How a hawkish Fed may impact AAA CLO returns

Portfolio Managers John Kerschner, Nick Childs, and Jessica Shill discuss what could be in store for AAA CLO returns given a still-hawkish Federal Reserve (Fed).

4 minute read

Key takeaways:

- The Fed recently reaffirmed its hawkish stance with another 25 basis-point hike and dot plot projections that indicate rates are likely to stay higher for longer.

- While the market continues to adopt a more dovish view than the Fed, neither party expects the federal funds rate to drop below 4% within the next 12 months.

- Considering historically high yields and wide spread levels, we believe AAA CLOs remain a strong choice for investors seeking to capitalize on the higher-for-longer rate environment.

Despite taking a brief pause from its rate-hiking cycle in June, the Federal Reserve (Fed) recently reaffirmed its hawkishness – that is, its intention to continue raising rates to fight inflation – with another 25-basis point (bp) rate hike, while leaving the door open for more to come. It also reiterated its stance that rates would remain higher for longer: The median year-end projection for the federal funds rate per the Fed’s Dot Plot – a chart showing each member’s forecast – increased to 5.6% in June from 5% in the prior quarter.

The interest-rate picture

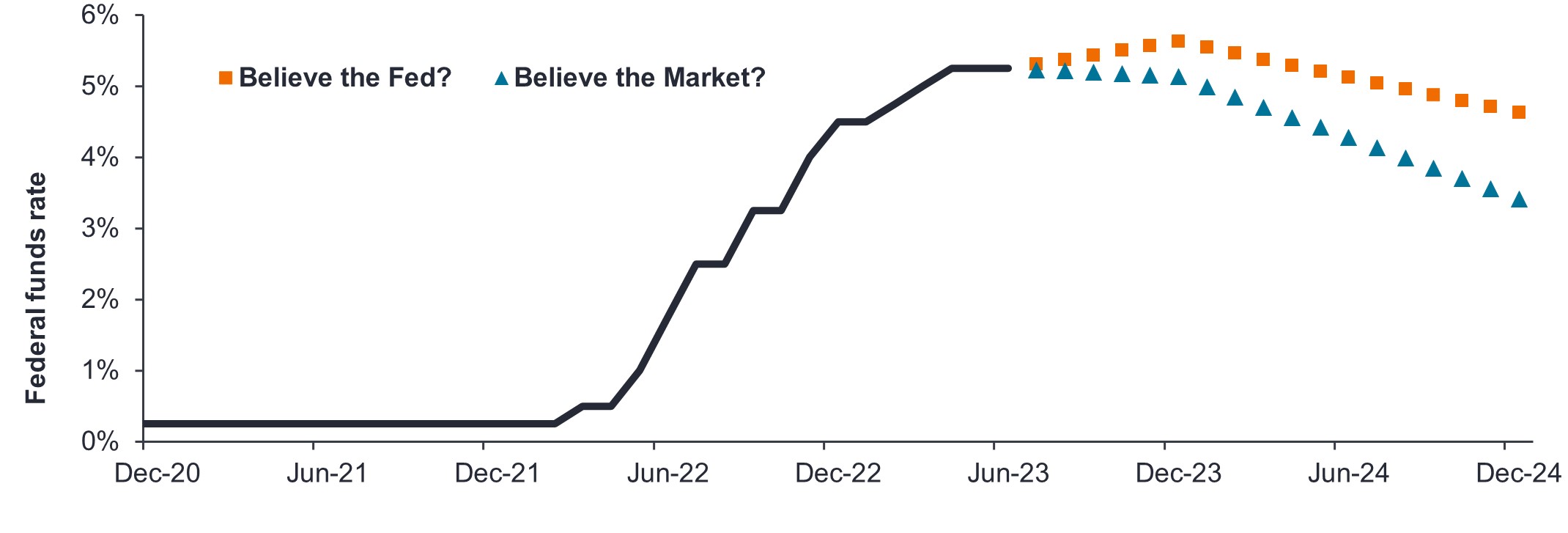

The market has persistently underestimated the Fed’s resolve since 2022 and continues to adopt a more dovish view than the Fed itself. As shown in Exhibit 1, the market’s expectation for the future path of interest rates is noticeably lower than the Fed’s own projections.

Exhibit 1: Expectations for the future path of interest rates

The Fed and the market do not agree.

Source: Bloomberg as of 30 June 2023. “Believe the Fed?” reflects the median federal funds rate of the July Fed Dot Plot, while “Believe the Market” reflects the federal funds rate forward curve (i.e., the market’s expectations for the future path of the federal funds rate).

Source: Bloomberg as of 30 June 2023. “Believe the Fed?” reflects the median federal funds rate of the July Fed Dot Plot, while “Believe the Market” reflects the federal funds rate forward curve (i.e., the market’s expectations for the future path of the federal funds rate).

In our view, the Fed is likely to stay the course unless it is presented with significant data imploring it to reconsider its hawkish stance. Either way, whether one believes the Fed or the market, neither party expects rates to drop below 4% for at least another 12 months.

As such, we think higher-for-longer rates will continue to underpin attractive yields in floating-rate fixed income such as AAA rated collateralized loan obligations (AAA CLOs). And while various short-term debt instruments such as Treasuries and short-term corporate bonds might also benefit from higher rates, in our view, AAA CLOs appear particularly compelling. This is because of a combination of their AAA credit ratings, inherently low duration due to their floating rate coupons, lower correlation to traditional fixed income, and historically wide spread levels.

The credit spread picture

Credit spreads – the additional yield an asset class offers above risk-free securities of similar duration – on AAA CLOs remain elevated versus both their historical average and short-duration investment-grade corporates. We consider this a positive for the asset class.

To illustrate, notwithstanding its better average credit quality, the yield to worst on the J.P. Morgan AAA CLO Index of 7.3% is almost 1.7% higher than the yield on the Bloomberg 1-3 Year Corporate Index. Additionally, as of 26 July 2023, the yield on AAA CLOs is 1.75% above the overnight funding rate and 32 basis points (bps) above its own 10-year average. In our view, these numbers suggest relative cheapness versus ultrashort-duration alternatives.

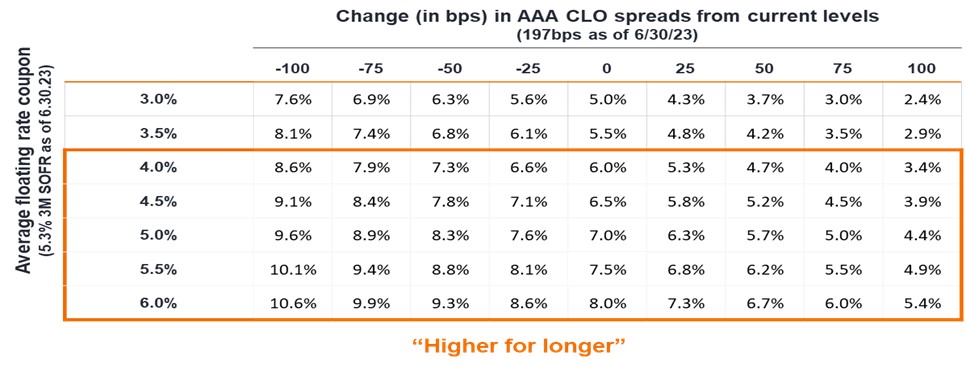

We think elevated spread levels in AAA CLOs may provide a cushion for the asset class should rates begin to trend lower in 2024 and beyond. In Exhibit 2, we highlight potential 1-year forward returns for AAA CLOs under various rate and spread scenarios.

According to our analysis, the current combination of high starting yield (around 7.3%) and wide spreads (around 175 bps as of 26 July 2023) may serve as a strong cushion in the event the Fed pivots sooner than expected and/or if spreads widen out to their COVID wide levels of around 270 bps.

Conversely, if rates continue to rise, or stay where they are, with spreads tightening back toward their long-term averages, we think there is significant upside potential for the asset class on a risk-adjusted basis.

Exhibit 2: Potential 1-year forward returns for AAA CLOs under various rate and spread scenarios

Source: Bloomberg, J.P. Morgan, Janus Henderson Investors, as of 30 June 2023. Hypothetical scenario analysis for illustrative purposes only. Past performance is not guarantee of future returns.

Source: Bloomberg, J.P. Morgan, Janus Henderson Investors, as of 30 June 2023. Hypothetical scenario analysis for illustrative purposes only. Past performance is not guarantee of future returns.

In summary

Considering historically high yields and spread levels, AAA credit quality, lower correlation to traditional fixed income, and inherently low duration, we believe AAA CLOs remain a strong choice for investors seeking to capitalize on the higher-for-longer rate environment.

Average Credit Quality (“ACQ”) is a weighted average of the credit ratings of a portfolio’s holdings. It is calculated by a third party vendor using a linear numeric system. Credit quality ratings for each security in the portfolio reflect the middle rating received from Moody’s, Standard & Poor’s and Fitch, where all three agencies have provided a rating. If only two agencies rate a security, the lowest rating is used. If only one agency rates a security, that rating is used. The vendor assigns each security a numeric value on a linear scale of 2 (highest rated) to 24 (lowest rated). The numerical ratings are then market value weighted to arrive at the aggregate weighted average quality score for the holdings in the portfolio. Non-rated securities are excluded. ACQs are not a rating of the portfolio itself. There are other methods for calculating ACQs that may yield different results.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

The Bloomberg US Corporate 1-3 Yr Index measures the investment grade, fixed-rate, taxable corporate bond market with 1-3 year maturities. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

J.P. Morgan CLO AAA Index is designed to track the AAA-rated components of the USD-denominated, broadly syndicated CLO market.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (ie, the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

Yield cushion, defined as a security’s yield divided by duration, is a common approach that looks at bond yields as a cushion protecting bond investors from the potential negative effects of duration risk. The yield cushion potentially helps mitigate losses from falling bond prices if yields were to rise.

IMPORTANT INFORMATION

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.