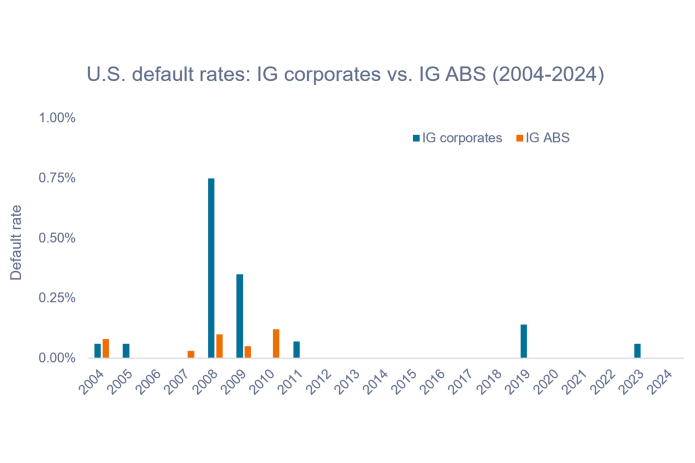

Source: S&P Global Ratings, as of 31 August 2025.

Default rates for IG ABS have compared favorably to IG corporate credit since their inception. From the late 1990s through 2025, no AAA ABS has defaulted, while 2002 was the only year in which the AA tranche experienced a default. There has not been a single default in IG ABS since 2010. Even at the height of the Global Financial Crisis, ABS held up well despite severe stress in financial markets.

A bond default occurs when the bond’s issuer fails to make a required payment or otherwise violates the terms of the bond agreement, such as failing to pay interest or principal when due, or failing to meet other contractual obligations.

A bond default rate is a metric that quantifies the percentage of bonds in a specific group that fail to make their scheduled interest or principal payments, indicating a borrower’s inability to meet their debt obligations.

Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

Investment-grade securities: A security typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

Tranches are segments of a pool of securities that are divided up by credit rating, maturity, or other characteristics.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.