Market review

Solid domestic data contributed to reinforcing near term lift in yields. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose 0.21%.

The Reserve Bank of Australia (RBA) did not meet in January, therefore the cash rate remained at 3.60%. Three-month bank bills rose 10 basis points (bps) to 3.84% by month end. Six-month bank bill yields fell 3bps to 4.09%. Australia’s three-year government bond yields ended the month 13bps higher, at 4.27%, 10-year government bond yields were 7bps higher at 4.81%.

January was an extraordinary month in terms of global, geopolitical events and central bank uncertainty. From the US demanding Greenland, to ousting the Venezuelan leader, and instigating a criminal probe into Federal Reserve Chair Powell. What is more remarkable is the market’s mostly benign response to the newsflow. Amid a general level of uncertainty, demand for assets continues to outweigh any potential global blowback. Peripheral markets are showing the impacts, volatility in gold and silver prices and a weakening US dollar are key indicators of that unease.

While these broad events are ongoing, providing a backdrop to the domestic market, at this point, they are not driving them. The local economy shows elevated inflation, with the RBA’s main measure, the trimmed mean quarterly series, at 3.4%yoy. The new monthly headline series remains at 3.8%. A series of administrative prices and one-offs have driven the headlines. Underlying this is steadying energy and rent prices, proving some degree of comfort ahead. The labour market remains highly volatile, with large changes month-to-month. The unemployment rate has dropped to 4.1%, but employment growth is low. Consumer confidence has dropped on the prospect of higher interest rate increases, while major city house prices are similarly subdued.

A case for RBA hikes can be made this year. The upcoming artificial intelligence (AI) related capital expenditure cycle is expected to contribute significantly to demand and come up against supply constraints. Much of this comes in H2 and beyond. Initially, the household sector remains sensitive but should stabilise.

Risk markets continued their solid momentum into 2026. Domestically, corporate and structured credit primary markets opened strongly with a range of issuers issuing bonds. Against a broadly constructive background for credit, the Australian iTraxx Index closed 2bps wider at 66bps, while the Australian fixed and floating rate credit indices returned +0.32% and +0.46% respectively.

Market outlook

We have updated our RBA base case, looking for a series of hikes through 2026, into 2027. While our hikes are later than current market pricing, they move higher than that priced into 2027. Our high case is one where inflation remains elevated and the RBA are forced to raise interest rates more than expected in H1 2026, continuing higher through the year and into 2027. This has a 10% weight. Our low case reflects a weaker economic outcome, if global uncertainties are renewed and the labour market deteriorates. We hold a modest long duration position, targeted on the curve, and remain vigilant to take advantage of market mispricing.

Monthly focus – Make way for AI Investment

The AI investment boom is upon us, we knew it was coming but the third quarter of 2025 showed that its appearance was perhaps sooner than expected. The trajectory is by no means guaranteed. There is a desire by policy makers, and players alike, to facilitate progress but some perspective on quantum, and constraints, provide a useful guideline to the path ahead. The AI sector influence on the economy initially shows up in investment. The productivity enhancements come later. Australia is seen as having a comparative advantage in terms of global geopolitics, economic conditions and availability of renewable energy sources. Given this, it is reported that the build and placement of data centres (DC) in Australia is higher than in comparative countries. Australia will benefit from setting up DC in Australia that service both local and non-Australian clients.

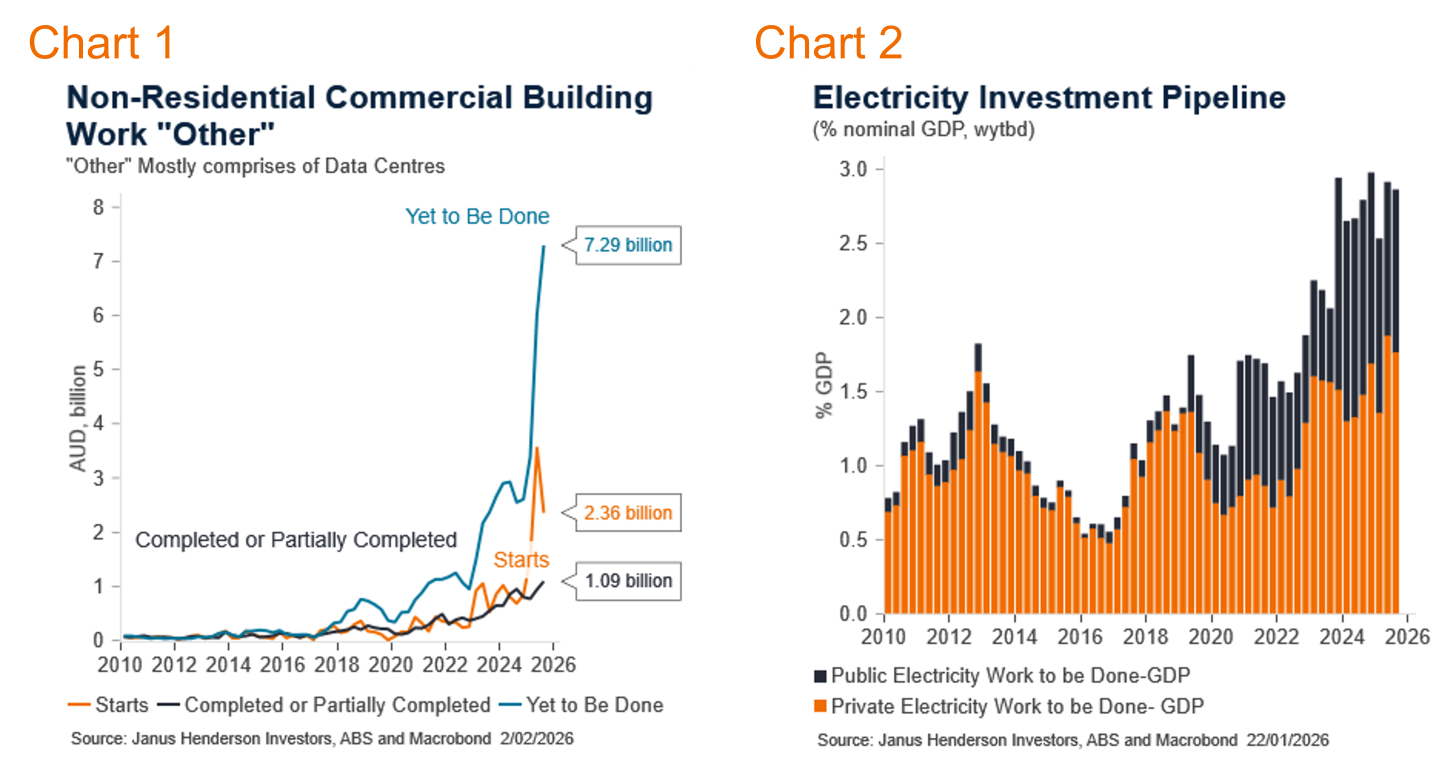

The rise in DC building has been dramatic. This captured economist’s attention in the third quarter data set, surging ahead. To Q3 2025, per quarter, actual building steadily rose at A$1.1bn, starts have surged to A$2.4bn but all eyes on the work yet to be done (WYTBD) at A$7.3bn. WYTBD are committed, approved developments that are expected to proceed in the next year. While not all will go through, a significant proportion is expected to be developed. The Q3 data for starts is also indicative of the possible pathways. It may not be a smooth process; delays can be expected. These represent a powerful rise in the sector. Mapped against the overall economy though, it may be smaller. The datacentre WYTBD is around 0.25% of nominal GDP at this stage. There have been numerous announcements regarding the pipeline for DC build commitments that will not be in the official ABS data.

If we assume the A$7.6bn increase, then deflate by target inflation, the rise in real private non-residential capital expenditure is an admirable 20%. Assuming it isn’t implemented all at once and smooth the spend over multiple years, this would imply an approximate 0.4 percentage point rise in the contribution to real GDP per year. This is not to be ignored, but equally it doesn’t suggest another boom period.

However, if the media announcements are to be believed, there is a long-term pipeline of around A$150bn. If, and this is a big assumption, this comes about, then there could be a significant contribution to real GDP over a decade. This includes spending on the inputs, such as energy and water, as well as software.

There are challenges to the projected implementation of datacentre construction. There has been a crowding out of construction as the public sector utilised available labour and inputs to building, creating roadblocks to rapid build out in the private sector. This will ease as the public build moderates.

Energy and Transmission

Energy is significant for DC and AI. DC are energy intensive and have huge energy, and thus transmission, needs. Increasingly, DC are saying they will provide their own energy, predominantly through renewables.

The electricity building on WYTBD is larger than that of DC, and while AI and DC are a large part of this, the changing needs of the entire energy sector is also behind the ramp up. The WYTBD now equates to just shy of 3% of GDP on a nominal basis. Much of the acceleration since 2024 has been in the public sector, while private plans have been flat, after a sharp rise though 2022-2023. That will need to change if private energy generation is to be used to meet the new AI needs.

Given the increasing focus on the social aspect of energy, and water, usage, often referred to as the energy trilemma of reliability, affordability and sustainability, combined with tight supply and rising costs, it should be expected that heavy users such as DC, and others, will meet their energy needs outside of the public provision. This can be represented as a capital expenditure tailwind, or an investment headwind. It is likely there is a bit of both. Some investors will be able to go ahead with private access to their energy, and water, needs. Others will see the costs, delays and social license as too high a barrier.

Spending on actual AI itself will likely increasingly factor into the equation. Overall software spend has already surpassed the late 1990’s boom and should further increase. As AI becomes cheaper per user, and other versions appear, this growth may slow. The generalised rise in overall spend thus far is also likely to represent the increased digitisation of lives and workforces that was already underway. AI adds to this. We would consider the contribution to growth to maintain on a steady path from here.

Views as at 1 February 2025.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.