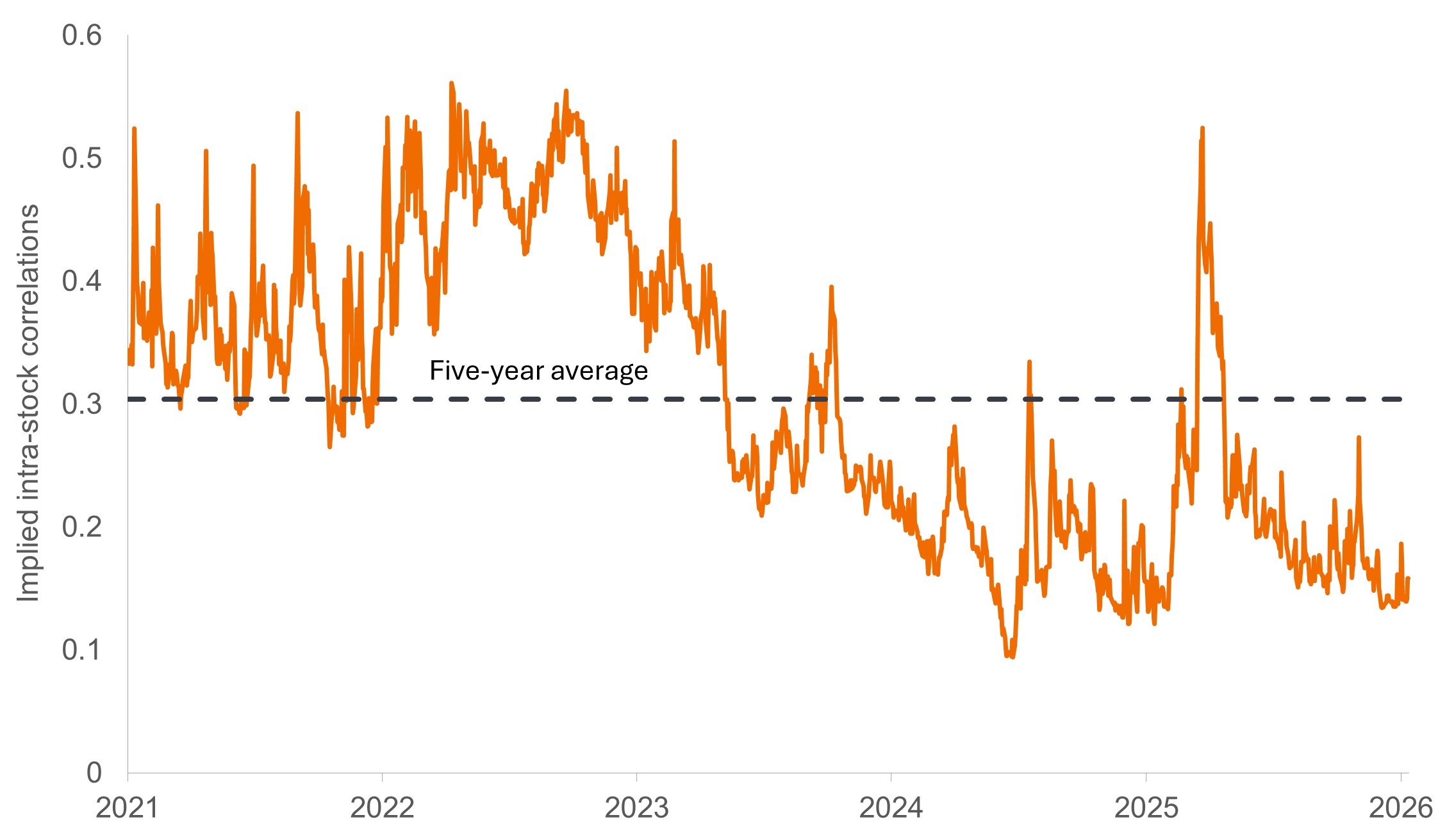

Our teams create diversity while reducing volatility – all within cross-asset class combinations of alpha generation, risk management and efficient beta replication strategies.

$22.0bn

Assets Under Management

24

Alternatives Investment Professionals

19

Average Years' Experience

As at 31 December 2025

Alternatives

Access a diverse set of alternative strategies that aim to provide low to moderate volatility with low correlation to both traditional and alternative asset classes.

Name

About this product

This market-neutral, alternative strategy invests across a diversified set of bottom-up strategies combined with a top-down 'protection' strategy.

Investment capabilities benefiting from:

- Specialised skills that seek to capture alpha from a broad range of opportunities.

- A globally positioned, highly experienced investment team that believes in challenging conventional thinking.

- A multi-dimensional approach and focus on risk management that helps us to deliver blended offerings.

Insights

Insights delivered to your inbox

Receive timely perspectives on the themes shaping today’s investment landscape.