Tariff related economic concerns saw a sharp equity market drawdown in April which coincided with rates rallying. These moves reminded investors of the crucial role that defensive allocations such as fixed interest play in diversified portfolios.

For credit focused investors, a higher probability of economic slowdown assigned by markets pushed credit spreads wider during April, as investors demanded greater compensation for perceived default risk. Attractive carry has shielded investors somewhat from the associated capital price movements with defensively positioned portfolios faring better over the month.

Pleasingly, Janus Henderson’s Australian Fixed Interest team’s preference for higher quality defensive credit leading into the period has been advantageous.

Sector positioning favouring more defensive credit is just one advantage afforded to active managers with other valuable downside protection and alpha strategies available. The use of synthetic credit protection strategies which are used less frequently and less recognised is one.

Active advantage from Credit Protection Strategies

Credit Default Swaps (CDS) are derivatives that can be used to hedge credit risk in portfolios.

To the uninitiated, these instruments can be thought of much like portfolio insurance, with the value of that insurance rising when economic uncertainty increases. CDS capability provides a liquid, cost effective, and quick to implement protection method over Australian public credit portfolios, and works well in a meaningful market stress or shock environment.

Janus Henderson’s Australian Fixed Interest team opportunistically and cost-effectively built one of the domestic market’s largest credit protection positions into portfolios using CDS prior to the most recent risk-off event. This was achieved during the much calmer market conditions that preceded the recent episode of elevated market volatility.

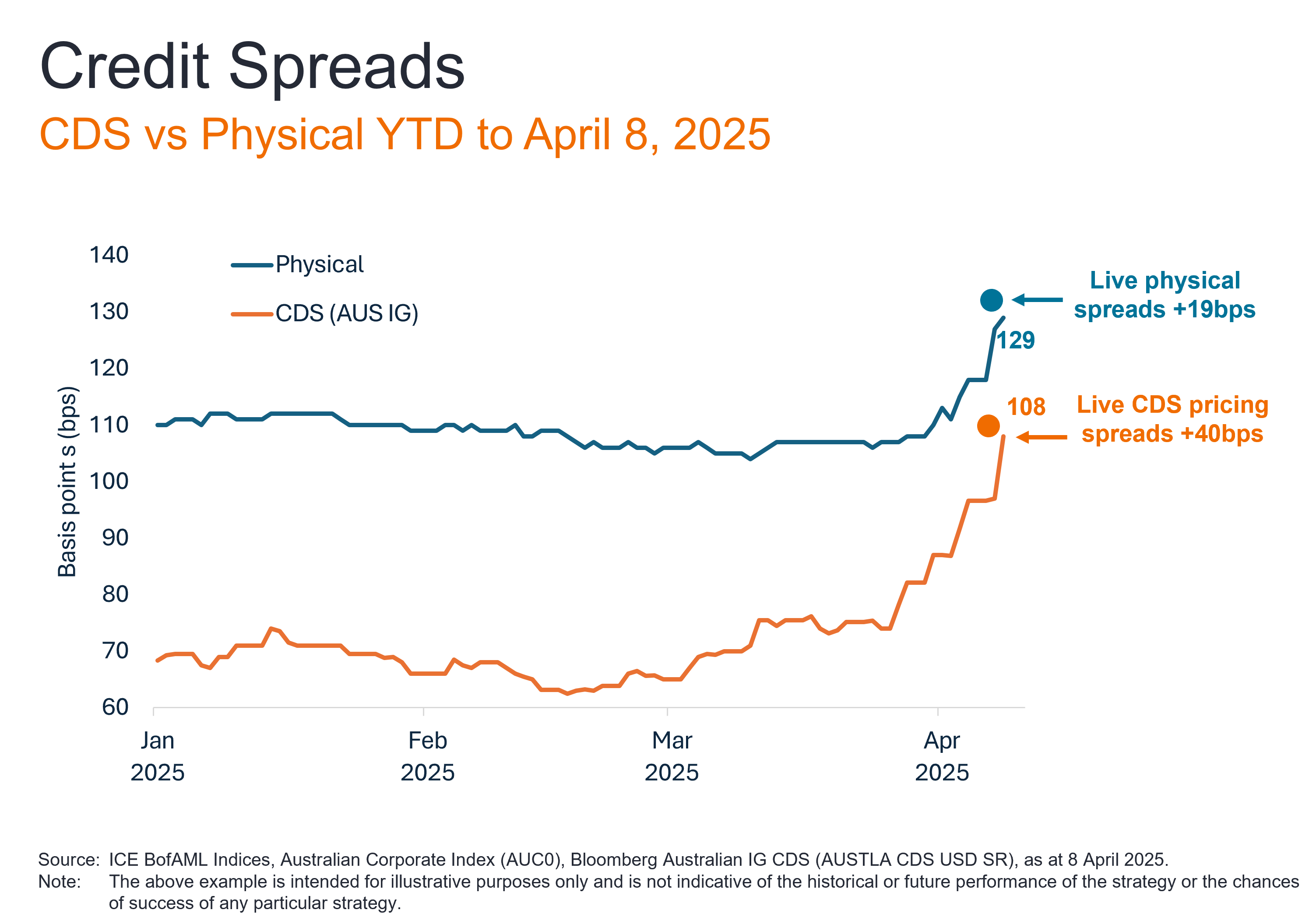

Notionally, the team’s CDS holdings amounted to protection from approximately one-third of the credit spread exposure or risk of widening in portfolios. Due to the more rapid repricing of the CDS securities, as investors quickly sought to obtain portfolio insurance, these securities appreciated in value much more swiftly and in greater magnitude than the physical credit securities they are used to hedge. The outcome was that the large CDS protection built into portfolios effectively protected two-thirds of the credit spread widening of physical credit exposure.

This example illustrates the ability of active managers using additional downside protection strategies as an advantage compared to passive solutions.

As always, as an active fixed interest investment team, we remain nimble in how we position portfolios to best mitigate risks to help deliver on our objective of delivering superior financial outcomes for our clients.

Important information

Protection: There is no assurance that the investment process will consistently lead to successful investing. No investment strategy, including a protection strategy, can ensure a profit or eliminate the risk of loss.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.