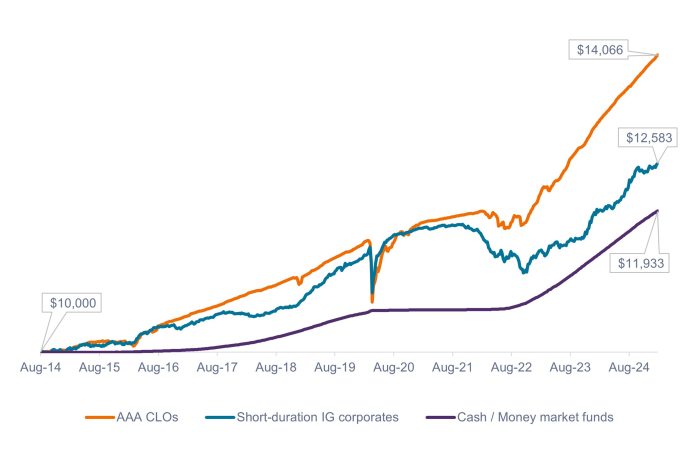

Source: Bloomberg, J.P. Morgan, as of 24 January 2025. Indices used to represent asset classes: AAA CLOs = J.P. Morgan AAA CLO Index, Short-duration IG corporates = Bloomberg U.S. Corporate 1-3 Year Index, Cash / Money market funds = Bloomberg U.S. 1-3 Month Treasury Bills Index. Past performance does not predict future returns.

Some investors who are hesitant to put their short-term cash reserves at risk may feel uneasy with any volatility in their short-duration holdings. We believe this approach may be overly cautious, as many investors could handle an incremental amount of volatility in exchange for potentially higher returns. Historically, despite occasional drawdowns, AAA CLOs and short-duration IG corporates have ended up comfortably ahead of cash over the long term.

– John Kerschner, Head of U.S. Securitized Products

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.