WHY CHOOSE THIS FUND?

Managed by

sector experts

Our 36-strong team of sector specialists conduct independent, differentiated research and idea generation.

Pure stock picking

approach

With a truly global focus, across market caps, geographies and sub-sectors, our team build a high-conviction portfolio of their best ideas.

Minimise the

macro

This team's disciplined investment process is designed to minimise macro risks by aligning sector allocations with the benchmark.

Managed by sector experts |

Pure stock picking approach |

Minimise the macro |

GLOBAL SECTOR-BASED APPROACH

The Central Research team consists of 36 equity research analysts across seven global sector teams (as at 30 June 2025):

Consumer

Communications

Energy & Utilities

Financial

Health Care

Industrials & Materials

Technology

- Consumer

- Communications

- Energy & Utilities

- Financial

- Health Care

- Industrials & Materials

- Technology

Our sector teams debate and collaborate to determine position sizes, regardless of index weight, based on the team’s level of conviction and the stock’s risk/reward potential.

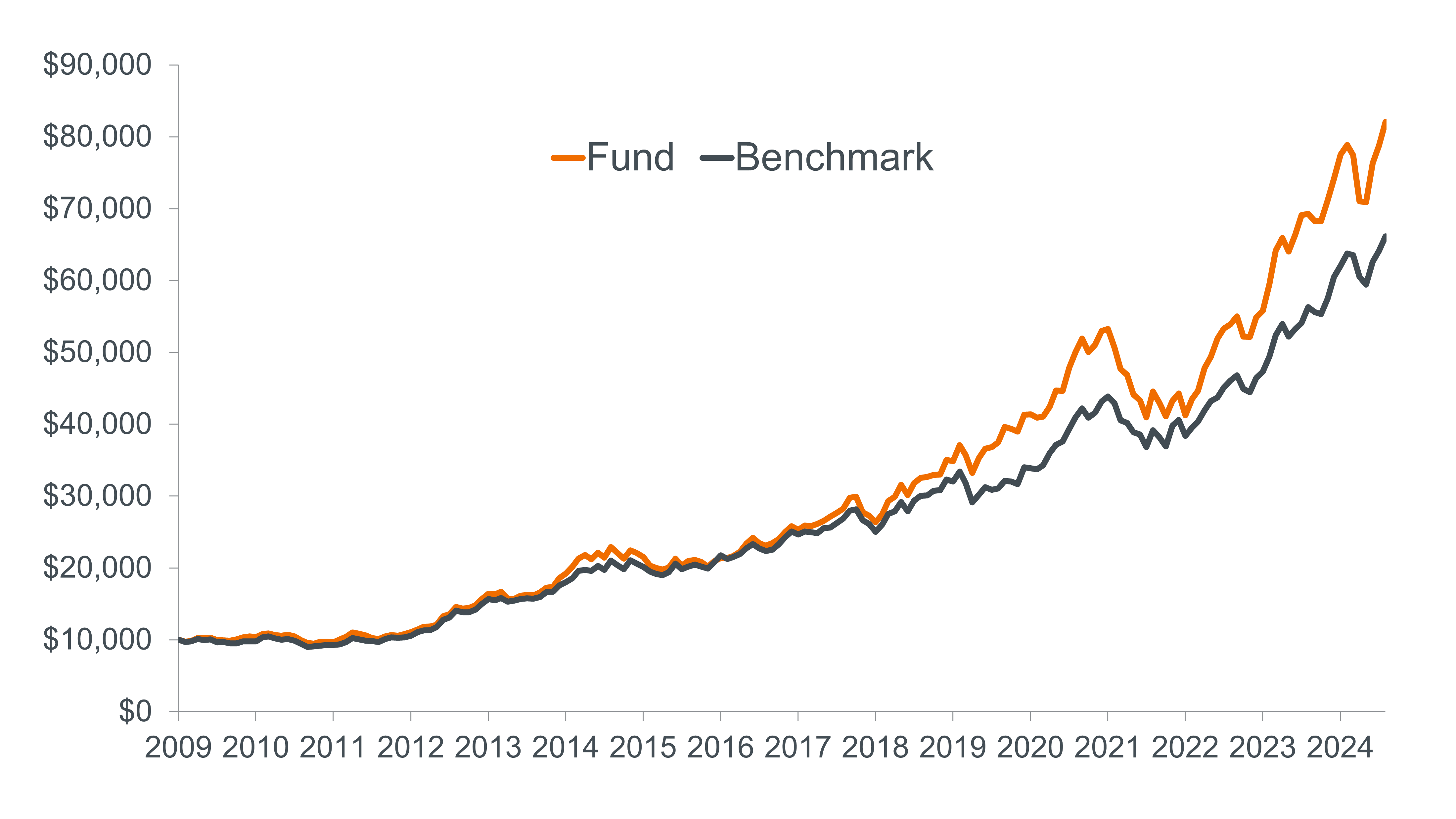

GLOBAL RESEARCH EQUITY FUND PERFORMANCE

The key to our success is alpha generation through bottom-up stock picking at a global scale.

The Fund was launched in Australia in 2009 and has a long-term track record of outperformance.

Growth of A$10,000 for MSCI World Index ex-Australia, net dividends reinvested and Janus Henderson Global Research Equity Fund (net of fees) since inception. Past performance should not be taken as an indicator of future performance. Performance figures are calculated using the exit price net of fees and assume distributions are reinvested. As at 30 June 2025.

INVEST IN A WORLD OF OPPORTUNITY

| FUND FACTS | |

|---|---|

| Asset Class | Equities |

| Benchmark | MSCI World Index ex Australia (net dividends reinvested in AUD) |

| Product Structure | Australian Managed Investment Scheme |

| APIR | ETL0186AU |

| Inception | December 2009 |

| Portfolio Managers | John Jordan, Josh Cummings CFA |

| Management Fee | 0.75% p.a. |

| Performance Fee | Nil |

| Distribution Frequency | Annually (if any) |

MEET THE LEAD PORTFOLIO MANAGERS

John Jordan

Portfolio Manager

Industry since 1997.

Joined Firm in 2008.

Josh Cummings, CFA

Portfolio Manager

Industry since 1996.

Joined Firm in 2016.

"We believe in putting stock selection in the hands of the experts.”

Josh Cummings

Portfolio Manager

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298, AFSL 240975), is the Responsible Entity for the Janus Henderson Global Research Equity Fund ARSN 140 461 945. Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). The Investment Manager for the Fund is Janus Henderson Investors US LLC (‘Janus Henderson’). Janus Henderson is permitted to provide certain financial services to wholesale clients pursuant to an exemption from the need to hold an Australian financial services licence under the Corporations Act 2001. Janus Henderson Investors US LLC is regulated by the United States Securities & Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. The Janus Henderson Global Research Equity Fund's Target Market Determination is available at eqt.com.au. A Target Market Determination describes who this financial product is likely to be appropriate for (i.e the target market), and any condition around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.