There is no dispute about the current fundamentals, Western Australia (WA) has a better existing economy and budget position than Victoria.

WA benefits from its natural resource royalties and low historical debt levels; it had a “good” pandemic, with few lockdowns or need for support spending. Reflecting this, WA enjoys a AAA rating, while Victoria has experienced downgrades and sits at AA.

The key question we ask, as investors in semi government bonds, is if those ratings are in the price and are we being adequately rewarded for what is to come next? We believe better value, and return, lies in holding Victorian semi government debt over Western Australian debt.

The starting position is that state government debt is underwritten by the Federal Government, it remains a clear contingent liability on the Federal Government. This was evident through the pandemic, by the Reserve Bank of Australia’s support and inclusion in its quantitative easing purchase program of state government debt, as well as explicit guarantees. Given this, we view the risks of default as negligible.

A quick overview of the outlook for both states show some divergence. WA has had a cracking time, things have been good. Those times are changing, and the outlook looks poorer. Resource royalties are moderating, as prices are below the levels of last year for coal and iron ore. Export volumes are lumpy, but there are risks to the downside arising from the global tariff uncertainties and lower global growth outlook. There is also a structural change occurring in the global market for iron ore and coal, that stands to cap the WA resources outlook, at best. WA receives a lower proportion of GST revenue, particularly after the latest recalculation.

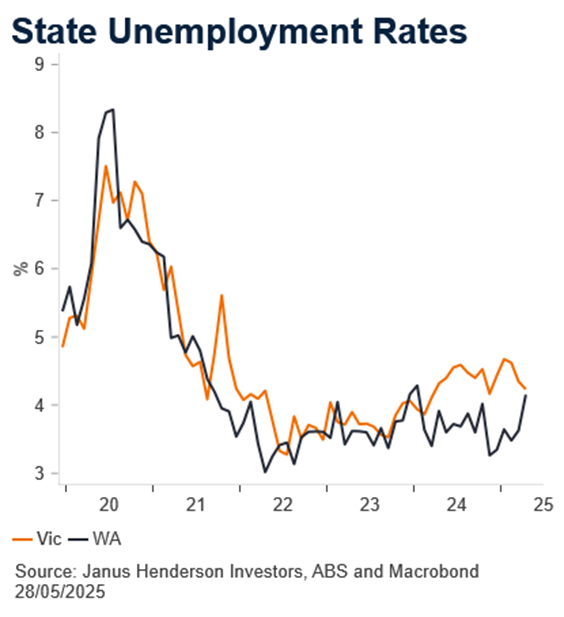

The Victorian economy is the opposite, times have been very tough. While headwinds remain, things are starting to pick up. The university sector is back (Victoria’s largest export), and migration levels are rising above the national average. The unemployment rate is falling, and house prices are rising again. The big capex projects have peaked and are moderating from here. Victoria will receive a higher allocation of GST revenues.

So, while WA has a better starting point, the outlook is softer, while Victoria faces better economic prospects. This is reflected in the budget outlook for coming years. Victoria recently released its budget, and while there were no huge improvements, the outlook was as expected and within its AA rating guidelines. WA reports its budget 19 June, and there is an expectation of a worse budget outcome. This is not to say the state will be a downgrade candidate, just that the best is perhaps in the recent past.

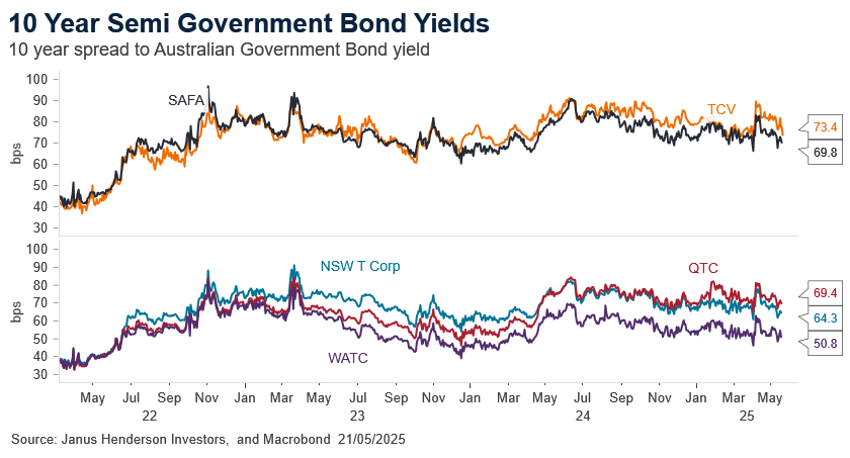

This brings us to price. What are we being rewarded for holding either semi? Treasury Corporation of Victoria’s (TCV) spread to government bonds reflects its AA rating. The generic Victorian 10 year spread to Australian Commonwealth Government bond (ACGB) currently sits around 73 basis points* (bps) and has been as high as 90bps. For a bond with a government guarantee, TCV offers an attractive risk/reward.

Looking at Western Australian Treasury Corporation (WATC) – a spread to ACGB of around 50bps*, as low as 49bps this year which was its tightest in 10 years, is on offer. The market is fully pricing the safety represented by WATC’s AAA rating, and then some. We do not believe the market is pricing for a softer outlook either.

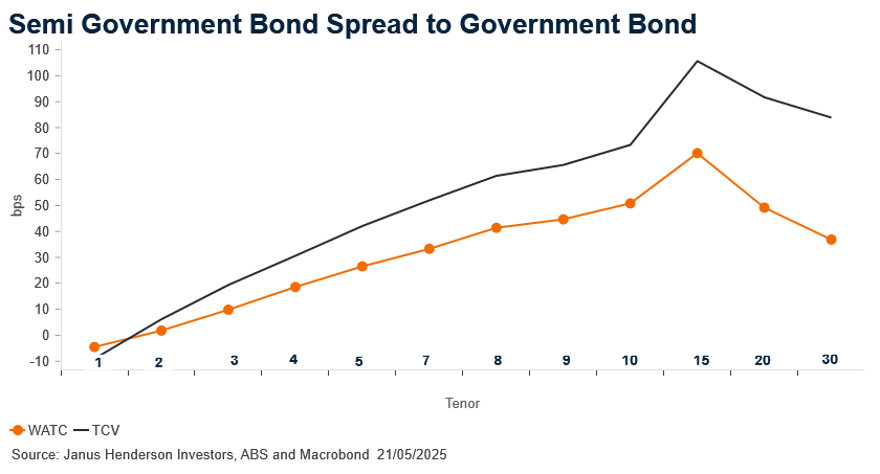

Finally, comparing the spread across the tenors (and again, we use generics here for simplicity) there is a large pick up in spread and roll-down in holding TCV debt, as compared to WATC, even accounting for the difference in rating.

The risks of a Victorian downgrade are not zero, but it is also not a certainty and while not perfect, the projected budget outlook is contained. WA has a good report card, but the out years will be harder. The markets are likely not pricing either one – too harsh for Victoria, and giving WA the benefit of the doubt. There is a better return to be had holding TCV, as compared to WATC, with only modest risk differences.

*As at 27 May 2025

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.