In a previous article, we discussed the parallels and key differences with the dot.com era as investor fears about a similar bubble increased volatility for tech stocks that were seen as pivotal to the success of the AI wave and its key beneficiaries.

Since then, markets have pivoted to concerns around AI monetisation and circular financing reminiscent of 2000. We believe investors should look to the all-important semiconductor industry for a deeper understanding of AI demand and supply dynamics. While daily headlines are reinforcing this disquiet, we believe the natural brake of more rational semiconductor supply plans can dampen investor concerns.

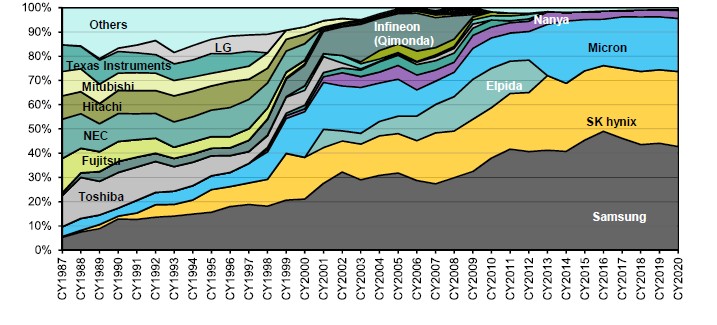

The DRAM market has consolidated to effectively three major suppliers

DRAM market share by player (revenue basis)

Source: Gartner, DRAMeXchange, company reports and Bernstein analysis. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable.

3 key differences for semis versus the dot.com era: Avoiding ‘Prisoner’s dilemma’

1. Semiconductor industry consolidation means fewer suppliers are feeding AI demand

The semiconductor industry looks vastly different today compared to 2000. Industry consolidation has reduced the number of Dynamic Random Access Memory (DRAM) suppliers from 18 to 3 today. Back then, the vast majority of logic semiconductor production was from companies that both designed and manufactured their own chips. These integrated device manufacturers (IDMs), with a fabless (non-manufacturing) business model relied on foundries still in their infancy and those IDMs producing leading edge semiconductors.

Today, the only IDM seeking to produce semiconductors at the leading edge is Intel, which has faced various challenges. Now, most leading-edge semiconductors are made by one foundry, TSMC. This means that instead of a prisoner’s dilemma scenario where one bad actor out of wide field could break industry supply discipline (ie. intentionally maintain the balance between supply and demand), current industry supply is controlled by only a handful of actors.

2. Geopolitics’ impact on AI semiconductor supply

In the early 2000s, globalisation was in full swing; semiconductor manufacturing outsourcing to Korea and Taiwan was upscaling, with China taking its first major steps into the industry. Having such a broad array of companies from different countries all competing to be the leader drove irrational competition and aggressive supply decisions. China then took on a more aggressive position in memory and more recently in lagging edge semiconductor manufacturing.

However, export restrictions on the most advanced semiconductor equipment (notably EUV and the most advanced immersion lithography tools from ASML), as well as deposition and etch tools critical to technologies – such as gate-all-around (GAA) and high bandwidth memory (HBM) – have made it very difficult for China to supply cutting-edge compute and memory (at least) in the medium term. This removes China as a global supplier and constrains its semiconductor industry to domestic supply and demand concerns.

3.The end of exponential chip supply

Similar to how the dot.com crash was exacerbated by Y2K pull demand, investors may have forgotten that post-2000, semiconductor oversupply was driven by the industry’s migration from 200mm to 300mm wafers. The decision to build multiple new fabs (fabrication facilities) in response to exaggerated demand was bad enough, but it was compounded by the fact that a 300mm wafer is 2.25x the size of a 200mm wafer, which meant exponentially more chips were being produced. It was this combination that led to such severe industry oversupply in the early 2000s. In contrast, today there is no upgrade planned beyond 300mm wafers.1 The pace of scaling, as defined by Moore’s Law, has also slowed due to physical limitations on the number of chips per wafer, therefore reducing the ability for supply to grow dramatically.

Experienced leading semiconductor management teams – A natural brake to AI overexuberance?

With new actors like OpenAI being a long way from being profitable, committing US$1.4 trillion in spending,2 this has justifiably led to concerns about overexuberance, sustainability and ultimately the ability to fund these vast sums in this brave new AI world. However, we believe what investors are missing in that debate is that the semiconductor supply chain has not even started to underpin those rosy forecasts and is only just deciding on plans to support this new wave of AI demand.

We provide more context to the current semiconductor supply lansdcape:

- Supply decisions are only at the planning stage

The semiconductor industry has only recently recovered from a major downturn brought on by the excessive extrapolation of pandemic-related pull demand, as well as overly aggressive expectations of edge AI device demand for PCs and smartphones. Until very recently, the vast majority of leading-edge foundry and memory demand came from smartphones and PCs, with datacentres a much smaller portion.

In the three years since the launch of ChatGPT signalled AI’s inflection, demand from NVIDIA (which relies mainly on TSMC to manufacture its chips) and the broader AI ecosystem was mainly sated by this excess industry capacity – with some incremental investment in TSMC’s CoWoS and high bandwidth memory (HBM) packaging capacity.

Only now, at the start of 2026, as supply shortages become more intense, does the industry face the question of how supportive it should be of their AI customers’ ambitions? Given it takes around three years to build a new semiconductor fab, we have good visibility into industry supply through 2028. Relative to AI demand, this appears to be a natural brake to more aggressive forecasts, given industry estimates of the need to increase leading edge logic and memory capacity by around 3-5x to meet these demand forecasts.

- Being the ‘adults in the room’

The future of the AI wave, a technology that is more directly correlated to compute power and the underlying semiconductors that provide it, is in the hands of effectively four companies: TSMC on the foundry side; SK Hynix, Micron and Samsung Electronics in high bandwidth memory (HBM). This is a result of the major consolidation in the semiconductor industry over the past decade. As Moore’s Law broke down, the cost of staying on the leading edge moved out of reach for all but the leading and largest players. These four long-established companies have been through decades of cycles and new technology waves. It is very likely these experienced management teams will be ‘the adults in the room’ – rationally assessing future AI customer needs, and planning accordingly, rather than merely being at the behest of their customers.

- Painful recent experiences

Those supply decisions will be made with fresh painful industry memories. The three DRAM suppliers have only recently recovered from once-in-a generation losses in 2023, a year in which Micron reported losses of around US$6 billion, and TSMC reported its first annual decline in sales since the 2009 Global Financial Crisis.3

Meanwhile, the broader semiconductor industry is still suffering from inventory overhang that was a result of inflated demand forecasts versus actual post-pandemic demand. The same hyperscaler customers that are driving AI demand today as recently as 2019 significantly cut demand forecasts, hitting the industry hard. All these experiences are making companies reluctant to endorse current AI demand forecasts, rightly requiring tangible evidence of real demand, before making the decision to build multiple costly new fabs.

- Geopolitics

Geopolitics and the current trade wars also complicate the situation in terms of where to build fabs. Given a key area of trade deals has been major investment in the US and AI compute restrictions, the decision to break ground on new semiconductor fabs is front and centre of the debate, making it hard to finalise plans. Will a company/country’s commitment for spending in the US be enough? Will the US require AI chips to be manufactured at a wafer level in the US, or will just backend packaging, assembly and testing be enough?

Conclusion

“It’s different this time” has not been a successful investment strategy in the semiconductor industry. However, versus 2000, there are differences in industry structure, technology and geopolitics, combined with the unique recent backdrop of a generationally bad downcycle, and ongoing trade negotiations. Given this backdrop, in the near term we should be seeing a much more cautious semiconductor industry that will keep exuberance in AI capital expenditure in check – at least through the next couple of years where we have high levels of visibility on industry supply.

However, we believe that this near-term industry conservatism provides a natural and rational brake to AI overexuberance. From a top-down standpoint, that is positive for the technology sector, providing a counter to the prevailing market narrative.

From an investment point of view, this could provide opportunities for the key semiconductor companies controlling the bottlenecks to AI supply, as well as semiconductor equipment companies. Moving through 2026, we expect to have more visibility on their supply response. Using our long-term tech investing experience, we will dynamically assess those plans to consider if they are reasonable, or merely paving the way towards longer-term oversupply. The semiconductor industry is a core part of our AI investment framework, to invest in the leaders of AI infrastructure. To do that, the cyclical and more volatile characteristics of the industry requires relatively more intensive active management than any sub-sector.

1 Semi.org, 300mm Fab Outlook Report, 10 December 2025.

2 TechCrunch, 7 November 2025.

3 Micron Technology Fourth Quarter and Full Year Report Fiscal 2023; TSMC Annual Report 2023.

Circular financing: Concerns that financing of AI infrastructure investment among mega caps is becoming unsustainable. Interconnected deals and investments within a small group of companies means companies are investing in each other, with the funding recipient using the capital to make purchases from the original investor. Some of these companies may have insufficient cash flows and it could lead to a bubble when company valuations become excessive, with broader market implications.

CoWoS: TSMC’s Chip on Wafer on Substrate with Silicon Interposer (CoWoS®-S) provides best-in-class package technology for ultra-high performance computing applications, such as artificial intelligence (AI) and supercomputing.

Cyclical industries/stocks: Industries/companies that sell discretionary consumer items or companies that are within industries that are highly sensitive to changes in the economy. Cyclical industries/stocks perform well during periods of economic expansion and perform poorly during periods of economic downturn.

Demand pull: An increase or upward trend in spendable money that tends to result in increased competition for available goods and services and a corresponding increase in prices.

Dot.com era: Refers to the internet boom of the 1990s, driven by the groundbreaking shift to digital commerce. While there are some companies that have thrived and are today’s tech leaders, investor overenthusiasm drove many stocks to sky-high valuations yet the sustainability of their business models were questionable, leading to the infamous dotcom bubble burst in 2000.

DRAM: Dynamic Random Access Memory is a type of RAM (random access memory), often used in PCs, laptops, smartphones, tablets and other computing devices. DRAM provides temporary storage for files that are used when the computer is running programmes or applications.

EUV: ASML is the sole global manufacturer of extreme ultraviolet (EUV) lithography machines, critical for creating advanced microchips.

Gate-all-around: A semi manufacturing process technology that can help continue silicon scaling, enabling transistors are able to carry more current while staying relatively small.

HBM: High Bandwidth Memory is an advanced memory technology that delivers faster data access with lower energy consumption than traditional memory.

Hyperscalers: Companies that provide infrastructure for cloud, networking, and internet services at scale. Examples include Google Cloud, Microsoft Azure, Facebook Infrastructure, Alibaba Cloud, and Amazon Web Services.

IDM: A company that takes charge of all processes in producing semiconductors from planning to producing the final products. In the semiconductor industry, an “Integrated Device Manufacturer (IDM)” controls every process from planning to manufacturing and sales, a “Foundry” only oversees production, and a “Fabless” only has the resources to design semiconductors.

Lagging edge semiconductors: Also known as trailing edge semiconductors are larger chips and legacy nodes in the semiconductor industry built on older technology powered by larger nodes. They are used in many computing devices and other semiconductor-led applications as well as most modern digital devices.

Moore’s Law: Predicted that the number of transistors that can fit onto a microchip will roughly double every two years, therefore decreasing the relative cost and increasing performance. However, now as the scale of chip components gets increasingly closer to that of individual atoms, it is now more expensive and more technically difficult to double the number of transistors, and as a result the processing power for a given chip every two years.

Prisoner’s dilemma: A situation where individual decision-makers have an incentive to act in a way that creates a less-than-optimal outcome for the individuals as a group.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment.

Y2K: Short for the year 2000, referred to fears of a coming disruption of major computer systems worldwide related to a coding shortcut that used only two digits for the year. Experts and analysts predicted significant malfunctions in systems like banking and government databases. However, despite the panic and extensive preparations costing billions, the new millennium arrived without the anticipated chaos.