A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Insights

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Although facing risks to both sides of its dual mandate, the Fed prioritized soft jobs data by delivering a quarter-point rate cut.

A discussion on equity and fixed income positioning during a period of AI-driven economic growth and Fed policy uncertainty.

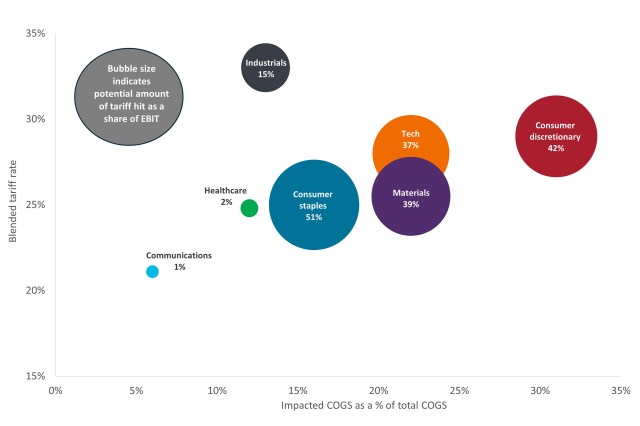

U.S. companies have thus far withstood the Trump administration’s barrage of tariffs, but signs of stress are emerging in the most exposed sectors.

Perspectives on volatility, tariffs, AI, and U.S. consumer strength.

How corporate efficiency is supporting profitability and earnings growth.

Assessing Fed Chair Powell’s speech at Jackson Hole and the implications for fixed income investors.

The risk of tariff-induced supply disruptions has raised the stakes for monetary policy error.

Despite weak jobs data, we consider the economy to be on solid footing and remain focused on the long-run tailwinds that may be created through policy change and secular growth drivers.

How fixed income investors can prepare for an uncertain journey by recognising trends and diversifying across different assets.