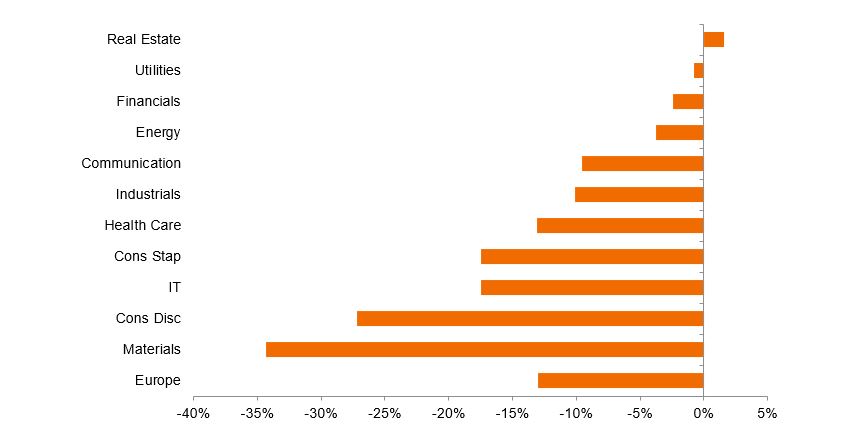

European listed real estate posted a respectable gain of close to 10% in the first half of 2025.1 Notably, the sector went from being the weakest part of the European equity market in early March following a negative reaction to the German fiscal bazooka and higher Bund yields, to the strongest in Q2. The asset class outperformed following President Trump’s ‘Liberation Day’ on 2 April, as investors sought the relative stability and defensive characteristics offered by real estate cash flows in a less predictable economic backdrop (see Figure 1). That the sector has kept pace with wider equity markets, while offering diversification, offers a reminder of the case for a real estate allocation.

Figure 1: European sector next 12 months earnings revisions ratio

Source: MSCI, IBES, Morgan Stanley Research as at 17 July 2025. Note: Real Estate industry group includes Equity Real Estate Investment Trusts (REITs) and Real Estate Management & Development.

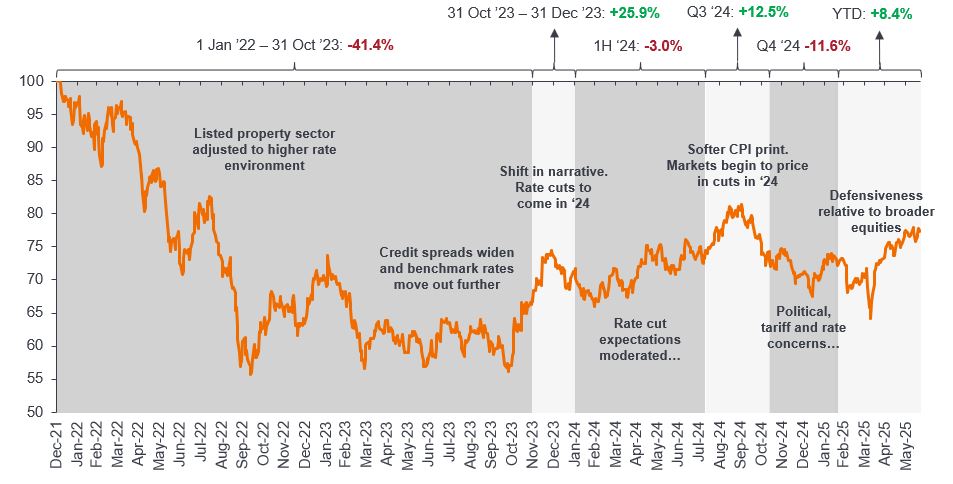

Zooming further out, we’d remind investors that European real estate investment trusts (REITs) were quick to price in a correction in real estate values when reacting to higher rates in 2022. The sector has tentatively been in a period of recovery since late 2023 as central banks pivoted and credit markets reopened (Figure 2).

Figure 2: Public REITs are forward-looking and often lead market trends

FTSE EPRA Nareit Developed Europe Capped Index since January 2022

Source: Janus Henderson Investors, Bloomberg, as at 20 June 2025. Past performance does not predict future returns.

That the equity market recovery has been so fragile, reflects both a less certain macro backdrop, but also a degree of scepticism on real estate fundamentals and values. This to us, is continuing to create opportunities for investors to boost their real estate returns in the years ahead through public markets, where we expect a continued re-pricing of the sector’s multiples to enhance underlying income and income growth-led real estate returns.

Healthy M&A activity reflects the value in European REITs today

Highlighting this value opportunity, a notable feature in the European REIT sector this year has been increased merger and acquisition (M&A) activity. We’ve seen private equity bids for several UK REITs, including healthcare-focused Assura (£1.8 billion market cap) and logistics focused Warehouse REIT (£485 million market cap). Bid premiums of circa 35-40% highlight the discounted valuation of the public real estate wrapper versus the true value of the underlying assets. 2

Sector consolidation is also increasing, with continental healthcare landlords Aedifica and Cofinimmo proposing a merger that could create a sector champion in Europe and has the potential to drive incremental earnings growth. A shrinking in the number of European REITs, leaving fewer, larger, more efficient and hopefully higher-rated companies we think is part of the necessary evolution of the sector as we look to learn lessons from the more established (and historically stronger performing) US REIT sector.

Improving growth prospects married with strong fundamentals

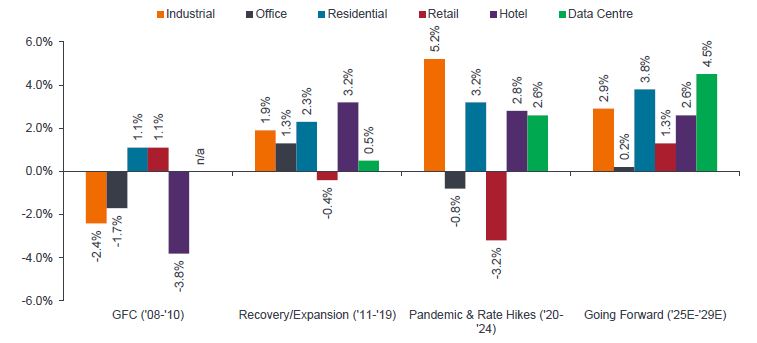

We expect real estate fundamentals to remain on a gradually improving path from here. Figure 3 illustrates Green Street Advisors’ positive outlook on REITs, with rental growth forecasted across key real estate sectors in 2025 through to 2029, including best-in-class Retail and Office. We have seen more evidence from recent company reporting, which demonstrates the ability of REITs to benefit from supply constrained markets. Rising interest rates and construction costs have resulted in significantly lower levels of new construction in most sector and markets.

Figure 3: Rental growth by property type

Net Rental Income (NRI) by property type

Source: Green Street, Janus Henderson Investors as at 31 December 2024. There is no guarantee that past trends will continue, or forecasts will be realised.

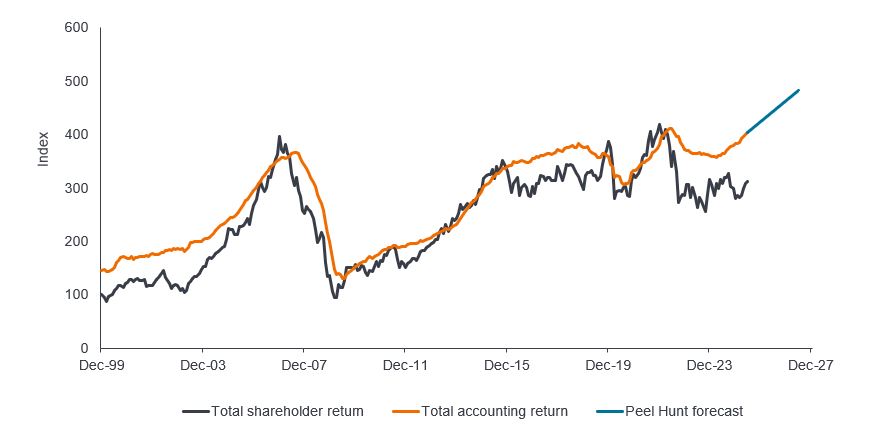

The more positive outlook for European REITs is likely to drive a continued valuation recovery and provide a platform for companies to continue to grow earnings and dividends, this potential does not seem to be reflected in today’s valuations (Figure 4).

Figure 4: Long-term sector total accounting and total shareholder returns for UK REITs

Source: Company accounts, Datastream, Peel Hunt estimates as at June 2025. Index rebased to 100 as at December 1999. There is no guarantee that past trends will continue, or forecasts will be realised.

There are opportunities in companies that are able to create value above and beyond a market recovery. Merlin Properties in Spain is building out a valuable data centre pipeline in the well-connected Iberian markets. Likewise, Central and Eastern Europe focused industrial/logistics landlord CTP is looking to generate double digit-value growth through its development activities in a market seeing significant tailwinds from near-shoring trends, with more than 20% of its recent leasing activity being to Asian clients ‘producing in Europe for Europe’.3 We also see value in turnaround stories. Retail landlords Unibail-Rodamco-Westfield and Hammerson have repaired their balance sheets, with the businesses once again looking for growth opportunities.

So, where do we go from here?

We look ahead with confidence that the REIT sector is on a firmer footing and offers both value and growth potential for investors. We reiterate our three key messages:

- Valuations have reset and are now recovering – but this is yet to be fully factored into REIT pricing.

- Operational performance of most REITs businesses remains robust, with continuing rental growth for best-in-class assets. This is likely to be supported by muted new construction activity in the years ahead.

- REITs are once more positioning for growth, seeking opportunities to deploy capital accretively and to leverage their strong operational platforms.

The first half of 2025 reminds us that portfolio diversification remains important, and we believe REITs can have a role to play here. The rise of M&A activity in the European listed sector is notable and highlights the value that we see in many parts of the market. While private assets may be en vogue, the fact that many private asset owners are turning to public REIT markets to deploy their capital, even at significant premiums, highlights the attractive opportunities on offer today for long-term investors.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

1 FTSE EPRA Nareit Europe Developed Capped Index in EUR terms, 31 December 2024 to 30 June 2025. Past performance does not predict future returns. The FTSE EPRA Nareit Developed Europe Capped Index is a subset of the FTSE EPRA Nareit Developed Index and is designed to track the performance of listed real estate companies and REITS in developed European markets.

2 Green Street News; “Assura agrees to £1.8bn PHP takover,” as at 23 June 2025; AIC; “Tritax Big Box bids for Warehouse REIT,” as at 25 June 2025.

3 SupplyChain Digital; CTP: Powering Europe’s Industrial Future, 27 June 2025.

Balance sheet: an indicator of a company’s financial strength. The balance sheet is a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time.

Bund yield: Bund yields are viewed as benchmark yield indicators for European government bonds; those with a 10-year and 30-year maturity are considered to be the German equivalent of US Treasury bonds.

Cash flow: the net balance of cash that moves in and out of a company. Positive cash flow shows more money is moving in than out, while negative cash flow means more money is moving out than into the company.

Diversification: a way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Multiple: equity multiples involve examining ratios between a company’s share price and an element of the underlying company’s performance, such as earnings, sales, book value, or something similar. Common equity multiples include the price-to-earnings (P/E) ratio, the price/earnings-to-growth (PEG) ratio, the price-to-book ratio (P/B), and the price-to-sales (P/S) ratio.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.