Market review

US “Liberation Day” and tariff turmoil dominated the market through April. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose 1.7%. The Reserve Bank of Australia (RBA) kept the cash rate at 4.10%, just prior to the market volatility. Three-month bank bills were down 25 basis point (bps), to 3.87% by month end. Six-month bank bill yields ended 41bps lower at 3.89%. Australia’s three-year government bond yields ended the month 38bps lower, at 3.32%, while 10-year government bond yields were 22bps lower at 4.38%.

Markets were already wary about the United States’ policy path when US President Trump proclaimed “liberation day” and a slew of prohibitive tariffs across countries. Market volatility spiked on fears of a broad supply shock to the US economy, and demand shock to many of the US’s, and Australia’s, trading partners. Subsequently, economic confidence data deteriorated, and real time tracking of international trade has shown a real slowdown. While the tariffs have a 90-day hiatus, concern regarding the rise in average tariff rates and slowing economic growth are evident in the economy.

The Australian economy goes into this period of global uncertainty from a period of soft but stabilising economic growth. The anticipated solid pick-up in consumer spending is challenged through confidence impacts in the first instance and potential employment impacts in the second, while the export outlook has deteriorated. Australia is not significantly impacted through trade with the US directly, but our major trading partners, China, Japan and South-East Asia, are likely to see slower economic growth. We have lowered our forecast for GDP growth in 2025 to 1.9%, with some risks to the downside if the global tariff negotiations are unresolved.

Market outlook

The changing global and domestic landscape, to a lower growth outlook with more manageable inflation, has led to the market pricing in a further 125bps of easing by the RBA. This matches our updated base case for the RBA to proceed with a, still modest, easing cycle, of around 150bps in total to 2.85%. Our low case now reflects a weaker economic outcome and the RBA easing by a total of 250bps, recognising the rising downside risks. We allocate a 25% weight to the low case. Through the sharp drop in yields, we have moved duration to neutral, seeing better opportunities elsewhere. We remain vigilant through the volatility to take advantage of mispricing, and continue to favour the shorter part of the yield curve, as the long end is caught up with global factors.

Monthly focus – Exceptional and privileged no more?

There is much talk of a loss of US exceptionalism or exorbitant privilege. This matters for Australia’s economy and financial markets, and just how much uncertainty is generated will reverberate through both the economy and markets.

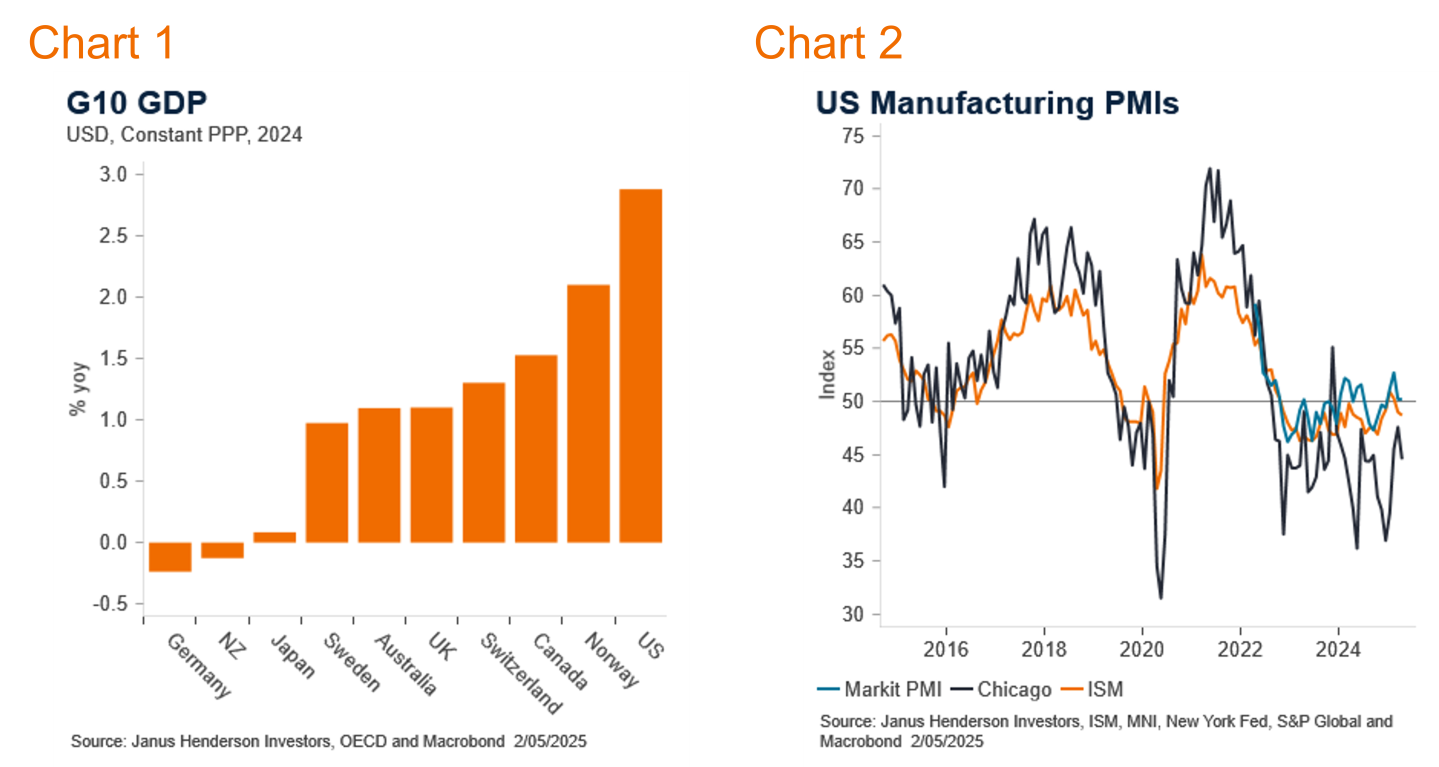

US exceptionalism is the excess economic growth, low unemployment and improved outlook brought about by economic policies and progressive innovation, including Artificial intelligence (AI). US economic growth has outperformed its G10 peers, topping out at a GDP rate near 3%yoy by the end of 2024 (Chart 1). This comes despite a prior Federal Reserve (Fed) hiking cycle, and buoyed by fiscal, technological and regulatory tailwinds.

The US economy now faces a series of uncertainties. The advent of DeepSeek, which allows for the possibility of using AI with cheaper inputs, was the start of questioning the US outlook. However, the outlook has been further eroded by the tariffs and the lack of clarity the tariff policy generates for economic decision making. While the 90-day tariff hiatus is a relief, and deals are likely to be done, business are yet to know exactly what the landscape looks like come June and beyond. Also, even with the pause, average tariff rates are higher than before this current period, which lowers growth.

We see the impact of this uncertainty in the US purchasing manager indices (Chart 2), which measure the current environment but more importantly expectations for the future. As these deteriorate, employment and investment decisions are halted. This reduces economic growth, and weighs on households, thus spreading out through the economy.

Changes to US migration policy will also soften the economic outlook, as migration flows have been a source of growth. In addition, changes in Federal Government employment and reduced government spending are also a headwind, at the margin. These factors moderate US exceptionalism.

The path for US growth has moved lower, but exactly how much will depend on the policy path taken in the next few months. A slower US economy tends to soften global growth, and impacts Australia through the general environment, including changes in asset prices.

However, it is the changes in the US’s exorbitant privilege which potentially have a greater impact.

The US exorbitant priviliege is the US’s role as the pre-dominant global reserve asset. This allows for a natural flow of demand for US assets, such as Treasuries, and cements US Treasury bonds’ role as the global benchmark bond. US Government bonds are considered the safest asset there are.

This privilege brings about rewards, such as a steady demand for US assets and therefore a lower interest rate to be paid on those Treasuries. It allows the US to run significant twin deficits, ie a large fiscal and current account deficit, that would otherwise warrant much higher interest rates.

The US has this privilege because of the depth of its market, and confidence in policy making institutions, both fiscal and monetary. Recent events have shaken faith in the US’s global role as the benchmark bond. Market concerns over the independence of the Fed, and therefore its ability to achieve its goal of price stability has contributed to concerns. The US fiscal deficit was already a question mark over the exorbitant privilege heading into this period. Concrete resolution of both factors will be a relief to all.

A rise in US term premia is a natural outcome of a questioning of the US’s role as a global safe haven. If markets have to price for policy uncertainty, and the possibility of shaken faith in US dollars, then they need to be further rewarded for holding these assets. Given the US is the benchmark bond, that raises global term premia, and market volatility, including in Australia. This is one of the factors behind the underperformance of long dated bonds. A loss of the US’s benchmark status isn’t the most likely outcome, but it is one that bears consideration.

Views as at 1 May 2025.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.