Autonomous vehicles (AV) remain in the very early stages of adoption. Whether measured by miles driven, vehicle ownership, or ride-hailing penetration, adoption rates are negligible. The pace of development is accelerating, however, with major service launches expected throughout 2026.

As we enter this period of momentum, we’re monitoring three key questions about how this technology might evolve, who stands to benefit, and how investors can approach the AV investment opportunity.

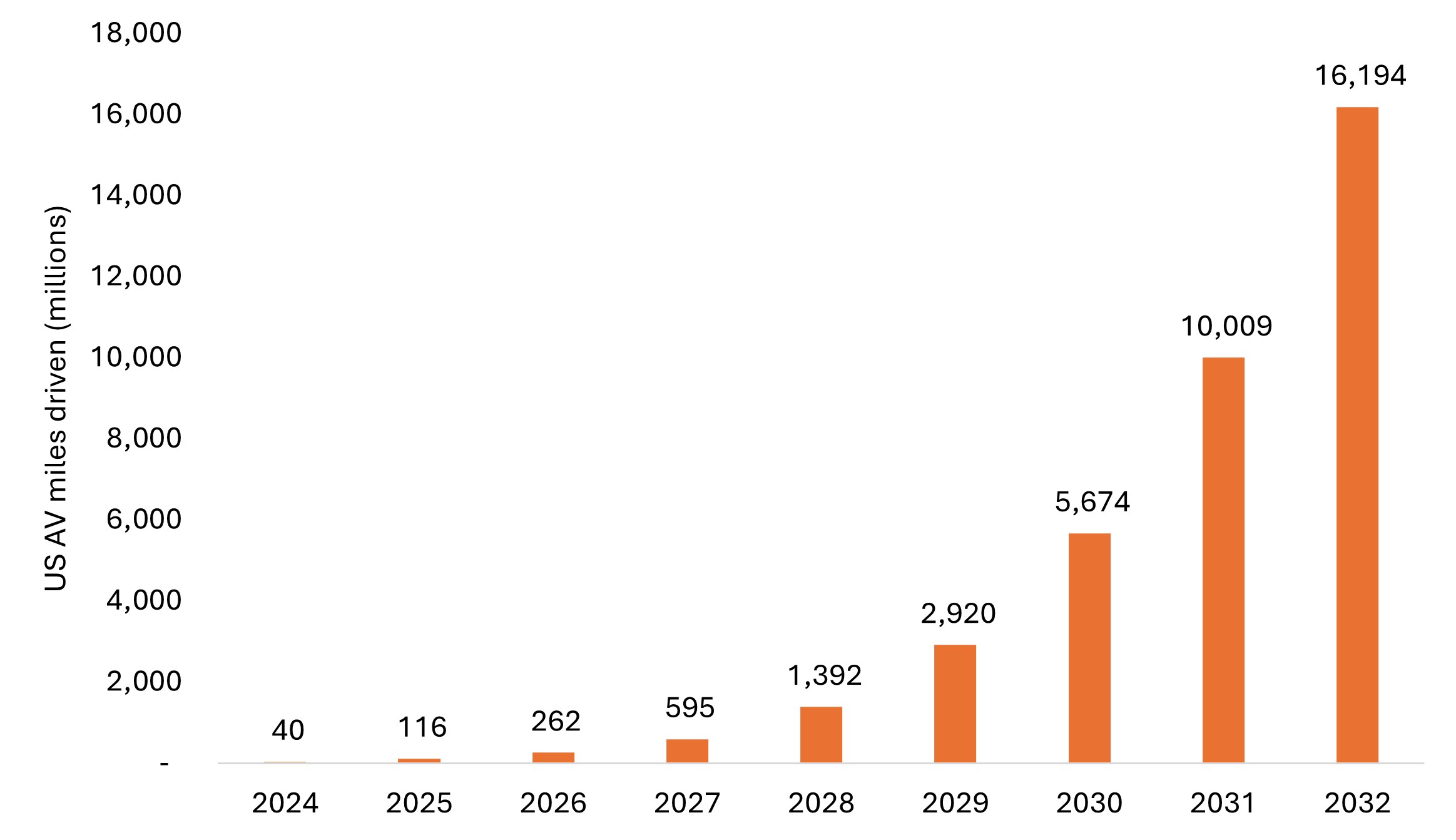

Exhibit 1: According to estimates, U.S. autonomous vehicle miles driven could achieve an annual growth rate of 103% from 2025 to 2032.

Source: Morgan Stanley Research, “Approaching an Autonomous Inflection Point,” 7 December 2025.

Will scale and early data advantages determine the winners?

From a market structure perspective, we believe the AV industry is most likely headed toward concentration rather than extreme fragmentation.

Early movers gain compounding advantages. Companies that capture data first can build better simulations, which leads to safer vehicles and software. This builds consumer trust and drives higher adoption, resulting in better vehicle utilization and stronger unit economics. Each step reinforces the next, creating a flywheel effect that is difficult for latecomers to replicate.

Early AV systems had to guess at the right decision by running countless simulations. New AI models have extended AV neural networks with reasoning capabilities, and this development represents a meaningful technological shift. The new generation can make more reliable, predictable decisions. Research shows that scaling compute, data volume, and model size all produce consistent safety improvements when faced with complex driving situations.

This matters because traditional competitive advantages in AVs are eroding. Hardware costs for components like LiDAR (Light Detection and Ranging) are declining. At the same time, software is improving across the industry through better data and simulations. Even regulatory frameworks and charging infrastructure are becoming more standardized across markets. As these traditional moats diminish, new advantages are emerging: superior unit economics, access to cutting-edge foundational models, and the ability to rapidly deploy across multiple markets.

These new advantages favor scale and tend to concentrate rather than distribute market share. If regulators demand continual safety improvements, the players who can afford exponential investments in compute and data collection will pull further ahead. Startups are competing against established technology giants that have been investing in these initiatives for over 15 years with no apparent capital constraints.

What we’re monitoring:

- How are competitive advantages evolving and which matter more going forward – technology, capital, data collection, distribution networks, cost advantage, brand, or safety perception?

- Whether software improvements become easily transferable so that smaller players can catch up quickly to create genuine competition.

- At what scale do AVs hit the flywheel that leads to unit-cost advantage?

- Whether Chinese manufacturers can deliver cheaper and better technology.

Can AVs become safe enough and cheap enough?

This question has two parts; we’re gaining conviction on the first, while the second remains challenging.

On the technological and safety debate, expert consensus is building around “redundant” systems that use LiDAR, radar, and cameras together rather than vision-only approaches. The view is emerging that vision-only approaches won’t allow AVs to achieve and scale superhuman driving abilities, which may become the standard regulators ultimately demand.

Tesla maintains that its massive fleet of vehicles using its Full Self Driving (FSD) camera-based system on the road provides a data advantage that makes additional sensors unnecessary. But the stakes are high: A single high-profile accident could erode public trust and invite regulatory scrutiny.

Meanwhile, Waymo faces challenges in scaling to millions of vehicles because its sensor-equipped cars are expensive to produce and deploy. Tesla already has millions of vehicles on the road with the potential to enable autonomous features.

This frames a race over the next three to five years: Can Tesla crack the technology and prove its camera-based system works safely before Waymo and others (using multi-sensor systems) overcome their production and distribution constraints?

In terms of cost, the picture for multi-sensor systems is less encouraging. While Waymo’s robotaxi production costs have decreased from their initial $150,000 to $180,000 range, we still lack visibility into whether costs can fall below about $80,000 per vehicle.

This creates a stubborn problem: Traditional ridesharing costs roughly $2.50 to $3 per mile, whereas driving your own car costs about 50 to 60 cents per mile. The cost of AVs needs to fall meaningfully below current ridesharing prices to drive adoption, ideally reaching $1 to $1.50 per mile. At higher costs, expansion into less-dense areas could reduce utilization rates because operators still need enough vehicles to meet peak demand. Without cheaper vehicles, the math doesn’t work yet.

What we’re monitoring:

- Tesla’s upcoming AV launches in new cities to assess whether its vision-only technology has reached commercial viability.

- Safety data and intervention rates from all players.

- The cost trajectory for both vehicle production and the LiDAR systems that most companies rely on.

- The potential for lower insurance costs if AVs are safer than human drivers.

What role do ridesharing platforms have in an autonomous driving future?

This question presents the most uncertainty, because the outcome depends on factors the platforms don’t fully control.

Ridesharing aggregators like Uber and Lyft could potentially offer value to AV operators. Their existing networks could boost revenue per vehicle through higher utilization, manage peak demand more efficiently, and provide fleet-management tools. The long-term optimistic case is that these rideshare platforms run efficient hybrid networks that prevent any single AV provider from dominating the market.

Exhibit 2: Four layers of autonomous vehicle providers.

This illustration is for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector.

Source: Morgan Stanley Research, “Approaching an Autonomous Inflection Point,” 7 December 2025. Note: OEM stands for Original Equipment Manufacturers.

However, the near-term economics are more challenging. Waymo remains severely supply constrained, with only about 2,500 – 3,000 vehicles on the road currently, many of which are deployed on existing rideshare platforms in cities like Atlanta and Austin. The problem is that rideshare platforms today are essentially trading profitable human trips for unprofitable autonomous ones, hoping they can eventually adjust pricing or commission rates once the technology scales.

Both assumptions are uncertain. If Waymo or another provider becomes a dominant winner-takes-most player, they could dictate terms or cut out platforms entirely and go direct to consumers. The platforms need multiple second- and third-tier AV companies to break out and scale, which is an outcome that requires significant capital investment and faces considerable technological uncertainty. In this scenario, the platform maintains competitive equilibrium and preserves its advantage.

But there’s also another scenario where platforms maintain their relevance. If AVs materially lower the cost per mile, the overall ridesharing market could expand beyond car ownership. In this case, even if platform commission rates decline, total revenue can still grow as the market becomes much larger.

What we’re monitoring:

- Whether additional AV companies beyond Waymo and Tesla can scale meaningfully.

- Whether the economics of the platform model improve as robotaxi costs decline and deployment expands.

- Whether ridesharing platforms offer better capacity utilization compared to an AV provider operating their own fleets directly.

- How local policymakers respond to potential workforce displacement.

Where this leaves investors

We believe AI advances are accelerating a winner-takes-most market structure benefiting companies with early-mover advantage and scale. We have growing conviction that multi-sensor approaches will win the safety debate. We also see significant uncertainty around whether rideshare platforms become essential partners or face potential displacement over a longer time horizon.

There are a few ways investors could approach this investment opportunity. One would be to focus on enablers such as chip suppliers, sensor manufacturers, and robotaxi fleet managers, which could benefit regardless of who wins the AV race. Another would be to identify which clear category winners emerge and determine if they justify positions. Focusing on adjacent markets like trucking logistics and agriculture may also offer exposure.

The potential for AVs to reshape transportation, logistics, and urban planning is significant. We continue to believe this space warrants close attention while acknowledging that the pathway to identifying winners and losers remains uncertain. For now, we’re watching, learning, and waiting for greater clarity on the fundamental questions that will determine how this industry evolves.