Equities in 2024: Seeking quality across sectors

Head of Americas Equities Marc Pinto discusses the compelling opportunities he sees across sectors and why a focus on quality is critical in the current environment.

7 minute read

Key takeaways:

- The extreme concentration in today’s equities markets suggests that overlooked segments of the market – particularly those that stand to benefit from powerful secular themes – present many compelling opportunities at attractive valuations.

- In this environment, we believe a focus on quality – which we define chiefly as consistent earnings growth across the cycle – is paramount.

- We see abundant opportunities for discerning investors across sectors, particularly in healthcare innovation and the tech companies that are enabling powerful themes like artificial intelligence (AI).

The prospect of a soft landing has been a driving force in the equity market’s rally, but that scenario is not guaranteed as continued strong jobs data have caused the Federal Reserve (Fed) to hedge earlier dovish comments on rate expectations. However, supply-chain and technology-driven deflationary forces are boosting productivity, providing a counterbalance to inflation concerns stemming from a robust labor market.

Meanwhile, the concentration among the highest-flying names in the S&P 500® Index dampens some of the optimism imparted by the market’s recent record highs. The U.S. presently accounts for almost half of the MSCI All-Country World IndexTM, and the technology sector comprises over a quarter of the S&P 500 – and that doesn’t account for the Internet and e-commerce platforms not classified as tech. The oft-cited Magnificent 7 stocks doubled in 2023, while the equal-weighted S&P 500 was modestly positive, and that disparity extends to valuations and earnings.

Against this backdrop, we believe a focus on quality – which we define as companies that can deliver consistent, not necessarily fast, earnings growth – is paramount. And we think there are abundant opportunities for discerning investors to find quality companies in multiple sectors and across market caps.

Tech: Looking under the hood

While the “Magnificent 7” has been grabbing all the headlines, we think there’s considerable opportunity in the tech sector outside of the largest names– particularly with those companies that operate under the hood of the tech machine.

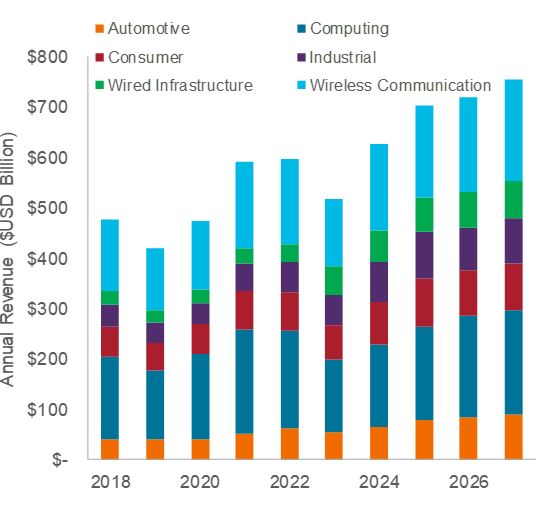

For example, some of the best performers in the market over the last couple of years have been a small basket of semiconductor stocks. Semiconductors provide the computing power needed to drive themes like artificial intelligence (AI) forward. Semiconductor capital equipment companies, likewise, provide the machinery that create chips powering all these applications. Regardless of which companies “win” at implementing AI, they will all need these underlying tools. That’s why the companies that make those tools may present a compelling investment opportunity – it’s not about picking end-market winners, because there will always be demand for these fabricators’ and chip makers’ products.

Figure 1: Semiconductor revenues by end usage

Source: Janus Henderson, Bloomberg Intelligence, as of 31 December 2023.

Just as many tech stocks are being overshadowed by the Mag 7, some important and enduring trends are being dwarfed by the enthusiasm surrounding AI. For instance, connectivity and the Internet of Things have been in place for years, and we don’t see them dropping off anytime soon. Whether it’s controlling our thermostat from the road or being able to monitor our health, there are myriad implementations for these technologies that we will continue to use in our daily lives. We also saw a massive increase in e-commerce during COVID, and that trend has continued.

Lastly, quality is not limited to a few cash-rich mega caps. Many of the other 493 companies in the S&P 500 – as well as in global indices – possess similar quality traits. We see this as one of the more promising opportunities for equities in 2024.

Healthcare and biotech: Peak innovation

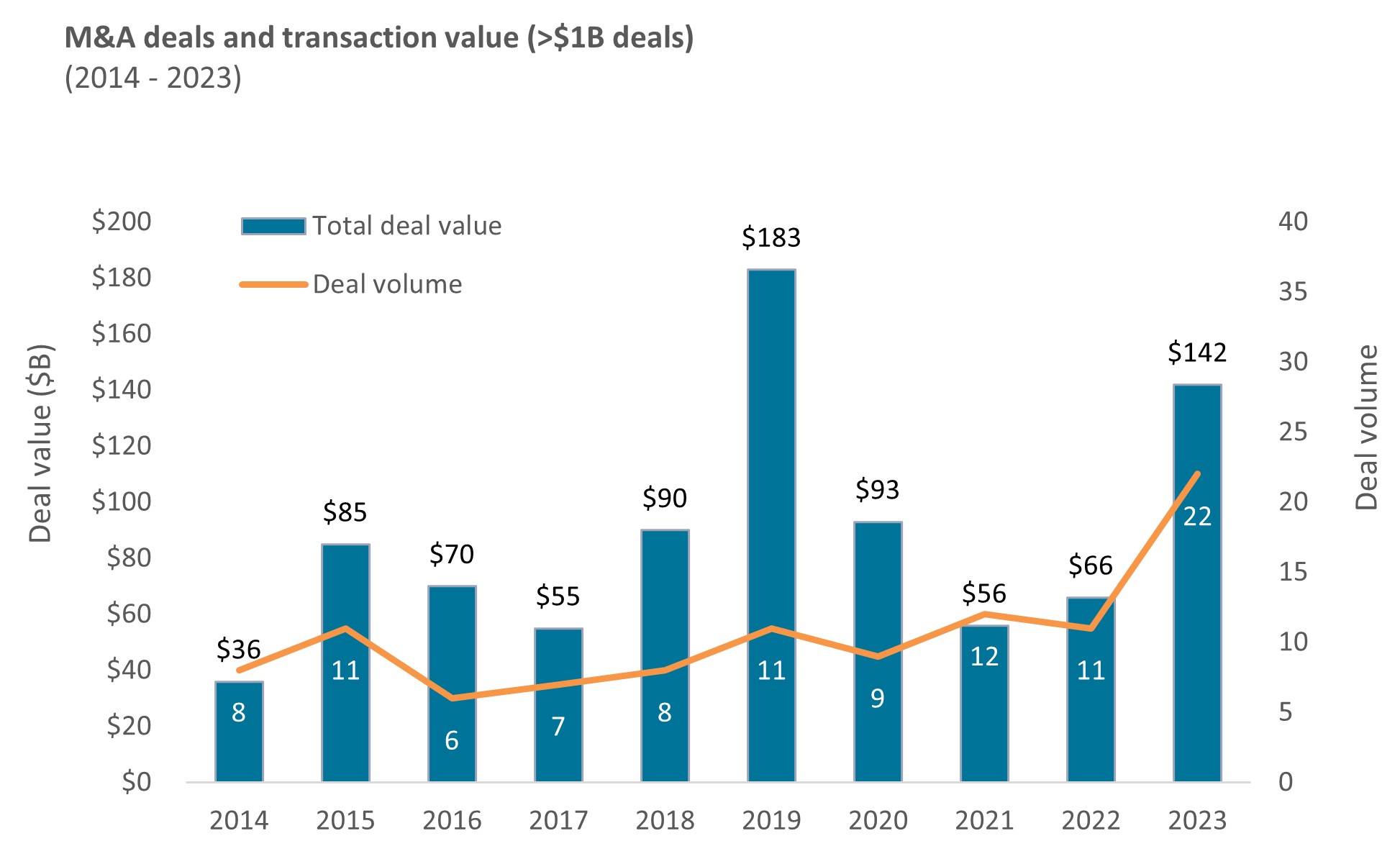

While AI and its knock-on effects are transforming the tech sector, innovation in healthcare is at a level we’ve not seen in decades. The number of new drugs receiving FDA approval in the past five years is a step-change higher than in the past, with a record 73 new therapies approved in 2023. Mergers and acquisition activity is also picking up, with several biotech companies being acquired by larger-cap biopharmaceutical companies (Figure 2).

Figure 2: Biotech M&A volume and deal values doubled in 2023

Source: TD Cowen, as of 31 December 2023. Note: Data reflect M&A deals >$1B in transaction value in the biotech sector.

Source: TD Cowen, as of 31 December 2023. Note: Data reflect M&A deals >$1B in transaction value in the biotech sector.

One of the most impactful events in the space has been innovation in GLP-1 weight-loss drugs. These drugs are clearly showing the ability for people to lose a significant amount of weight, likely extending their benefits to health conditions that arise from obesity, such as diabetes. However, as a result, companies that provide services in these areas – i.e., dialysis and insulin pumps – are taking a hit because the market is questioning whether GLP-1 drugs could render them obsolete.

Despite this uncertainty, we think the trend is positive – both for healthcare and the overall economy. And we see opportunities to be selective and identify companies that are under-valued because the market has likely over-corrected based on the shifts that are occurring within the space.

REITs: Opportunities beyond the index

Real estate investment trusts (REITs) are another area where we’re seeing high concentration, with the entire REIT index being heavily influenced by just a few players – almost like the sector has its own Mag Seven. Again, this is a situation where being selective and actively seeking to differentiate from the index can uncover opportunities. We also expect to see valuations return to becoming more closely aligned with fundamentals if interest rates start to fall, given that REIT stocks typically perform inversely to movements in rates.

It’s also worth noting that, while the market tends to paint the entire real estate sector as consisting only of office and retail, there is demand in many other areas. For one, the population is growing, and as the current generation expands, the pool of renters will continue to increase and the demand for affordable housing should ramp up.

Additionally, with the aforementioned e-commerce and healthcare trends comes the need for warehousing, logistics, data centers, and cell towers, as well as healthcare facilities. Public REITs stand to benefit from their exposure to these alternative and faster-growing areas of the real estate market. So, while REITs are a bit of a contrarian trade, we think the fundamentals are strong and expect them to do well if the soft-landing scenario plays out.

Financials: Riding the payments wave

As with companies supplying the tools that enable AI in tech, when it comes to financials, we’re seeing opportunities in the companies that are enabling the transition away from traditional services, namely cash and check, to credit cards and digital transactions. How many places does one go nowadays that accept cash? It’s almost as if cash is becoming somewhat irrelevant, and payments companies and payment processors are riding that wave. We expect continued growth in that area, even in a variety of economic environments.

Banks, on the other hand, have different growth drivers, and carrying large balance sheets makes it harder for them to move the needle. But valuations are attractive, and of course, financial institutions typically deliver strong dividends, so this can be an attractive sector for investors seeking steady income.

In terms of the overall health of the financials, there’s comfort to be had that the events we saw in March 2023 with Silicon Valley Bank and other institutions didn’t metastasize into a run on the entire financial system – especially since some notable past downturns were precipitated by a financial crisis. It speaks to the health of the global financial system that it was able to withstand that crisis.

Conclusion

Despite some uncertainties, we think the path forward is best approached with a sense of cautious optimism. The current investing landscape suggests that there are abundant opportunities for discerning investors, particularly in healthcare innovation, resilient financials, and forward-looking technology. Equipped with a fine-tuned strategy focused on quality, investors may continue to navigate the evolving tide of market forces as we progress further into the decade.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

MSCI All Country World Index℠ reflects the equity market performance of global developed and emerging markets.

IMPORTANT INFORMATION

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect.