Market review

The global outlook remains highly uncertain, as trade policy and geopolitics developments continue to follow an uneven path. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose 0.16%.

The Reserve Bank of Australia (RBA) lowered the cash rate to 3.85%. Three-month bank bills were down 15 basis point (bps), to 3.73% by month end. Six-month bank bill yields ended 11bps lower at 3.77%. Australia’s three-year government bond yields ended the month 1bp higher, at 3.33%, while 10-year government bond yields were 9bps higher at 4.26%.

The summary of where markets ended the month belies the much wider intra-month peaks and troughs. This volatility was brought about by intermittent relief on tariffs, with the prospect of bi-lateral deals, and countered by an escalation of sectoral tariffs such as electric vehicles, and steel. Meanwhile, economies are adjusting to the new world, sentiment is stabilising, manufacturing leading indicators tick up, and services moderating on uncertainty. The overall picture remains one of very mild economic growth and steadying inflation, supported by modest central bank easing. The US remains an outlier, with the Federal Reserve in watch and wait mode amidst outlook uncertainty. Budget deficits remain a key theme of global bond markets, as the US fiscal bill makes its way through the legislative process.

The RBA lowered the cash rate, as expected, but their cautiousness was a surprise to markets. The domestic economy remains patchy, amid key uncertainties. The household remains weak. Measures of spending have disappointed and point to a rebuild of savings. Wages were better than expected, with the public sector leading the way. Core April monthly inflation was a fraction higher and appears to have stabilised for now, but it is heavily goods weighted. Meanwhile, the labour market continues to confound expectations, with another strong outcome, although the unemployment rate is steady at 4.1%. The Australian election delivered a clear majority to the incumbent Labour party, with an extended lead.

Market outlook

Markets continue to price a further 90bps of easing by the RBA, watching for two-sided risks in the current unclear environment. This remains close to our base case for the RBA to ease 150bps in total to 2.85%. Our low case reflects a weaker economic outcome and the RBA easing by a total of 250bps. We allocate a more modest weight to the low case, as global uncertainties moderated in the month. Duration remains neutral, as we see better market opportunities elsewhere. We remain vigilant through the volatility to take advantage of mispricing and continue to favour the shorter part of the yield curve.

Monthly focus – Capital expenditure: Investing in uncertainty

The quarterly suite of economic data is upon us, where we learn which parts of the economy are firing as expected, or not. There is, rightly, much focus on the household but how private investment is going remains important. Future levels of employment, productivity and output are reliant on what is invested in the here and now.

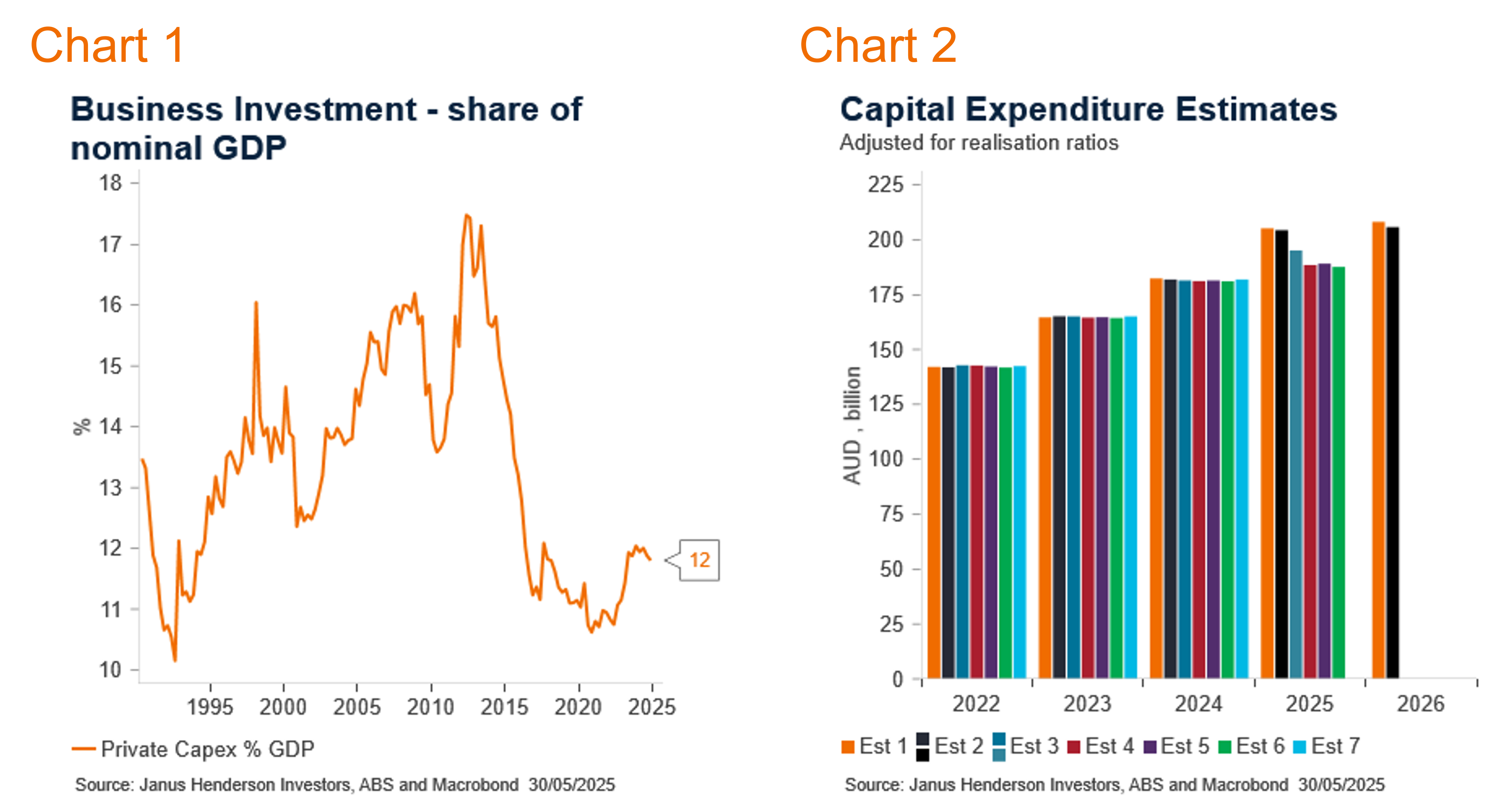

Private capital expenditure (capex) has been very low for a number of years, as a percent of GDP (Chart 1) and currently sits at around 12%. There has been a surge in public sector capex, however, that has now likely peaked, as the major state projects come to an end, and the anticipated new projects are not as concentrated, timewise. This leaves space for the private sector to step in, but that is not the forecast for the next year.

The first quarter capex data was disappointing, falling -0.1% quarter on quarter, and below market expectations. The weakness was in private plant and equipment, while building was higher. We were not so surprised with the outcome and look for some softness to continue. This is one of the factors behind our relatively low GDP forecast for the year, and slightly more RBA cuts forecast, than the market is expecting.

It is normal for the private capex cycle to moderate after the RBA hiking cycle has ended, as this type of investment is late cycle. It takes time to decide to invest, and then implement the program. After interest rates have been high for an extended period of time, investment softens. This moderation is also consistent with a peaking in the business measures of capital utilisation, as utilisation comes lower, there is less need for additional investment. NAB’s business survey has shown such a moderation, albeit from extremely high levels. And, finally, we are also seeing the expectations of businesses themselves come through with less strength than usual. Companies report their future plans, and we adjust them for how much usually gets translated into actual investment, termed the realisation ratio (Chart 2). There has been a decline in the 2025 plans, and 2026 is setting itself up for a relatively paltry outcome.

Capex moderation has been expected from these long-known factors. However, we now also face an uncertain economic operating environment. The original list was behind our initial soft private investment estimates, but these have been augmented by the global trade war, highly volatile capital markets and falling business confidence. We’ll be monitoring for any further hesitation and deterioration of capital investment expectations ahead, which may nudge the RBA closer to the low case, than the base case. Although, in this world of uncertainty, global geopolitical and trade decisions may be, long-term, positive for Australian capital investment on a number of fronts. It is another example of whilst the US trade war doesn’t have significant first order impacts on Australia’s economy, it likely has consequences.

Views as at 1 June 2025.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.