Source: Janus Henderson Investors, Bloomberg, as of 19 September 2025.

Note: Price-earnings ratios based on blended forward 12-month earnings estimates.

Conversations about how tech fits within a broader equities allocation invariably include two questions: First, “Doesn’t it account for a large portion of the benchmark?” and second, “Isn’t it expensive?”

The share tech and internet stocks in the S&P 500® Index has expanded to roughly 40%. This has left investors who had been underweight tech even less exposed to powerful secular themes such as artificial intelligence (AI). Others trimmed exposure during the rally, seeking to avoid concentration. But there is risk to being materially underweight tech.

Our view is that, as themes like AI play out over a multi-year horizon, leading tech companies will compound earnings at a rate far higher than that of broader equities. Modestly increasing tech exposure – but still keeping it under market weight – can position investors to participate in themes that we believe are likely to account for an increasing portion of aggregate corporate earnings.

In the past five years, technologies like cloud computing were first catalyzed by the digital transition brought by COVID-19 lockdowns then joined by the generational theme of AI. The power of the sector’s business models is illustrated by operating margins expected to average 34% over the next two years, compared to 18% for broader stocks. Attractive margins and top-line growth are estimated to deliver earnings growth averaging 19% over the next two years compared to 13% for the S&P 500.

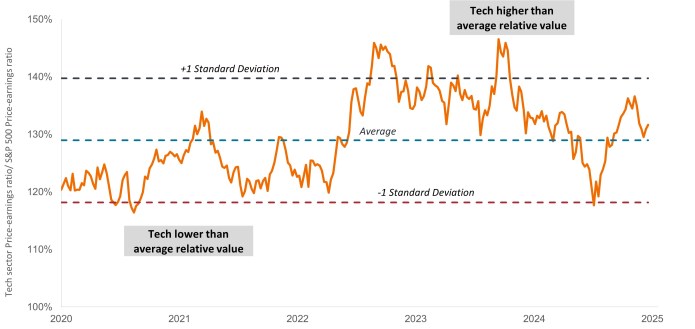

These projections, when coupled with reasonable valuations, provide a compelling argument for investors to reconsider the size of their tech allocation.

We believe the market continues to underappreciate the ability of leading tech companies to compound earnings across the duration of the secular theme with which they are associated. Within this context, many of these innovators’ valuations remain reasonable.

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Important information

Please read the following important information regarding funds related to this article.

Key investment risks:

- The Fund's investments in equities are subject to equity market risk due to fluctuation of securities values.

- Investments in the Fund involve general investment, currency, hedging, economic, political, policy, foreign exchange, liquidity, tax, legal, regulatory, securities financing transactions related and small/ mid-capitalisation companies related risks. In extreme market conditions, you may lose your entire investment.

- The Fund may invest in financial derivatives instruments for investment and efficient portfolio management purposes. This may involve counterparty, liquidity, leverage, volatility, valuation, over-the-counter transaction, credit, currency, index, settlement default and interest risks; and the Fund may suffer total or substantial losses.

- The Fund's investments are concentrated in companies which will benefit significantly from advances or improvements in technology (may include small/ mid capitalization companies) and may be more volatile.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.