As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

How does the tech sector benefit from exceptional leadership to navigate an era of heightened macro and economic uncertainty?

Amid global uncertainty and shifting credit conditions, we explore how innovation, attractive valuations, and deep research make small caps a compelling choice.

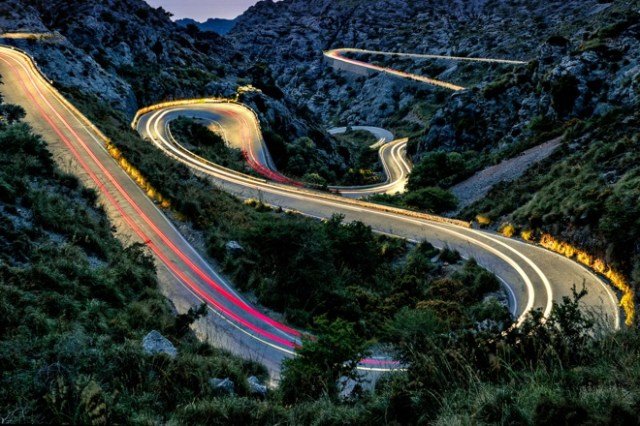

At JHI's recent Madrid Investment Summit, Ali spoke with Jeremiah Buckley and Luke Newman about where they are finding the most compelling opportunities within equities.

Conversations with clients on fixed income at JHI's Madrid Investment Summit.

At the Janus Henderson London Investment Conference, experts discussed the implementation of 2025’s new political environment on portfolios and highlighted strategies to help position for a brighter investment future.

How might investors position themselves to capitalise on the growth of the humanoid robots revolution?

Janus Henderson’s ‘Partnerships for a Brighter Future’ event in New York discussed AI and bionic enhancements that can support human resilience.

Ali Dibadj, CEO, speaks with Janus Henderson’s experts about shifting market dynamics and the growing demand for active management.

An update on the three macro drivers we believe will shape markets in the second half of 2025.