The recent selloff in software stocks in the wake of advancements in native AI ignores many of these businesses’ inherent strengths.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Today’s ABS structures provide better transparency and investor protections.

Despite strong early-2026 gains, markets continue to underestimate the scale and longevity of Europe’s defense spending cycle.

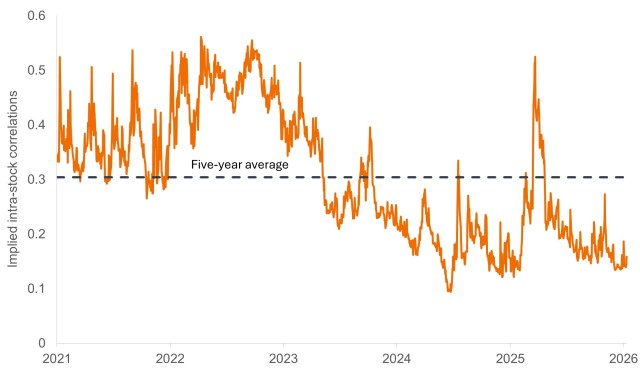

We view the lack of systemic risk priced into the market as the culprit for correlations among U.S. equities being near historic lows.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Why active management, fundamental research, and selectivity across sectors are key to identifying opportunities while managing volatility in fixed income.

Why rational pricing and rising dispersion represent a rare opportunity for absolute return investors.

As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

The fourth quarter of 2025 featured powerful secular themes that the Research Team believes will continue to create compelling opportunities across sectors in the year ahead.

While options markets indicate a relatively sanguine 2026 for equities, investors should take note of a potentially worrisome absence of systemic risk.

Considering the impact on oil prices and energy stocks from the U.S. removal of Nicolás Maduro.