Market review

Australian bond markets saw a repricing of the Reserve Bank of Australia (RBA) in September. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose 0.1%. The RBA maintained the cash rate at 3.60%, as was expected. Three-month bank bills were steady at 3.58% by month end. Six-month bank bill yields rose 9 basis points (bps) to 3.66%. Australia’s three-year government bond yields ended the month 15bps higher, at 3.55%, while 10-year government bond yields were 2bp higher at 4.30%.

While global ructions continued in the background, it was the local data that drove the big moves in local yields. Second quarter GDP was a touch higher than expected, with a pick-up in household consumption. There are continued concerns around the transition between a softer public sector and a better off household sector, so better than expected spending news was welcome. That transition isn’t entirely guaranteed, with employment growth dropping again. Although, with the unemployment rate steady, through lower participation, the RBA is less concerned about a softening labour market.

The inflation side of the RBA’s mandate captured more attention, with the volatile monthly series precipitating renewed inflation concerns. The headline series was higher than expected, at 3%yoy, returning to the top of the RBA’s target band. In the details, market services, strongly related to the labour market, was higher and led to the RBA’s heightened inflation awareness in their recent press conference. This cloudy picture has the RBA returning to a highly data dependent stance.

The global backdrop shows a slowing US economy, countered by the renewed Federal Reserve easing cycle. The Chinese economy remains lacklustre, while global trade continues to be uncertain. High government debt levels remain a concern for bond markets in the UK, parts of Europe and Japan.

Market outlook

Renewed inflation concerns have seen a repricing of the RBA’s expected path higher, with a low in the cash rate at 3.30% in August 2026. This is higher than our base case for the RBA to ease a further 75bps to 2.85%. Our low case reflects a weaker economic outcome and the RBA easing by a total of 250bps. We allocate a modest weight to the low case. We hold a small, long duration position to take advantage of some of the lift in yields, while we remain vigilant through the volatility to take advantage of two-way mispricing.

Monthly focus – Global trade still to play out

The US implemented decades high and comprehensive tariffs across the globe throughout the last six months. The global economy has absorbed these thus far, seemingly defying initial concerns. There are increasing signs of a slowing in global trade and adjustments in existing trade relationships. We expect the transition to a new set of trading relationships to slowly continue.

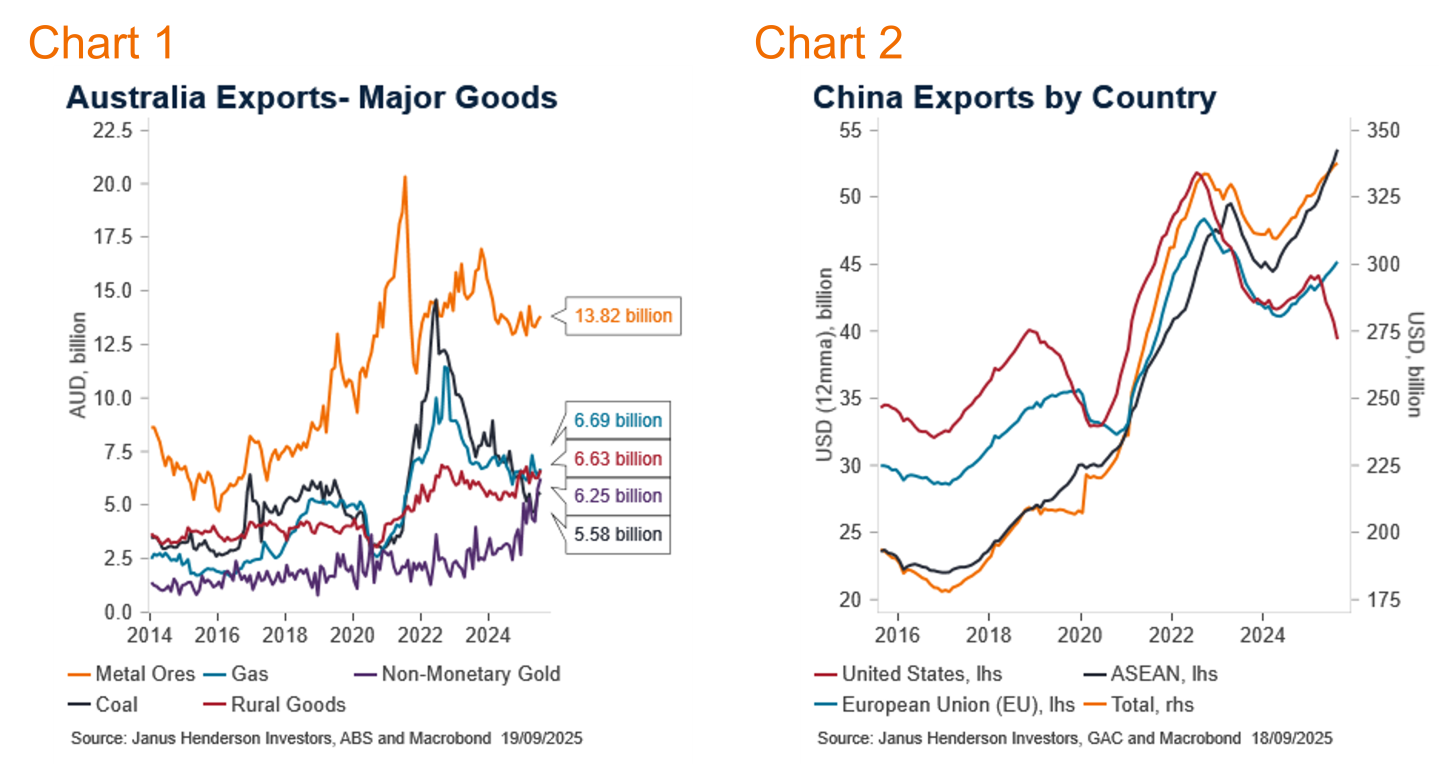

Australia’s direct tariffs from the US are at the low end of the range, at 10%, and our trade with the US is a small proportion of total trade. As such, the direct impacts from the US’ policy were always expected to be limited. Concerns centre on the indirect impact of trade with our largest trading partners including China, Japan, South Korea, Taiwan and India. Thus far, all is well. Australian exports are tracking comfortably. Goods exports have been solid, while services recover from Covid era weakness. However, there are signs that global policies have not yet been fully absorbed by the global economy, and the time to relax, considering these fundamental changes, has not yet arrived.

Australian exports are a function of broad global economic growth. The stop-start and uncertain nature of the global tariff implementation has pushed back the expected impact they will have on global economic growth, but not fully eliminated it. The tariff pressure has now started to build, and we see global demand levels easing off. China’s GDP is slowing, due to tariff impacts but also domestic factors, and demand for iron ore and coal are slowing along with it. Nominal trade values have picked up as prices have improved, but volumes are lower. This bodes poorly for the future as demand is easing at the point where global competing sources of iron ore are about to rise. One bright export light is non-monetary gold. Gold exports have risen sharply, along with the rise in prices, to make it a major export good, besting coal. Rural goods are also holding well.

Services exports have partially recovered from their pandemic slump. Net personal travel remains soft, albeit off its recent lows. Education services exports lifted to above pre-pandemic highs but have now stalled. Changing global education demand and regulation have tempered additional growth. A loosening of domestic policy and reinvigoration of Chinese and Indian student demand are required to elicit a resumption of higher growth from current levels.

Global patterns are showing signs of slowing goods exports, particularly to the US. China, for example, has seen a sharp slowing of exports to the US, but a concomitant pick-up in exports to its Asian neighbours. The sustainability of these redirected flows may be challenged if found to be re-exports and thus attracting even higher tariff rates. For now, the flows are in flux, and yet to find a new equilibrium. History tells us that higher tariff rates will always reduce trade volumes, and in turn global growth. What we have learnt this time, is that the process can take significantly longer to flow through due to the uncertain and inconsistent nature of the implementation. It would be premature to ignore the historical experience of poorer macro-outcomes in the face of higher trade restrictions.

We anticipate an easing in iron ore exports over the coming year, and a generalised moderation in broad export growth, based on lower global economic activity. As domestic consumption improves, and the stated defence spending increase is delivered, import growth is expected to rise. As a result, we forecast a deterioration in Australia’s net trade position, which will be a net detractor for GDP through 2026 and into 2027.

Views as at 1 October 2025.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.