

Global Technology Portfolio Manager Graeme Clark experiences Waymo’s latest autonomous vehicle technology during a recent trip to Phoenix, which is bringing the reality of sustainable transport closer.

6 minute read

Key takeaways:

- Waymo, a key player in autonomous driving is rapidly expanding its reach with operations in four US cities.

- Waymo’s strategic partnership with Uber is in our view a clear endorsement of the readiness of autonomous driving technology and acceptance for mass consumption.

- Autonomous driving technology is now reaching an important inflection point for wider adoption, increasing its investment potential.

| The JH Explorer series follows our investment teams across the globe and shares their on-the-ground research at a country and company level. |

Phoenix, Arizona is one of four cities in the US where Waymo’s autonomous ride-hailing service is available for consumer use. From its beginnings in 2009 as Google’s self-driving car project, the first fully autonomous drive on public roads was achieved in 2015, and later was renamed Waymo under Google’s holding company, Alphabet.

Steady progress

The first public trial of Waymo’s vehicles and autonomous technology started in 2017 in the Metro Phoenix area. A year later, the ‘Waymo One’ ride-hailing service and app was formally launched in 2018 using its hybrid Chrysler Pacifica minivans, with some driver intervention. In October 2020, the company opened up fully driverless operations to the general public, again in Phoenix. This was a significant milestone for Waymo, which led to the opening up of new markets, including San Francisco (2022), Los Angeles (2023) and Austin, Texas (2023).

Technology coming together driving the way forward

Waymo operates a fleet of electric Jaguar I-PACE vehicles, using a combination of different technologies to enable fully autonomous rides. LIDAR (Light Detection and Ranging) sensor technology enabled by 29 cameras on the vehicle provides a clear 3D picture of the car’s surroundings, while radar technology adds details of distance to objects and speed. These onboard sensors create a vast amount of data, which is processed real-time onboard, harnessed by server-grade central processing units (CPUs) and graphics processing units (GPUs).

Image published with permission from Waymo.

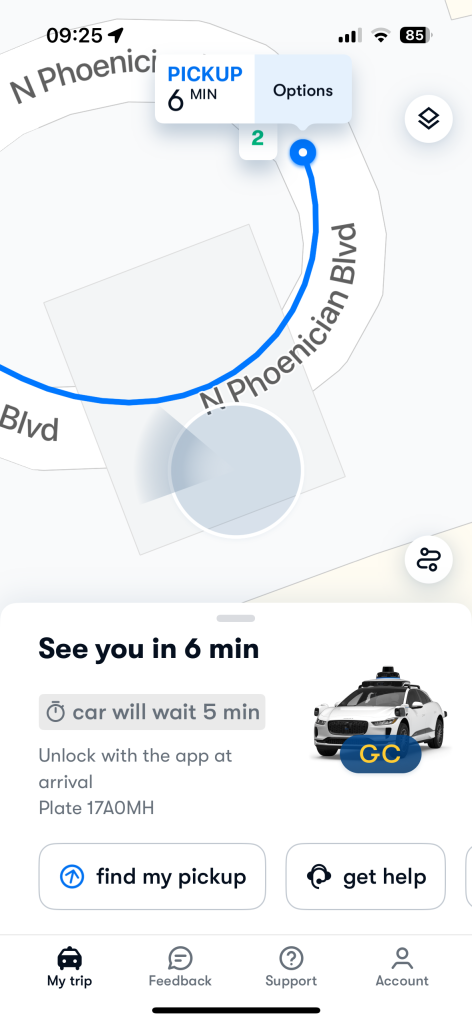

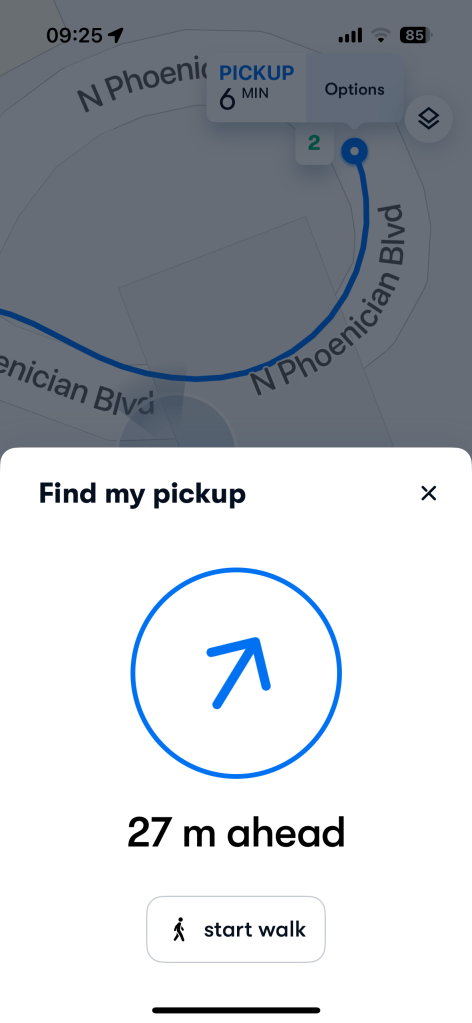

With the Waymo One app now available to download in international markets, a recent trip to an investment conference in Phoenix presented an ideal opportunity for me to fully test the Waymo offering. I was keen to experience first-hand a fully autonomous drive to see how all of this technology would translate in real life. I was also excited to speak to locals, including Uber drivers, for their thoughts and experiences with the Waymo vehicles.

Waymo-Uber partnership reflects commercial viability

While I completed all of my journeys via the Waymo One app, a recent strategic partnership allows users of the Uber app in Phoenix to accept a ride in a Waymo vehicle when one is matched to an UberX, Uber Green, Uber Comfort, or Uber Comfort Electric request. I found the Waymo One app to be very easy to use and it even showed me the exact directions to meet the vehicle.

Images published with permission from Waymo.

Testing it out

The car was unlocked via the app and once inside the vehicle controls were available on both the app and the rear-facing screen inside the I-PACE car. I took a number of journeys at different times, including a round trip and also drop off and pick ups. All the experiences were smooth and uneventful, but often the drop-off point chosen was not perfect for the rider – perhaps intended to be the easiest point for Waymo to drop off to move onto the next ride (similar to human drivers?!).

I was surprised how quickly I became comfortable inside the driverless Waymo. This comfort came from a smooth experience, and how impeccably the vehicle dealt with the routes, such as turning onto a main road, driving in traffic and responding to the surroundings in terms of pedestrians and other vehicles.

There were a few scenarios that the self-driving vehicle dealt with well. These included when a maintenance worker in the central reservation moved into the road – the Waymo smoothly moved out to clear space for the worker to safely pass. Another was when a pedestrian suddenly started walking into the road ahead – the car slowed and stopped and then moved on safely. In one instance, a car cut across our path – again the Waymo spotted the car early and slowed down to enable both vehicles to progress safely.

Image published with permission from Waymo.

A positive experience overall

From my conversations with locals about Waymo vehicles, many hadn’t even noticed them on the road. But most Uber drivers did have a view on them; I was surprised how positive the views were. However, that positivity could be down to restrictions at the time – Waymos were not allowed into the airport for kerbside pick up (this changed in December 2023), and also Waymos were not allowed on freeways. This essentially meant that Waymos were best suited to short, metropolitan routes, which many Uber drivers prefer to avoid, leaving the more lucrative longer journeys for Uber drivers. I wonder if that attitude has changed with Waymo now able to pick up kerbside at Phoenix SkyHarbor Airport?

Overall, I was hugely impressed with how the Waymo technology worked in action, the app was very easy to use and the Waymo I-PACE reacted perfectly to its surroundings. With no traffic, the Waymo smoothly reached the 40 miles per hour speed limit, while in traffic it sat at a clear distance from the vehicle in front at the appropriate speed.

On the path to commercialisation

We have talked about the opportunity for autonomous driving for years aligned with the long-term sustainability trend towards the electrification of transport. Among the potential benefits are improved safety, less congestion and reduced carbon emissions. As with most technologies, reaching mainstream consumers has taken longer than expected, with challenges such as consumer adoption, regulation and safety. But our first-hand experiences of the technology in action is a clear signal to us that mass adoption can accelerate from here, as should the opportunities for investors.

Our ESG integration approach: Thoughtful, practical, research-driven and forward-looking

Waymo is a trademark of Waymo LLC.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Use of third-party names, marks or logos is purely for illustrative purposes and does not imply any association between any third party and Janus Henderson Investors, nor any endorsement or recommendation by or of any third party. Unless stated otherwise, trademarks are the exclusive property of their respective owners.

IMPORTANT INFORMATION

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.