Source: Janus Henderson Investors, Bloomberg, as of 19 September 2025.

Note: COGS = cost of goods sold.

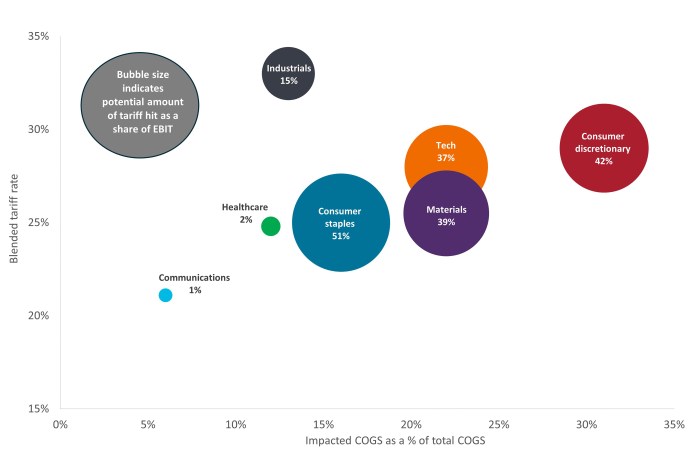

After stockpiling inventories early in the year to withstand the expected tariff increase, companies are now seeing levies hit shipments to U.S. ports. The degree to which sectors are impacted depends upon a number of factors, including country- and sector-level tariffs (e.g., steel and autos) and the number of inputs – or finished products – that are subject to duties. As illustrated in the chart above, different sectors face varying levels of exposure to tariffs and, thus, risk to operating margins.

Consumer, technology and materials companies are acutely exposed to higher blended rates. Consequently, these are the sectors most at risk of margin compression should they be unable to pass along higher costs.

The worst-case scenarios on financials have yet to materialize as companies have deployed a series of tactics to support margins. Among these are pricing, improving efficiencies, and shifting supply chains to minimize tariff exposure. An example of the latter is moving production from countries hit with high tariffs – namely China – to locations like Mexico that are covered by existing trade agreements.

Stresses in some of the most exposed sectors are beginning to appear. Thin margins in the discount consumer space mean that higher costs are invariably passed onto customers. And with job and wage growth sputtering, these consumers are exercising caution in purchasing decisions. Should the economy slow, other sectors may face the choice between reducing margins and potentially losing stretched customers.

With simply moving production to the lowest-cost destination a less viable option, investors will need to identify the companies with the strongest pricing power and/or the most cost-efficient supply chains to navigate a vastly different trade landscape.

As the early-year inventory buildup is whittled down, we are beginning to see the full force of materially higher tariffs, but thus far the corporate sector has largely taken this monumental rejiggering of the global trade system in stride.