A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

What Trump’s nomination of Kevin Warsh as the next Fed chairman could mean for markets and the future path of monetary policy.

A stabilizing U.S. labor market gives the Fed room to wait and see whether inflation resumes its downward path.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Although facing risks to both sides of its dual mandate, the Fed prioritized soft jobs data by delivering a quarter-point rate cut.

In their 2026 outlook, Lucas Klein and Marc Pinto discuss how AI and structural reforms, especially in Europe, present opportunities for selective investors.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

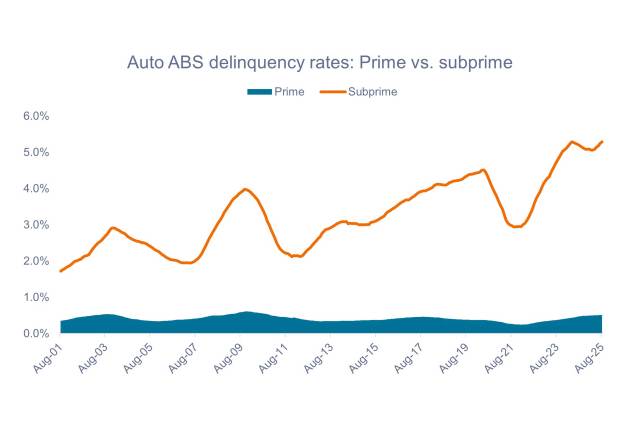

John Kerschner discusses how macroeconomic themes are impacting securitized markets and where he sees opportunities in his 2026 outlook.

An economy with balanced economic risks merits an equally balanced approach to bond allocations until greater clarity emerges on the labor market and inflation.

While the subprime consumer is becoming strained and delinquencies in that segment are on the rise, ABS exposed to the prime consumer remain on solid footing.

The third quarter highlighted various secular trends that could potentially set the stage for long-term earnings growth.