Parmi les points saillants de la dernière conférence téléphonique sur les résultats trimestriels de NVIDIA, on note que la société a cité 2026 comme un point d'inflexion pour l'IA agentive, stimulant la demande croissante de puissance de calcul et la génération de revenus.

Analyses de marché

Nos dernières réflexions sur les thèmes qui façonnent le contexte actuel en matière d'investissement. Découvrez les dernières analyses, les publications trimestrielles ainsi que les recherches approfondies de nos experts.

Lorsque les stratégies traditionnelles en matière de matières premières s'avèrent insuffisantes, comment les stratégies alternatives peuvent-elles débloquer des opportunités plus larges et plus résilientes ?

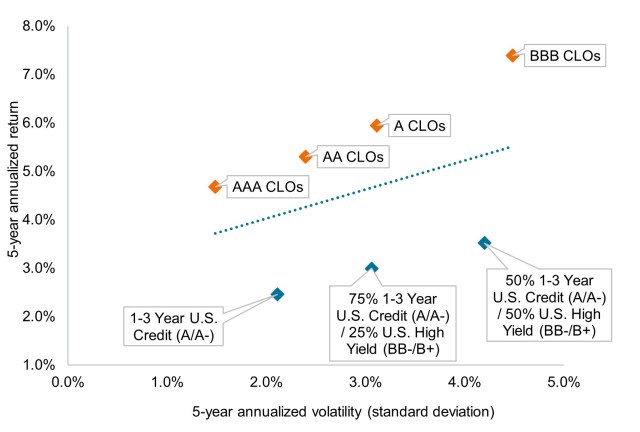

Au cours des cinq dernières années, les obligations de prêts titrisés (CLO) ont offert certains des meilleurs rendements ajustés au risque disponibles sur les marchés obligataires.

Pour mieux comprendre la volatilité récente, nous pensons que les investisseurs doivent saisir l'ampleur de la transformation induite par l'IA et son impact inévitable sur tous les secteurs d'activité.

Trois éléments essentiels à prendre en compte pour une stratégie équilibrée efficace, ainsi que les tendances à suivre sur les marchés actions et obligataires en 2026.

L’Europe est confrontée à des défis, mais la dynamique croissante des réformes et les vents porteurs structurels redessinent ses perspectives d’investissement.

La forte dispersion observée en 2026 crée un contexte favorable aux investissements sélectifs dans les petites capitalisations mondiales.

Après avoir participé à la conférence phare du secteur, nous repartons avec une conviction renforcée quant au contexte constructif qui façonnera les soins de santé en 2026.

Des fondamentaux solides, une dynamique de marché en amélioration et une demande croissante des investisseurs pour la diversification positionnent l'immobilier pour unerating en 2026.

Discussion sur les opportunités de valeur dans le crédit, le Titre adossé à des prêts et les hypothèques, et pourquoi une réelle compréhension de chaque crédit sera cruciale en 2026.

Un point mensuel sur les marchés présentant la performance des actions et des obligations mondiales, les tendances par secteur et par classe d’actifs, ainsi que les thèmes clés qui façonnent le paysage de l’investissement.