Market review

Markets were volatile in November, with the local flavour tilted to reassessing the next move for the Reserve Bank of Australia (RBA) on the back of strong data. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, fell -0.88%. The RBA maintained the cash rate at 3.60% early in the month, while three-month bank bills rose 3 basis points (bps) to 3.66% by month end. Six-month bank bill yields rose 9bps to 3.97%. Australia’s three-year government bond yields ended the month 27bps higher, at 3.87%, 10-year government bond yields were 22bps higher at 4.51%.

The RBA were cautious, continuing to be data dependent at their November meeting. There are uncertainties surrounding the economy, as the labour market is easing, while inflation remains higher than the RBA are comfortable with. Remaining on hold, in the near-term, is the prudent move in the face of conflicting risks. The first release of the new monthly consumer price index (CPI) series was much higher than expected. The series was biased upwards by changes in Government policies relating to electricity and rental assistance, as well as the timing of school holidays. Alongside this was a generalised rise in prices that saw the headline series at 3.8%yoy, and the trimmed mean at a higher than expected 3.3%yoy. Strong capital expenditure on new data centres points to an upswing in non-traditional investment. The labour market improved, but still shows a trend softening, and the unemployment rate sits at 4.3%. Consumer sentiment rose, but perception of future employment fell.

Global markets saw a high degree of volatility in November. A lack of US data, through the Government shutdown, combined with growing focus on artificial intelligence (AI) investment sources and value, led to weaker risk sentiment. Global markets ended the month almost back where they started, banking on the US Federal Reserve to continue easing policy. The official US data vacuum saw greater reliance on surveys, where the US ISM manufacturing index dropped more than expected, while services rose. This was also seen in many global purchasing manager indices. The AI investment theme is driving growth expectations for the coming year, amid moderating global trade and geopolitical uncertainties.

Market outlook

With inflation higher than the RBA are comfortable, markets are expecting the RBA to remain on hold until late 2027. Our base case sees the RBA looking to ease in H1 2026. This still leaves policy above our estimate of neutral through this cycle. Our low case reflects a weaker economic outcome, if global uncertainties are persistent and the labour market deteriorates. We allocate a small weight to the low case. We hold a modest long duration position, while we remain vigilant through the volatility to take advantage of two-way mispricing.

Monthly focus – Keep on consuming

Overall economic growth in 2026 is, as always, dependent on the rate of household consumption. With a number of question marks around the sector, we take a closer look. Through the coming year, we expect a more sustained restoration of trend growth rates in household consumption, but these will be dependent on levels of income and wealth growth.

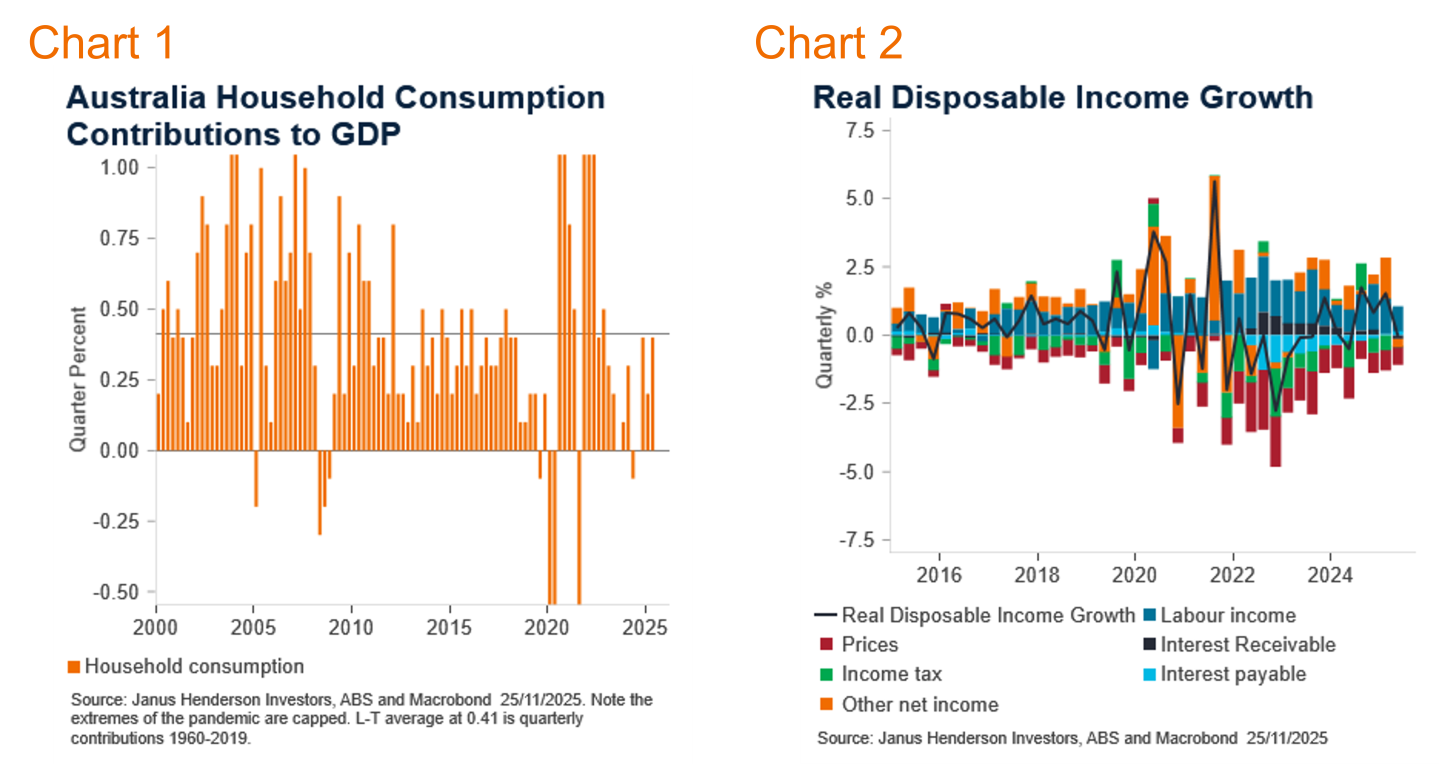

Household consumption only returned to its long-term average quarterly growth rate in Q2, 2025 after almost two years of sub-par spending (Chart 1). Chart 2 shows the sources of the increase in real disposable income, which allows for a rise in household consumption. After a pronounced period where interest costs rose, in response to a tightening of monetary policy, these eased as the RBA lowered the cash rate from February 2025. If consumers are concerned that the RBA are done with easing, that lift to incomes from lower cash rates fades as a tailwind to spending.

Boosts to real disposable income from tax changes and inflation are also moderating. Income tax cuts through the second half of 2024 are now a memory as bracket creep from wage gains builds tax payments back up. Real incomes have also been supported by the reduction in inflation from its peak at 8.2%yoy, to around 3.0%yoy at present (quarterly data). We expect headline CPI to moderate by end 2026, but the new monthly series suggests that price increases were a renewed headwind in Q4.

With the payments contraction support ebbing, we turn to incomes. Labour incomes have been supportive through the cycle, as the labour market remained solid. Consistent employment growth, combined with wages growth, allows for overall labour income support. This eased in Q2, as employment growth moderated. Forward indicators of employment suggest further slowing ahead.

The income support for a sustained pick up in household consumption may pull back a little in the coming few quarters, as some of the easy gains are behind us. Households can turn, instead, to savings. We have already seen a slight pull back in the savings rate in the second quarter. We also see a greater reduction in the level of household excess mortgage payments, than the reduction in mortgage payments. This is suggestive of households using savings and lowering excess payments to boost household consumption through the first half of 2025.

In order to maintain spending, and indeed raise growth rates, households will need to be confident about the coming year. The guidance on this is mixed. The recent consumer confidence survey showed a spike in confidence levels, to their best since 2022. However, views on the likelihood of being unemployed also spiked, which is unusual. On a brighter, and more consistent, note there has been a rise in household wealth. Household assets are mostly comprised of housing stock, and house prices are performing well, with the eight capital cities up 7.5%yoy. The next largest asset is the stock of superannuation holdings. Here too, performance is solidly positive as financial markets have been buoyant, recent volatility notwithstanding.

A sustained rise in household spending growth is probable but not guaranteed. In light of some factors such as a slower labour market, and less impetus from near-term lower inflation, tax and mortgage payments there may be scope for support if spending falters.

Views as at 1 December 2025.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.