Market review

June provided no fewer global shocks, while markets adapt to the barrage of newsflow. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose 0.75%.

The Reserve Bank of Australia (RBA) did not meet in the month, with the cash rate at 3.85%. Three-month bank bills were down 12 basis points (bps), to 3.60% by month end. Six-month bank bill yields ended flat at 3.78%. Australia’s three-year government bond yields ended the month 7bps lower, at 3.26%, while 10-year government bond yields were 10bps lower at 4.16%.

In a period in which there have been seismic shifts in the global geopolitical landscape, markets have been relatively unflustered. US trade negotiations continue, with mixed success and rising anticipation ahead of the July 9 deadline. Israel and the US commenced, then ceased, military conflict with Iran. US President Trump continues to push against the authority of the US Federal Reserve, undermining a central tenet of modern economics. This occurred amid a background of an erosion of global institutions, such as the G7. The economic impacts have less immediacy than the headlines, and are nuanced, justifying the seemingly careless attitude of financial markets to historical events. These are important economic events, pointing to higher inflation and lower economic growth in general, but this takes time.

Closer to home, global events are showing in the NAB business survey, which was weak, but less so elsewhere. First quarter GDP was weak, with annual growth lower at 1.3% year-on-year (yoy). Household spending remains soft, despite a pickup in consumer confidence and rising real incomes. Precautionary savings are rising, pointing to uncertainty. The labour market remains solid, with softening edges. Headline employment was weak, while lower participation supported a steady unemployment rate. Monthly inflation dropped again, to 2.1%yoy, allowing the RBA more comfort on meeting their inflation objectives.

Market outlook

Markets continue to price a further 99bps of easing by the RBA, having moved to a more dovish stance amid global uncertainty. This remains close to our base case for the RBA to ease a further 100bps to 2.85%. Our low case reflects a weaker economic outcome and the RBA easing by a total of 250bps. We allocate a modest weight to the low case. Duration remains neutral, as we see better market opportunities elsewhere. We remain vigilant through the volatility to take advantage of mispricing and continue to favour the shorter part of the yield curve.

Monthly focus – Inflation green light

The RBA is mandated to maintain price stability, which is defined as annual growth in CPI between two and three percent. It has been a rough few years, in which soaring inflation rates have proven just how damaging it is when the RBA does not achieve its goals. With annual inflation peaking at 7.8%yoy in the fourth quarter of 2022, it has fallen back to mid-band at 2.4%yoy. The RBA’s job isn’t over, but they can be more relaxed than in quite some time. We see a multitude of competing pressures ahead, but for the near-term cycle, the pressure is easing. This provides the RBA scope for lowering the cash rate to near our estimate of neutral.

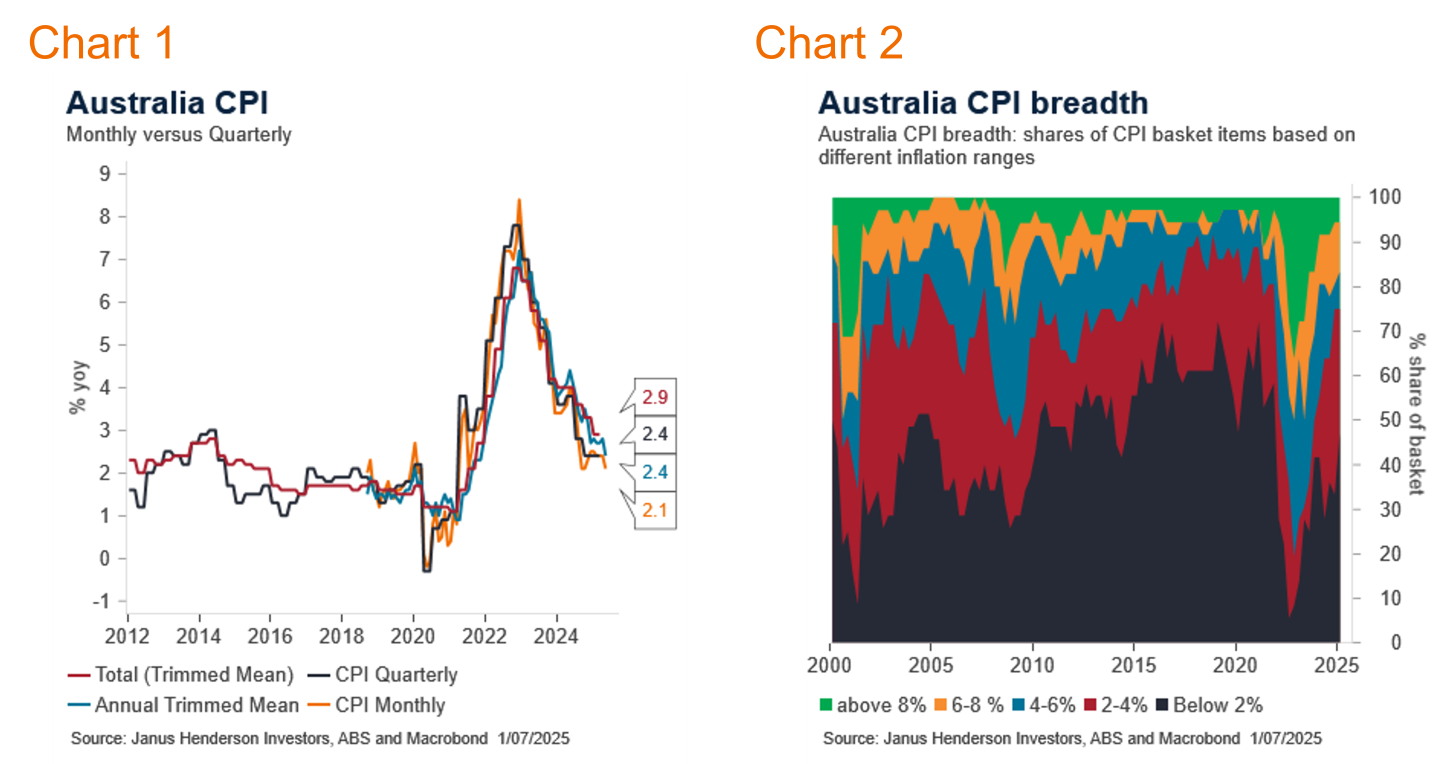

The Australian Bureau of Statistics has introduced a monthly CPI series, which will become the main inflation benchmark in late 2025. While continuing to evolve and improve until then, the precursor series is proving useful. The May headline monthly CPI showed annual inflation moderating to just 2.1%yoy. The trimmed mean version, which extracts the most volatile items, dropped to mid-band at 2.4%yoy (Chart 1). The quarterly series are proving to follow that monthly series relatively well, on trend.

Services prices remain elevated, but are moderating, this is consistent with private wages which are showing a similar pattern. High services prices are being offset by low goods prices, which have stabilised at low levels. Modest goods prices come from low tradeables prices, or the lower cost of imported goods. China’s inflation rate remains negative, and, in the near term, we can expect more products to be rotated away from the United States, toward countries with high consumer demand, such as Australia. This should further lower imported prices, along with a steady to rising Australian dollar.

We are also encouraged by the rising share of prices categories which are rising at a rate consistent with the RBA’s target band (Chart 2). 28% of items in the CPI basket are now rising between two and four percent per annum, compared to a low of three percent when inflation was near a peak in Q2 2023. 47.2% of items are recording gains of less than two percent, compared to a low of six percent in late 2022. There are still outsized gains in some categories, 6% of items are seeing gains over eight percent per annum. We do not expect them all to fall to target, but anticipate these categories to reduce back to an average share.

Inflation expectations are moderating and remain contained, the unemployment rate is arguably at or close to the level at which inflation is contained (NAIRU). These factors point to a more comfortable inflation environment over the coming year.

Beyond the coming year and amid profound changes in the global economic environment, we have increased concerns regarding higher inflation. A broadly higher global tariff rate, rising fiscal deficits, changing population population growth rates and climate change are all expected to be inflationary factors. They can be offset by rising productivity derived from implementation of AI. We discount the risks of inflation undershooting the RBA’s target over time, and see the inflation rate moving to the upper part of the RBA’s target band over the medium term. This prevents the RBA easing well below the neutral cash rate this cycle, absent a significant near-term economic shock.

Views as at 1 July 2025.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.