- Who we are

-

-

About Janus Henderson Investors

-

Our people

-

Environmental, Social and Governance (ESG)

-

Diversity, Equity and Inclusion

-

-

-

We provide access to some of the industry’s most talented and innovative thinkers.

Meet our teams

-

Find out how environmental, social and governance considerations are embedded within our organization and investment principles.

Learn more

-

See how diversity, equity, and inclusion are valued and supported at Janus Henderson.

Learn more

-

- Media

-

-

Media resources

- Press releases

- Media events

- Media contacts

- Media resources

-

-

- Insights

- Careers

Find your local site

Press releases

Janus Henderson launches new Sustainable Technology Fund (OEIC)

6th September: London & Denver – Janus Henderson Group plc (NYSE: JHG, ASX: JHG) announces the launch of the Janus Henderson Sustainable Future Technologies Fund, which will aim to deliver long-term capital growth by investing in sustainable technology-related companies. The Fund will be available as an OEIC and is primarily aimed at both wholesale retail and institutional investors in the UK.

The fund’s investment team: Alison Porter, Richard Clode and Graeme Clark are based in London and Edinburgh; together they have over 70 years of combined investment experience. They will be supported by a new and growing global team of ESG specialists, led by Janus Henderson’s Head of ESG Investments, Paul LaCoursiere. The fund will be supported by a dedicated analyst team (including a sustainability analyst), and the global team of specialists within the broader Governance & Responsible Investor (GRI) team, with access to a dedicated ESG data platform.

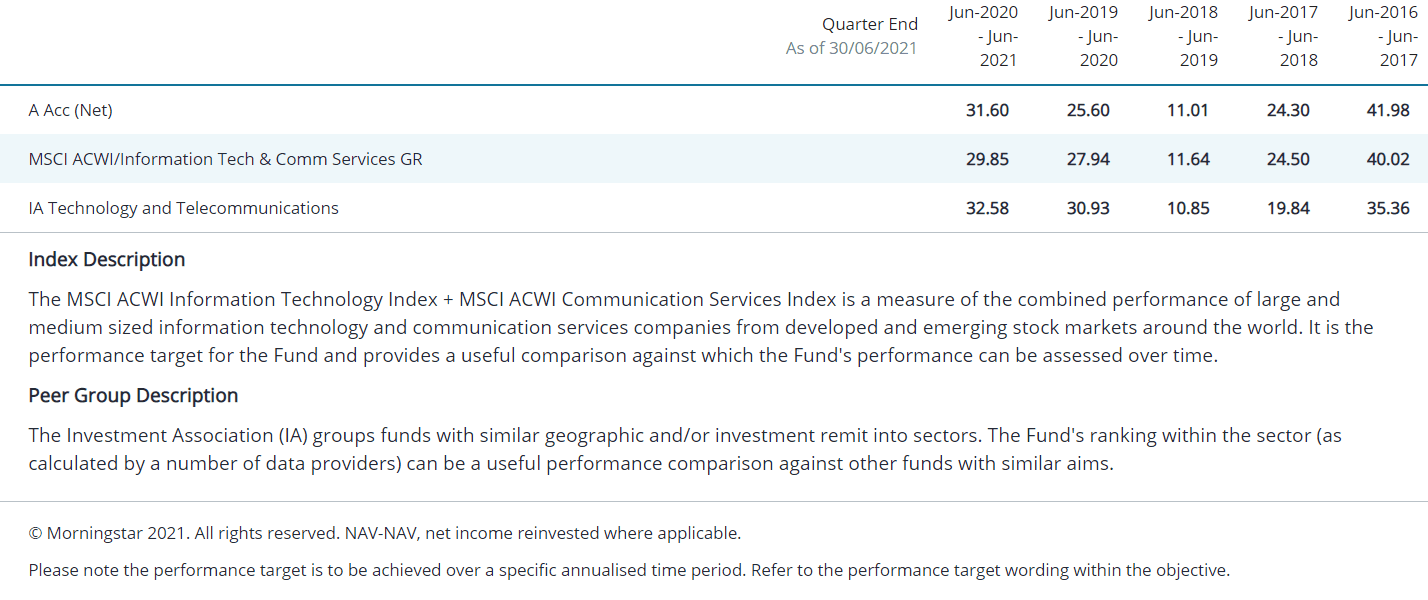

The fund management team has solid environmental and sustainability credentials; this new fund builds on the success of the Janus Henderson Global Technology Leaders Fund, sharing the same investment team who have a strong, consistent track record; generating returns of annualised returns of 14.4% versus 11.9% for the peer group[1] since the funds inception in 1984.[2],[3]

The fund’s investment approach will use a positive thematic framework to select investments; which will align to the UN’s Sustainable Development Goals and derive at least 50% of their revenues from fund’s sustainable technology themes.[4] The sustainability objective of the Sustainable Future Technologies Fund ensures meaningful diversification and differentiation from traditional tech, offering exposure to emerging technology companies aligned to the UN SDGs; this increases the breadth of sustainable investment solutions available to clients.

Richard Clode, Fund Manager at Janus Henderson Investors said: “Clients increasingly, expect and demand managers deliver positive social, environmental and financial outcomes. We are really excited by the potential of this fund; moving away from traditional technology and looking for emerging and overlooked companies who meet a stringent sustainability criterion. Technology has the ability to deliver across all of the components of ESG; while global regulation and classification initially concentrated on environmental sustainability, this fund is looking to go much further and expand to incorporate much wider social issues. The reach of technology is limitless and the sector has a unique and critical role to play in servicing social goals; to help democratise access to services, reduce inequality and upgrade quality of life.”

Simon Hillenbrand, Head of UK Retail comments: “Interest in both technology funds and funds with a sustainable investment focus has been relentless in recent years; this fund combines Alison, Richard and Graeme’s expert technology capabilities, with a product focused more directly on positive ESG impact. The launch of this fund demonstrates Janus Henderson’s commitment to meeting client demand and working toward a more sustainable world.”

– ends –

[1] IA Technology and Telecommunications Sector

[2] Global Tech Leaders Fund, I ACC factsheet,31 July 2021

[3] The Janus Henderson Global Technology Leaders Fund is indexed on the MSCI ACWI/Information Tech & Comm Services GR; the index Usage is as a Target/Comparator.

[4] Digital Democratisation, Tech Health, Low Carbon Infrastructure, Data Security, Smart Cities, Sustainable Transport, Resource & Productivity Optimisation and Clean Energy Technology.

Notes to editors

Janus Henderson Group (JHG) is a leading global active asset manager dedicated to helping investors achieve long-term financial goals through a broad range of investment solutions, including equities, fixed income, quantitative equities, multi-asset and alternative asset class strategies.

At 30 June 2021, Janus Henderson had approximately US$428 billion in assets under management, more than 2,000 employees, and offices in 25 cities worldwide. Headquartered in London, the company is listed on the New York Stock Exchange (NYSE) and the Australian Securities Exchange (ASX).

Contact details

Stephen Sobey, Head of Media Relations

T: +44 0207 818 2523

M: +44 7836 631 776

E: stephen.sobey@janushenderson.com

Notes to editors:

Sustainable Future Technology: Fee structure

| Management fee | Est. other

Expenses |

Est. OCF | Max OCF | ||

| Class I | 0.75% | 0.11% | 0.86% | N/A | Standard Retail Clean & Standard Institutional |

Global Tech Leaders Fund Performance: (I ACC)