JANUS HENDERSON

Global Natural Resources

Investing across the entire global natural resources supply chain

A world of opportunities

The long-term trends of increasing population, prosperity and urbanisation, particularly among developing economies, are leading to rising global consumption growth rates of natural resource minerals, energy and food. We believe that these long-term demand drivers, combined with constrained supply, mean the importance of natural resource equities relative to other sectors will continue to grow.

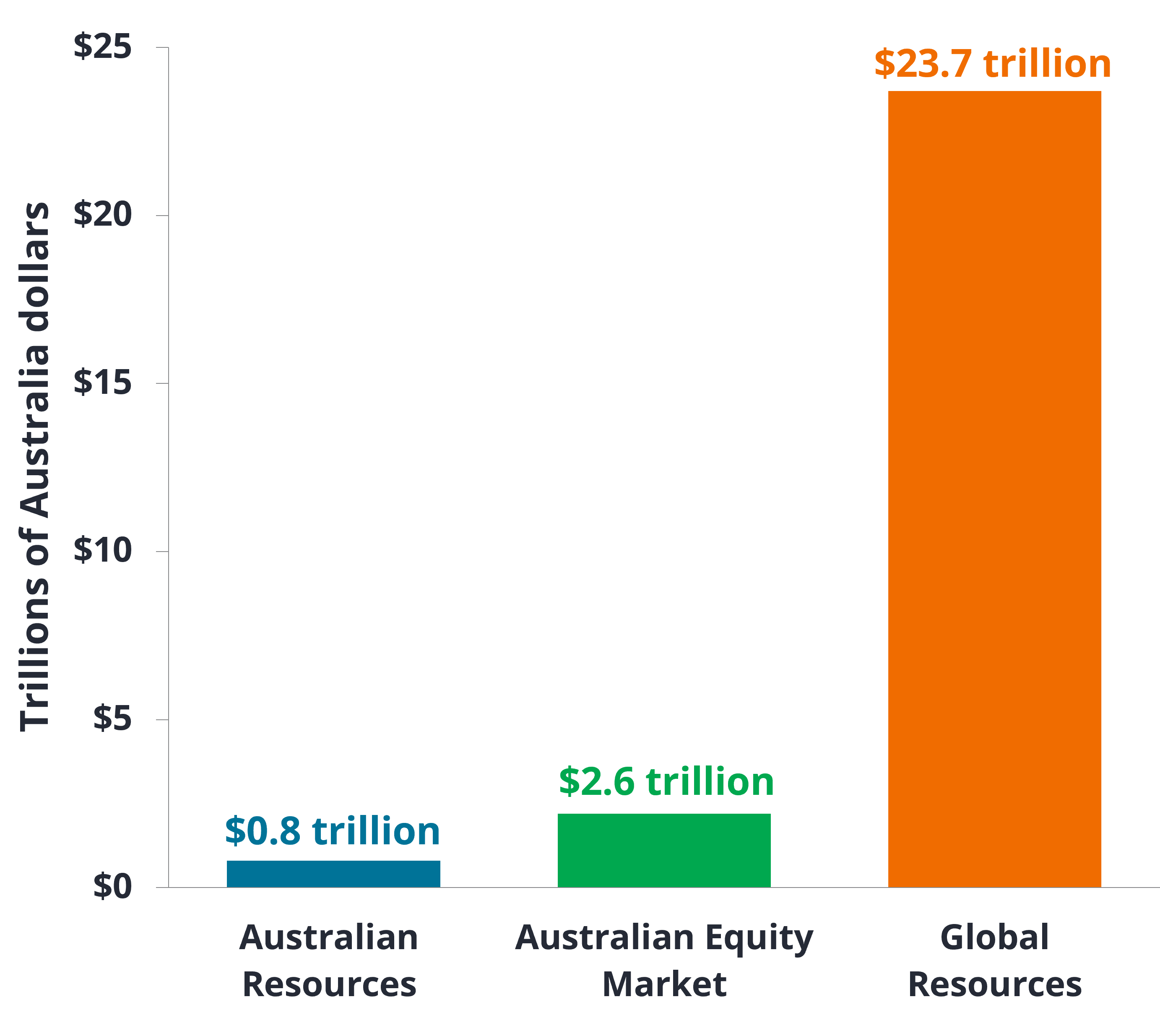

While Australia is fortunate to be home to two of the largest players in natural resources, BHP and Rio Tinto, the reality is that these companies only represent a small portion of the global natural resources investment opportunity – the global resource investment universe is almost 30 times the size of the Australian resources market and nine times the size of the Australian stock market1.

1. Source: Janus Henderson Investors, Bloomberg. As at 26 October 2022. Note: Based upon Janus Henderson Investors view of core natural resources; mining, energy and agriculture across the value chain, companies > A$1 billion market capitalisation.

Capability

The Janus Henderson Global Natural Resources Fund is a high conviction equity portfolio invested across mining, energy and agriculture companies. A global investment approach broadens the scale and range of the natural resources investment universe and also improves the chance of early identification of profitable resource investment trends and pricing inefficiencies across global markets.

The Fund has the flexibility to move across the resource supply chain including the production, extraction, exploration, processing, distribution and transportation of natural resources or the provision of services to the industry. The broader natural resource approach means the Fund can take advantage of pricing shifts between upstream and downstream sectors and across a range of commodities.

Key features

- Robust investment philosophy focused on quality companies, rather than selecting companies based on relative index weightings

- Flexibility to move across the resource supply chain of mining, energy and agriculture

- Specialist global natural resource investment team with stock market experience combined with geological and industry expertise

- Increased diversification and reduced volatility through a unique portfolio of mining, energy and agriculture stocks

Natural resources aren’t just mined from the ground, there are vast investment opportunities across all three subsectors - Mining, Energy and Agriculture, including upstream, midstream and downstream businesses.”

Daniel Sullivan, Head of Global Natural Resources

All investments carry risk. The risk of investing in the Janus Henderson Global Natural Resources Fund are disclosed in section 4 of the Product Disclosure Statement.

About the fund

HOW TO INVEST

- Read the Product Disclosure Statement

and Additional Information Guide - Print and complete the Application form

- Send the completed application form to:

Janus Henderson Australia Client Services

GPO Box 804

Melbourne VIC 3001 Australia

Alternatively, speak to a financial planner.

FUND DOCUMENTS

FUND FACTS

| APIR code | ETL0331AU |

| ASX mFund | NWG01 |

| Inception date | 1 July 2012 |

| Benchmark | S&P Global Natural Resources Index (net dividends reinvested) in AUD |

| Risk profile | High |

| Minimum initial investment | $25,000 |

| Management fee | 1.10% p.a. |

| Buy/Sell spread | 0.15% / 0.15% |

| Unit pricing frequency | Daily |

| Income distribution | Annually (if any) |

RESEARCHER RATINGS

PLATFORM AVAILABILITY

- AMP North

- Asgard

- BT Panorama

- CFS Edge

- HUB24

- Macquarie Wrap

- Mason Stevens

- mFund

- Netwealth

- PowerWrap

- Praemium

- uXchange

Meet the team

Daniel Sullivan

Daniel Sullivan

Head of Global Natural Resources

Daniel Sullivan is Head of Global Natural Resources and a Portfolio Manager at Janus Henderson Investors, a position he has held since 2019. Previously, he was a portfolio manager and senior resource analyst at 90 West, which Henderson acquired in 2015. Earlier, he worked as an analyst and a portfolio manager at Goldman Sachs, Deutsche Asset Management, Zurich Scudder Investments, and AMP Investments.

Daniel received a bachelor of mining engineering degree (Hons) from the University of Sydney and a graduate diploma of applied finance and investment from the Securities Institute of Australia. He has 32 years of natural resources experience.

Darko Kuzmanovic

Darko Kuzmanovic

Senior Portfolio Manager

Darko Kuzmanovic is a Senior Portfolio Manager at Janus Henderson Investors, a position he has held since 2019. Darko manages a global resources fund and has extensive experience in global resources markets. Before joining Henderson as a portfolio manager in 2015, he was a partner and portfolio manager at Caledonia Resources Management and a portfolio manager at Colonial First State. Prior to that, he was a portfolio manager at David Tice & Associates in Vancouver and a member of the global resources team at Zurich Scudder.

Darko received a bachelor of metallurgical engineering degree (Hons) from the University of New South Wales and an executive MBA from Macquarie Graduate School of Management. He has 36 years of natural resources experience.