Has public real estate finally reached an inflection point?

Guy Barnard, Co-Head of Global Property Equities, reflects on a challenging year for property equities and explains the team’s more constructive outlook for 2024.

7 minute read

Key takeaways:

- Public REITs could be a key beneficiary of an inflection point in interest rates given the re-pricing already seen and the potential for attractive and growing dividends.

- Investors have overlooked a sector that is still seeing good tenant demand and earnings growth from property types benefiting from structural tailwinds.

- Public real estate may soon shift to ‘offense’ given a cost and access to capital advantage compared to private real estate.

We concluded our 2023 outlook by saying that, “there can be little real doubt that private real estate valuations are likely to have to adjust in 2023,” and that, “while 2023 will bring further challenges, we believe the starting point today (in listed real estate markets) is more reflective of the reality to come.”

Looking back

While 2023 certainly presented fresh challenges, the key driver of real estate investment trust (REIT) performance continued to be the moves in interest rate expectations and, specifically, real rates. This led to further volatility in the global REITs market in 2023 but ultimately little return, with the FTSE EPRA Nareit Developed Index in USD down around 1% as we write (27 November, 2023).1

While the public real estate market has continued to reflect the shifts in rate expectations in its daily pricing, a slower ongoing correction is being seen in private property markets.

Headlines vs reality

In 2023, we continued to highlight to investors that the many headlines surrounding ‘commercial real estate (CRE) in crisis’ were not entirely reflective of the reality that we see as active investors in the public REIT market. As is well-documented, the US office market is facing an extremely challenging backdrop for landlords, but forms only a small part of the REIT sector (4% of US public REITs) and one which we have avoided. Likewise, the challenges facing US regional banks, and the resulting reduction of debt availability, will present greater challenges in the private rather than the public real estate markets in which we invest. For the latter, leverage levels are historically low and companies have continued to demonstrate their ability to access both debt and equity on still accretive terms.

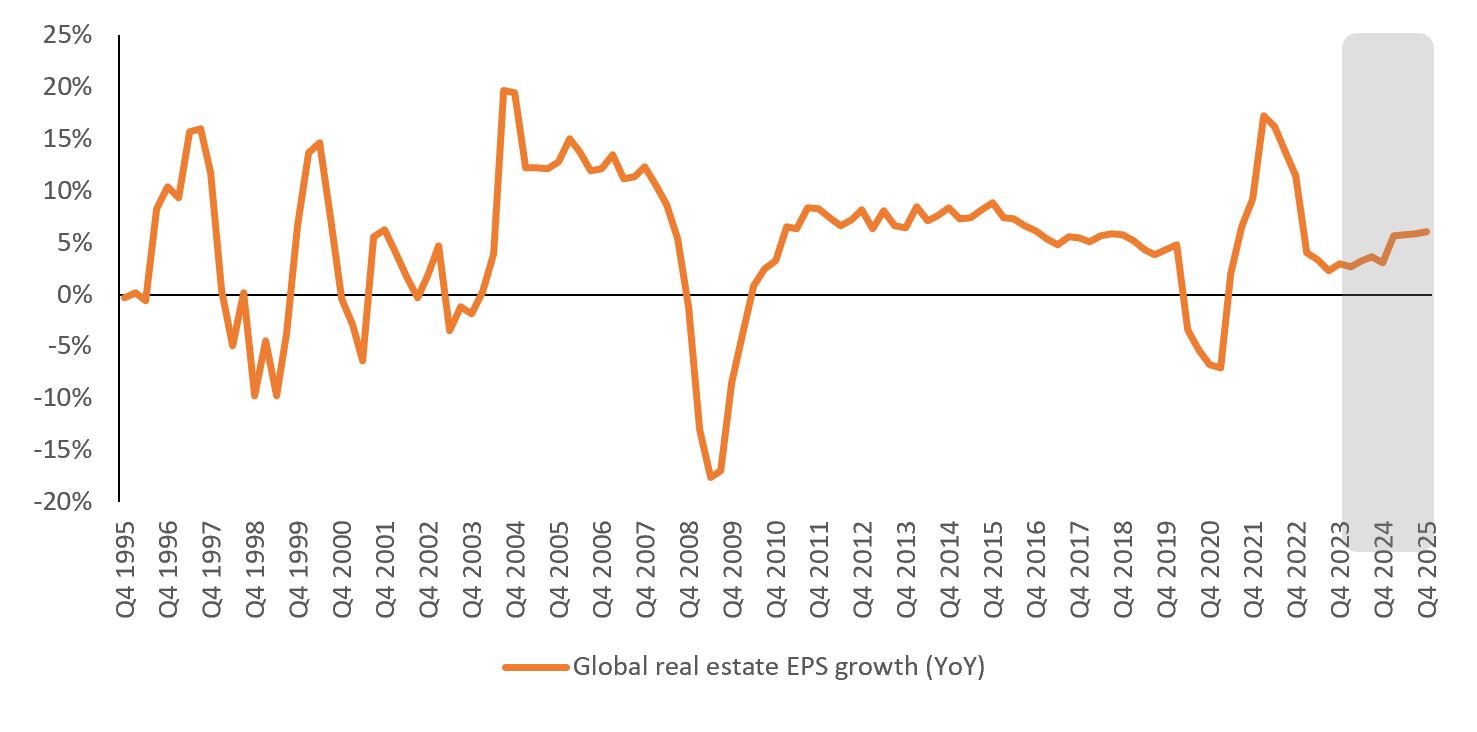

It is also important to remember that despite the significant de-rating seen in the REIT market in the last few years, the operational performance of the businesses we invest in has generally been strong, with 2023 estimated to be a year of mid-single digit earnings growth (Figure 1).2 The combination of continued growth in the face of share price declines means public REIT shares have become much “cheaper”. In fact, since the beginning of 2022 while global REIT share prices have declined by more than 25%, REIT cash flows per share have grown by c.13% (UBS data), resulting in an earnings multiple decline greater than any other equity sector.

Figure 1: Global public real estate earnings growth

Source: Refinitiv, IBES, UBS. Based on rolling 12-month forward earnings per share (EPS). Global real estate EPS growth is market cap weighted average of UBS factor model constituents (US, UK, Cont. Europe, AU, JP, HK, and Singapore, representing c70-80% of EPRA Developed Index. Grey shaded area highlights the IBES consensus estimates for EPS growth.

Most public REITs have continued to collect and grow rental income streams, benefiting from healthy tenant demand in many sectors and an increased focus on best-in-class assets. While demand is normalising in some sectors, and there are headwinds in a slowing economy, a focus on areas of structural growth and those companies that can be considered as quality compounders could potentially deliver further earnings growth in 2024.

Well-placed for further growth?

Looking ahead we view real estate as a sector that presents risks and offers opportunities for investors. Risks for those companies that took on too much debt in the good times and face difficult refinancing discussions as those loans mature. Risks for those exposed to areas of the real estate market that are facing structural obsolescence, high market vacancy levels, and no pricing power.

However, we see more opportunities in the public REIT market as we look forward. Strong balance sheets should enable many public companies to be opportunistic buyers of real estate, taking advantage of motivated sellers who may own good buildings but with weak balance sheets.

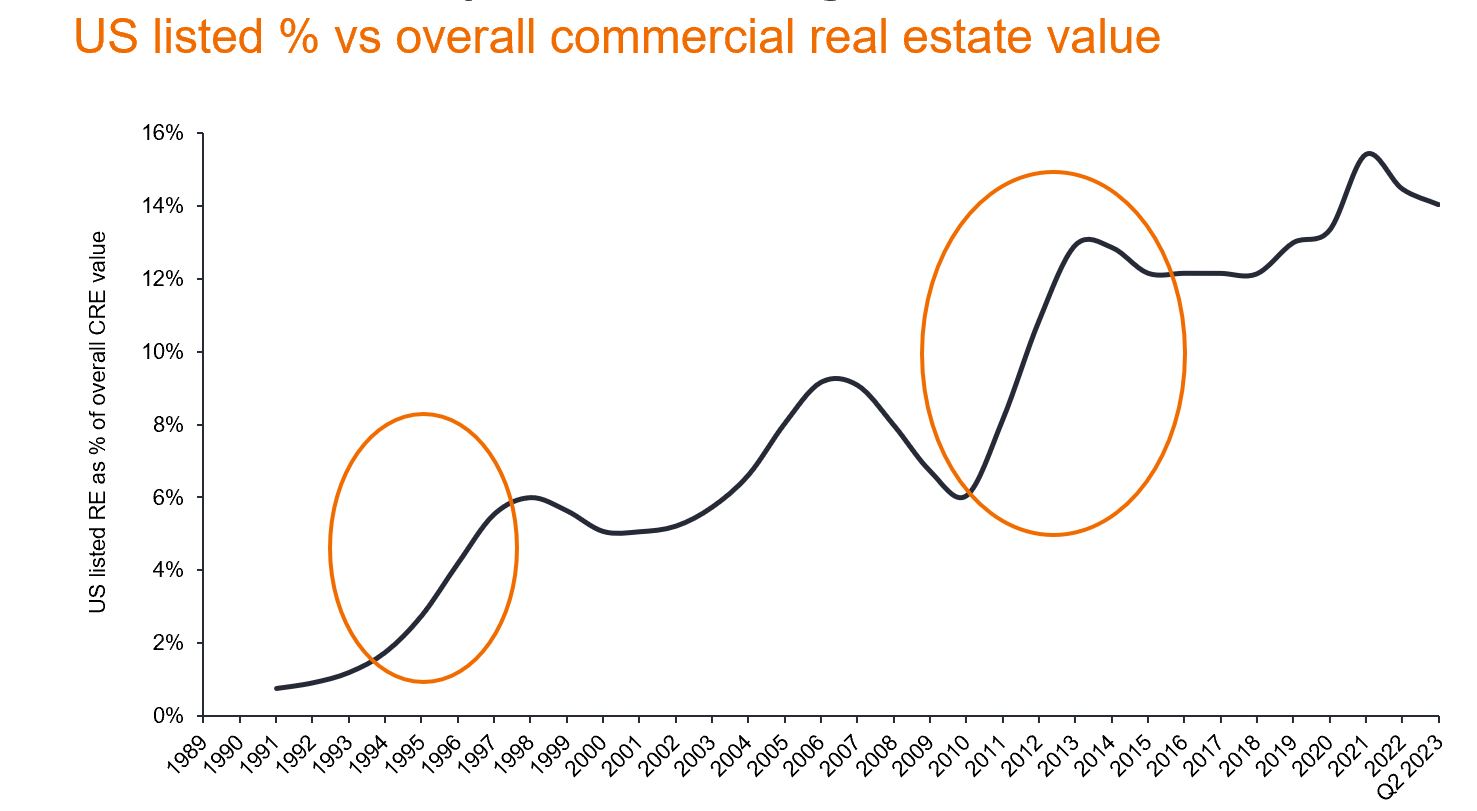

In our view, public REITs’ access to capital and at relatively lower costs compared to private real estate sets them on the path for faster growth in the years ahead – an advantage that should not be underestimated (Figure 2). This dynamic has occurred before, and has resulted in strong performance for public REITs.

Another factor benefiting public REITS is the greater exposure to alternative and faster growing areas the real estate market, such as data centres, logistics, storage, healthcare, and housing. Here, in-house operational platforms should help the REIT grow further and potentially outperform other real estate vehicles.

Figure 2: An opportunity for further growth in the public REIT market

Source: EPRA Nareit, UBS, Janus Henderson Investors analysis, as at 30 June 2023.

Are we at an inflection point?

As investors we are always looking for inflection points. The ability to benefit from a shift in view is an opportunity to generate returns. Looking to 2024, we may now be at an inflection point in the interest rate cycle, which has been such a dominant theme in markets for the last two years, with public REITs one of the hardest hit sectors. While it may be premature, recent market moves highlight that if the narrative around rates does shift, investors may want to again consider those sectors that have been shunned of late.

A two-stage recovery

That REITs are unloved, while sad for us as specialist managers, is not new news, with fund manager surveys showing that exposure to the sector is close to Global Financial Crisis lows. While we believe a stabilisation in interest rates is a crucial first step in real estate’s recovery, we also believe that a decline in rates is not a pre-requisite for public REITs to generate attractive returns from today’s levels because they are already trading at valuations that fully reflect the market’s concerns.

In the private property market, greater confidence in the cost of debt should lead to a pick up in real estate transactions as sellers’ pricing expectations become more realistic and closer to pricing that makes sense for buyers (i.e. lower). This is a scenario that we expect to see in the first half of 2024, which will drive greater price discovery and a resumption of more normal transaction volumes.

In the public REIT market, with shares already priced at or below more realistic values reflective of the new rate environment, recoveries typically begin six to nine months before direct values bottom, with excess pessimism removed as investors rebuild allocations to the sector – we believe we are in this period today.

Confidence in real estate asset valuations will enable investors to look beyond macro turbulence and refocus on the fundamentals: income and income growth, plus the ability for management teams to create value through development and asset management initiatives. While plateauing rates may limit the near-term capital growth story across real estate as a whole, not all real estate is equal across geographies, sectors and companies, and there will be areas of underappreciated growth for active managers like us to identify.

Third time’s a charm?

We therefore look to 2024 with greater confidence and conviction in public REITs’ prospects once again. In a real estate market of winners and losers, we believe the public REITs sector finds itself well-placed, owning more of the ‘right’ real estate, with easier access and significantly lower cost of capital to its advantage in most markets.

A shifting macro narrative may lead investors to revisit public REITs, reduce underweights, and positively re-rate the sector from its current low levels, as well as return the focus to the attractive and growing dividends on offer. Interest rate cuts if they do come, would likely offer further support.

We also highlight the potential for laggards to become leaders within equity markets. Taking some comfort from the fact that public REITs have never seen three years of consecutive negative returns it feels fair to ask whether ‘third time‘s a charm’?

1 Bloomberg, as at 27 November 2023. Past performance does not predict future returns.

2 UBS estimates as at November 2023. Forecasts may vary and are not guaranteed.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time, used to gauge the financial health of a company.

De-rating: the downward adjustment of a company’s financial ratios, such as the price-to-earnings (P/E) ratio, in response to business or market uncertainty.

EPS: earnings per share is the bottom-line measure of a company’s profitability, defined as net income (profit after tax) divided by the number of outstanding shares.

FTSE EPRA Nareit Developed Index tracks the performance of real estate companies and real estate investment trusts (REITs) from developed market countries.

Leverage: the amount of debt that a REIT carries. The leverage ratio is measured as the ratio of debt to total assets.

Price discovery: the process of determining the price of an asset/security/commodity in the market through the interactions of buyers and sellers.

Real rate: interest rates adjusted for inflation, reflecting the real cost of funds to a borrower or real yield to an investor.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs) may be subject to additional risks, including interest rate, management, tax, economic, environmental and concentration risks.

Important information

Please read the following important information regarding funds related to this article.

Key investment risks:

- The Fund's investments in equities are subject to equity securities risk due to fluctuation of securities values.

- Investments in the Fund involve general investment, currency, liquidity, hedging, market, economic, political, regulatory, taxation, securities lending related, reverse repurchase transactions related, financial, interest rate and small/ mid-capitalisation companies related risks. In extreme market conditions, you may lose your entire investment.

- The Fund may invest in financial derivatives instruments to reduce risk and to manage the Fund more efficiently. This may involve counterparty, liquidity, leverage, volatility, valuation and over-the-counter transaction risks and the Fund may suffer significant losses.

- The Fund’s investments are concentrated in European property sector (may include small/ mid capitalization companies). It may be more volatile and subject to property securities related risk.

- The Fund may invest in Eurozone and may suffer from Eurozone risk.

- The directors may at its discretion pay distributions out of gross investment income and net realised/ unrealised capital gains while charging all or part of the fees and expenses to the capital, resulting in an increase in distributable income for the payment of distributions and therefore, the Fund may effectively pay distributions out of capital. This amounts to a return or withdrawal of part of an investor's original investment or from any capital gains attributable to that original investment, and may result in an immediate reduction of the Fund’s net asset value per share.

- The Fund may charge performance fees . An investor may be subject to such fee even if there is a loss in investment capital.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.

Key investment risks:

- The Fund's investments in equities are subject to equity securities risk due to fluctuation of securities values.

- Investments in the Fund involve general investment, currency, liquidity, hedging, market, economic, political, regulatory, taxation, securities lending related, reverse repurchase transactions related, financial and interest rate risks. In extreme market conditions, you may lose your entire investment.

- The Fund may invest in financial derivatives instruments to reduce risk and to manage the Fund more efficiently. This may involve counterparty, liquidity, leverage, volatility, valuation and over-the-counter transaction risks and the Fund may suffer significant losses.

- The Fund’s investments are concentrated in property sector and may be more volatile and subject to property securities related risk.

- The Fund may invest in Eurozone and may suffer from Eurozone risk.

- The directors may at its discretion pay distributions (i)out of gross investment income and net realised/ unrealised capital gains while charging all or part of the fees and expenses to the capital, resulting in an increase in distributable income for the payment of distributions and therefore, the Fund may effectively pay distributions out of capital; and (ii) additionally for sub-class 4 of the Fund, out of original capital invested. This amounts to a return or withdrawal of part of an investor's original investment or from any capital gains attributable to that original investment, and may result in an immediate reduction of the Fund’s net asset value per share.

- The Fund may charge performance fees. An investor may be subject to such fee even if there is a loss in investment capital.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.

Key investment risks:

- The Fund's investments in equities are subject to equity securities risk due to fluctuation of securities values.

- Investments in the Fund involve general investment, currency, liquidity, hedging, market, economic, political, regulatory, taxation, securities lending related, reverse repurchase transactions related, financial, interest rate and benchmark risks. In extreme market conditions, you may lose your entire investment.

- The Fund may invest in financial derivatives instruments to reduce risk and to manage the Fund more efficiently. This may involve counterparty, liquidity, leverage, volatility, valuation and over-the-counter transaction risks and the Fund may suffer significant losses.

- The Fund's investments are concentrated in the Asia-Pacific property sector and may be more volatile and subject to property securities related risk.

- The directors may at its discretion pay distributions (i) out of gross investment income and net realised/ unrealised capital gains while charging all or part of the fees and expenses to the capital, resulting in an increase in distributable income for the payment of distributions and therefore, the Fund may effectively pay distributions out of capital; and (ii) additionally for sub-class 4 and sub-class 5 of the Fund, out of original capital invested. This amounts to a return or withdrawal of part of an investor's original investment or from any capital gains attributable to that original investment, and may result in an immediate reduction of the Fund’s net asset value per share.

- The Fund may charge performance fees. An investor may be subject to such fee even if there is a loss in investment capital.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.

Key investment risks:

- The Fund's investments in equities are subject to equity market risk due to fluctuation of securities values.

- Investments in the Fund involve general investment, currency, hedging, economic, political, policy, foreign exchange, liquidity, tax, legal, regulatory, securities financing transactions related and small/ mid-capitalisation companies related risks. In extreme market conditions, you may lose your entire investment.

- The Fund may invest in financial derivatives instruments for investment and efficient portfolio management purposes. This may involve counterparty, liquidity, leverage, volatility, valuation, over-the-counter transaction, credit, currency, index, settlement default and interest risks; and the Fund may suffer total or substantial losses.

- The Fund's investments are concentrated in companies (may include small/ mid capitalization companies, REITs) engaged in or related to the property industry and may be more volatile and are subject to REITs and property related companies risks.

- The Fund may invest in developing markets and involve increased risks.

- The Fund may at its discretion pay dividends (i) pay dividends out of the capital of the Fund, and/ or (ii) pay dividends out of gross income while charging all or part of the fees and expenses to the capital of the Fund, resulting in an increase in distributable income available for the payment of dividends by the Fund and therefore, the Fund may effectively pay dividends out of capital. This may result in an immediate reduction of the Fund’s net asset value per share, and it amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment.

- Investors should not only base on this document alone to make investment decisions and should read the offering documents including the risk factors for further details.