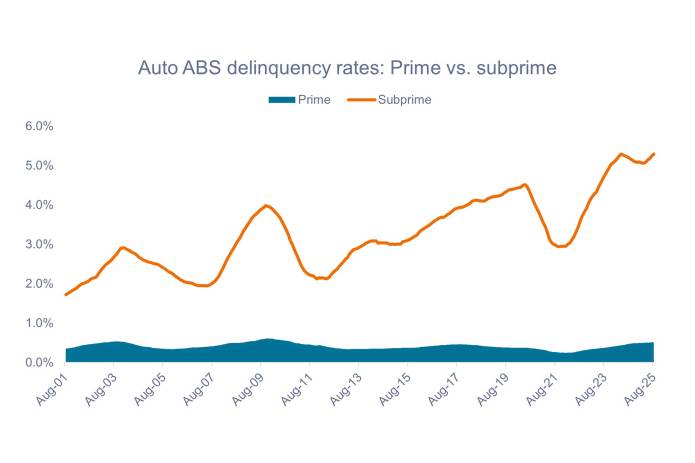

Chart to Watch: Indiscriminate selling in auto ABS creates opportunities for active managers

While the subprime consumer is becoming strained and delinquencies in that segment are on the rise, asset-backed securities (ABS) exposed to the prime consumer remain on solid footing. Additionally, with subprime loans making up less than a third of the total auto ABS market, the market as a whole is dominated by high-quality borrowers.

2 minute read

Key takeaways:

- The recent bankruptcies of auto parts manufacturer First Brands and auto lender Tricolor have left some investors spooked and asking whether these events are an early warning sign for consumer credit.

- In our view, these two credit events were idiosyncratic in nature and unrelated to the health of the underlying consumer, despite their taking place around the same time. We do not see evidence of broader weakness in credit markets, particularly among prime-rated consumer loans.

- As active managers, we can eschew troublesome pockets (such as, at present, subprime auto exposure) while also seeking to take advantage of fear-based selling to buy high-quality prime assets at discounted prices. Further, strong underwriting standards and credit enhancements within ABS structures provide an additional layer of protection for investors, particularly among the highest-rated tranches.

Source: Intex, Goldman Sachs Investment Research, as of 31 August 2025. Chart shows trailing 12-month moving average of share of balances 60 days or more past due. Borrower credit scores: Subprime <620, prime >660.

Back in 2022 and 2023, we witnessed spread widening within commercial mortgage-backed securities (CMBS) due to high-profile turmoil in pockets of the office subsector. In addition to steering clear of troubled office buildings, we took advantage of fear-based selling within the broader market to buy CMBS assets we liked – such as data centers – at discounted prices.

Today, we see a similar opportunity in ABS: While we prefer to avoid subprime exposure at present, the bankruptcies of First Brands and Tricolor have resulted in indiscriminate selling of numerous higher-quality assets, providing an opportunity to acquire prime auto ABS at historically attractive prices. We cannot overemphasize the potential value of active management within securitized markets.

Idiosyncratic risks are factors that are specific to a particular company and have little or no correlation with market risk.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Tranche: In securitized products like CLOs, a tranche is one of a number of related securities offered as part of the same transaction, with each representing a different degree of risk and carrying a commensurate credit rating.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.