Source: BofA and Citi research, Janus Henderson Investors analysis, as at 15 May 2025. Past performance does not predict future returns.

If a tree falls in the forest…

We believe the job of real estate investment trusts (REITs) in a portfolio is to provide healthy returns, income, and diversification from traditional equities. As with the philosophical question of whether a tree falling in a forest makes a sound if there is no-one there to hear it, REITS as an asset class seem to have been forgotten by many investors, but is the asset class back to ‘doing its job’?

We think most investors are still focused either on 2022, where listed REITs were downwardly repriced 30% in about six months in response to the Federal Reserve’s rapid-fire rate hikes. Or they conflate listed REITs, which ‘took the pain’ three years ago and are now ‘working’, with private REITs, some of which are still taking write downs or remain gated (limitations on redemptions). In fact, US REITs have delivered healthy returns in three of the four full post-COVID years, annualising 7.6% from 2021-2024.1

But how are REITs ‘working’ today? To give a couple of recent datapoints, US REITs have returned circa 9% over the 12 months ending 30 June 2025,2 which we believe is very healthy and is in line with the long-term performance of the asset class. The past twelve months have seen some volatility, but over this time frame, US REITs have delivered almost 200 bps lower volatility than the S&P 500 Index (16.5% vs 18.6%) and experienced a max drawdown of 14% vs nearly 17% for the broader equity market.3

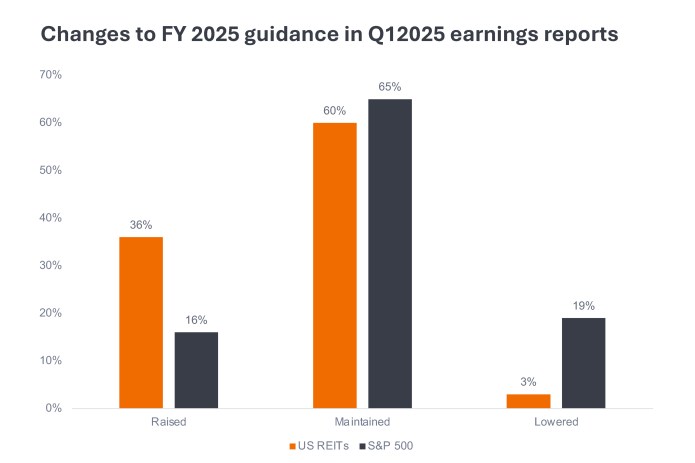

The ability of US REITs to navigate the turbulent Q1 2025 earnings season, speaks to the merits of the asset class. The Q1 2025 earnings reporting cycle immediately followed President Trump’s ‘Liberation Day.’ In the face of uncertainty, many companies in the broader equity market either lowered or removed their 2025 full-year guidance. REITs generate revenue from rent collection, which are typically tied to long leases, translating into steady and predictable income streams that can typically be forecast with a high level of confidence. The REIT model provides such strong visibility that around 36% of listed US REITs raised guidance vs only 3% that lowered. No REITs pulled guidance. We believe this speaks volumes as to the predictability of REIT cash flows vis-à-vis general equities.

1,2,3 Bloomberg. US REITs (FNRE) annualised total returns in USD from 2021 to 2024; FNRE vs broader equities (S&P 500) in USD terms 12 months to 30 June 2025. Past performance does not predict future returns. FTSE Nareit Equity REITs Index (FNRE): is representative of listed securities in the commercial real estate space across the US economy, excluding timber and infrastructure REITs. S&P 500® Index reflects US large-cap equity performance and represents broad U.S. equity market performance.

Basis point: one basis point equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Max drawdown: measures the most significant potential percentage decline (difference between the highest and lowest price) in the value of a portfolio or security over a specific period.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

Important Information

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

Important information

Please read the following important information regarding funds related to this article.

Key investment risks:

- The Fund's investments in equities are subject to equity securities risk due to fluctuation of securities values.

- Investments in the Fund involve general investment, currency, liquidity, hedging, market, economic, political, regulatory, taxation, securities lending related, reverse repurchase transactions related, financial and interest rate risks. In extreme market conditions, you may lose your entire investment.

- The Fund may invest in financial derivatives instruments to reduce risk and to manage the Fund more efficiently. This may involve counterparty, liquidity, leverage, volatility, valuation and over-the-counter transaction risks and the Fund may suffer significant losses.

- The Fund’s investments are concentrated in property sector and may be more volatile and subject to property securities related risk.

- The Fund may invest in Eurozone and may suffer from Eurozone risk.

- The directors may at its discretion pay distributions (i)out of gross investment income and net realised/ unrealised capital gains while charging all or part of the fees and expenses to the capital, resulting in an increase in distributable income for the payment of distributions and therefore, the Fund may effectively pay distributions out of capital; and (ii) additionally for sub-class 4 of the Fund, out of original capital invested. This amounts to a return or withdrawal of part of an investor's original investment or from any capital gains attributable to that original investment, and may result in an immediate reduction of the Fund’s net asset value per share.

- The Fund may charge performance fees. An investor may be subject to such fee even if there is a loss in investment capital.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.

Key investment risks:

- The Fund's investments in equities are subject to equity market risk due to fluctuation of securities values.

- Investments in the Fund involve general investment, currency, hedging, economic, political, policy, foreign exchange, liquidity, tax, legal, regulatory, securities financing transactions related and small/ mid-capitalisation companies related risks. In extreme market conditions, you may lose your entire investment.

- The Fund may invest in financial derivatives instruments for investment and efficient portfolio management purposes. This may involve counterparty, liquidity, leverage, volatility, valuation, over-the-counter transaction, credit, currency, index, settlement default and interest risks; and the Fund may suffer total or substantial losses.

- The Fund's investments are concentrated in companies (may include small/ mid capitalization companies, REITs) engaged in or related to the property industry and may be more volatile and are subject to REITs and property related companies risks.

- The Fund may invest in developing markets and involve increased risks.

- The Fund may at its discretion pay dividends (i) pay dividends out of the capital of the Fund, and/ or (ii) pay dividends out of gross income while charging all or part of the fees and expenses to the capital of the Fund, resulting in an increase in distributable income available for the payment of dividends by the Fund and therefore, the Fund may effectively pay dividends out of capital. This may result in an immediate reduction of the Fund’s net asset value per share, and it amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.