Discover why portfolio structure, not bubble timing, determines resilience. Learn how equity income strategies help investors capture AI-driven growth while reducing volatility and protecting capital during downturns.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

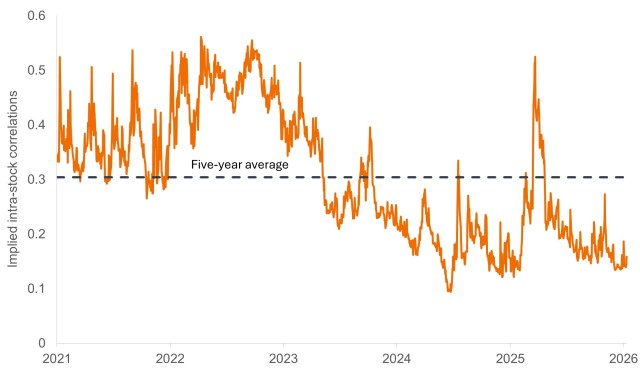

We view the lack of systemic risk priced into the market as the culprit for correlations among U.S. equities being near historic lows.

Why active management, fundamental research, and selectivity across sectors are key to identifying opportunities while managing volatility in fixed income.

Why rational pricing and rising dispersion represent a rare opportunity for absolute return investors.

While options markets indicate a relatively sanguine 2026 for equities, investors should take note of a potentially worrisome absence of systemic risk.

Victory Park Capital discuss the opportunities and risks in this dynamic area of private credit.

Introducing some of the factors supporting the case for absolute return at a time when disruption is becoming the norm.

Attractive yield and fundamental diversification makes emerging markets hard currency debt a compelling opportunity for 2026.

Jonathan Coleman explores key drivers that could support U.S. small-cap performance in 2026, including reshoring trends, M&A activity, and AI productivity gains.

European CLOs offer resilience and opportunity in 2026, driven by strong demand and supportive regulation – helping investors balance yield and stability.

In their 2026 outlook, Lucas Klein and Marc Pinto discuss how AI and structural reforms, especially in Europe, present opportunities for selective investors.