Rate shock is real

Recent months have seen a spurt higher in yields, with various conjectures put forward for the moves. Economists have rowed back on recession fears in the US while fresh emphasis has been put on bond supply. Could more structural factors be behind the rise in yields?

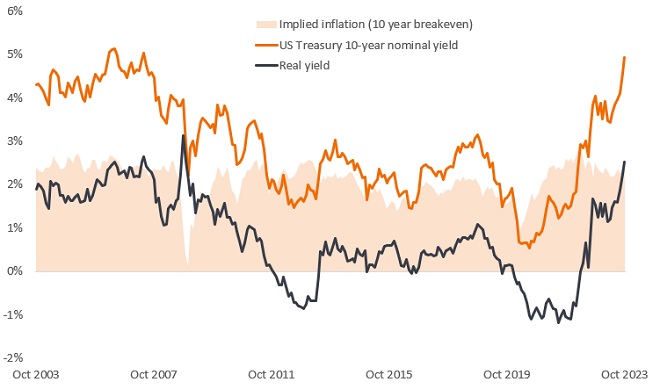

Figure 1: Real yields at a post-Global Financial Crisis high

Source: Bloomberg, US Treasury 10-year nominal yield, US Treasury 10-year Inflation Protected Securities (TIPS) yield (real yield). The 10-year breakeven rate is a measure of expected inflation, implying what market participants expect inflation to be in the next 10 years on average. It is derived from subtracting the yield on TIPS from nominal bonds yields of the same maturity. 31 October 2003 to 31 October 2023. Yields may vary over time and are not guaranteed.

For fixed income investors, the shifting narrative poses a particular dilemma. A stronger economy is potentially good for credit fundamentals but upward pressure on yields is an offsetting factor. Real rates have risen, reflecting a higher term premium and expectations for a “higher for longer” rates regime. Should we be reassessing our view that we are near peak yields?

*The Fixed Income Investment Strategy Group (ISG) brings together investment professionals from across the global fixed income platform and other Janus Henderson teams, providing a forum for debate around the fixed income asset class and key drivers of the market. The ISG Insight seeks to provide a summary of recent debate within the group.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.