Our teams manage global asset allocation strategies, applying a variety of lenses and risk management approaches.

$58.8bn

Assets Under Management

15

Multi-Asset Investment Professionals

21

Average Years' Experience

As at 31 December 2025

Multi-Asset

Name

About this product

This diversified global allocation strategy is informed by views on extreme market movements, both negative and positive.

For 30 years, this dynamic allocation strategy has delivered our equity and fixed income expertise in a one-stop core solution.

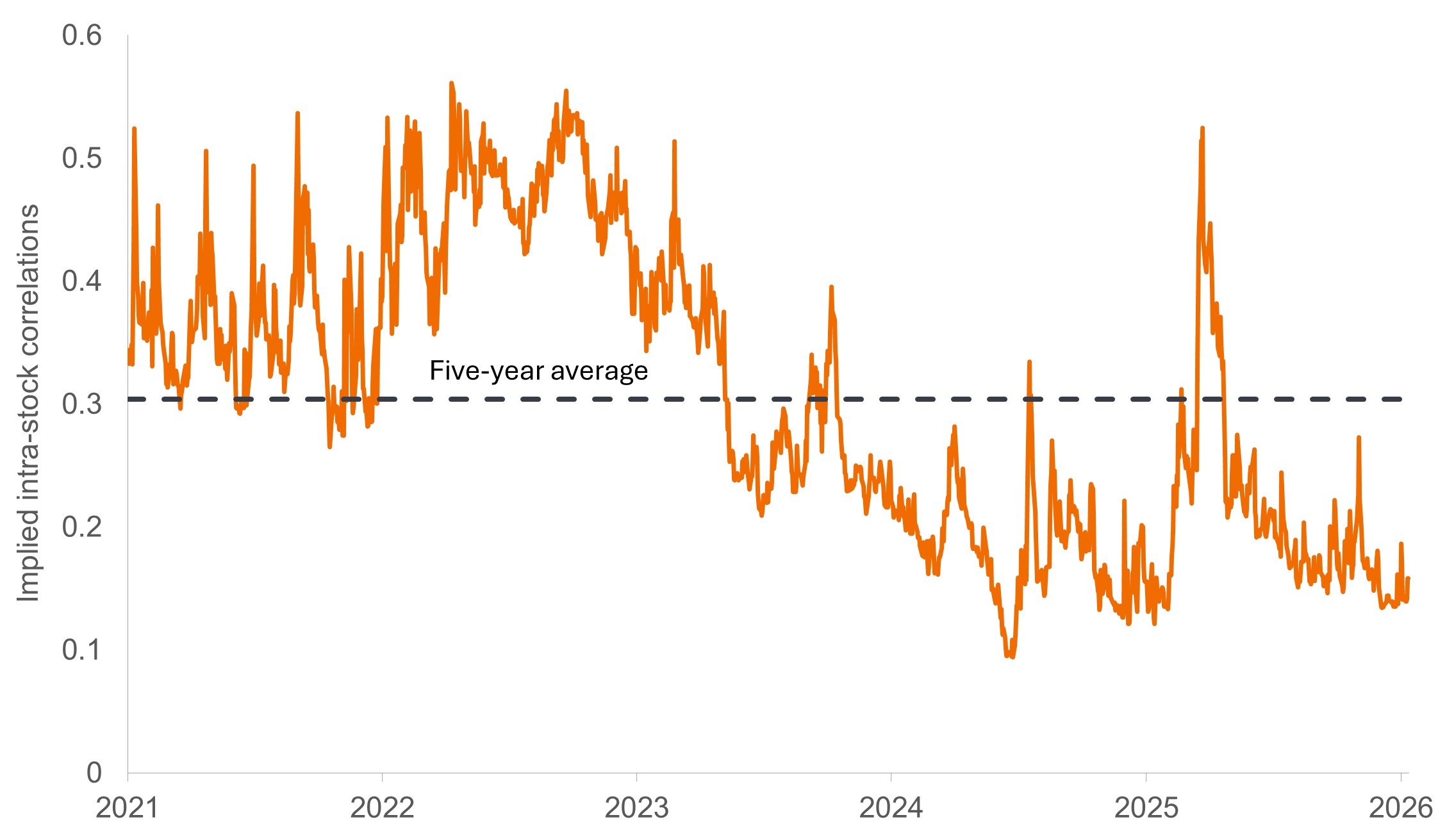

Diversification may offer a more efficient portfolio

Theory and history suggest that a diversified portfolio is expected to deliver a better return per-unit-of-risk than a more concentrated portfolio. We strongly believe that any serious focus on wealth preservation or wealth accumulation should have a diversified portfolio at its core.

Insights

Insights delivered to your inbox

Receive timely perspectives on the themes shaping today’s investment landscape.