Why the prevailing narrative of new energy-generation capacity exceeding AI data center demand could be off the mark.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

AI is entering a new phase defined by reasoning led models, agentic systems and accelerating infrastructure investment.

With innovation back in focus, a dense slate of drug launches, data readouts, and regulatory decisions makes 2026 a consequential year for pharma and biotech.

How can corporate governance determine whether European small caps become hidden champions or underperformers?

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Energy disruption, not geopolitics, is driving emerging markets as higher energy prices could reshape the winners and losers. The persistence of higher prices will determine the eventual impact.

The severity and duration of crude oil price volatility depend upon how the conflict could impact energy infrastructure and/or shipping in the Strait of Hormuz.

An early reaction to military strikes in Iran and the implications for investors.

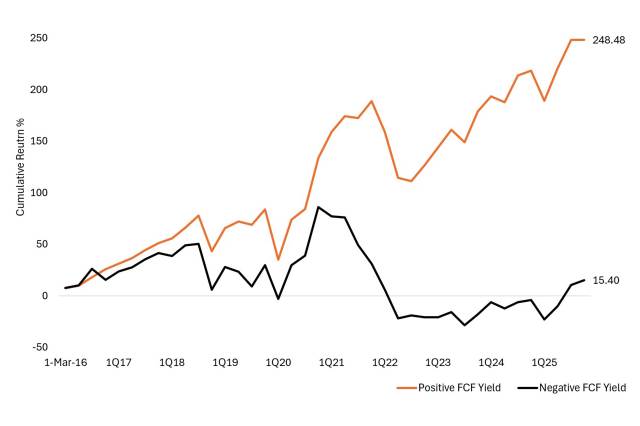

A divergence in performance between positive and negative cash-flow businesses could signal opportunity for investors focused on quality factors.

Key risks and opportunities within asset-backed securities (ABS) for investors seeking to navigate the evolving fixed income landscape.

Key highlights from NVIDIA’s latest quarterly earnings call includes the company citing 2026 as an agentic AI inflection point, driving increasing compute demand and revenue generation.