The software sector has faced headwinds in recent months as AI disruption concerns have grown. Valuations have compressed across the sector, reflecting investor uncertainty about how AI might reshape established software businesses.

But we believe the current market reaction tells only part of the story. While AI presents real challenges for software companies, there are also meaningful defensive advantages that warrant consideration.

Software sector faces challenges…

AI disruption concerns have been building and have evolved over two years as investors evaluate fundamental questions about software business models.

The first issue centers on seat-based pricing. Many software companies charge based on user count. If AI makes employees more efficient, companies may need fewer software licenses. This threatens the revenue foundation for established vendors, particularly application software companies.

More recently, “agentic AI” has emerged as a consideration. These systems handle complex workflows independently, potentially reducing current platforms to simple data repositories. For example, a company might still need its customer management system, but AI agents operating on top of the platform could capture the real value by pulling information from multiple sources.

New AI-native competitors represent another development. Major language model providers are expanding into business applications, building on modern technology stacks. When news broke recently that a leading AI company was developing hiring solutions, shares of established players dropped 2% to 3% in a single day. While we think fears of wholesale replacement are overblown, the market reaction demonstrates investor sensitivity to AI competition.

Machine coding capabilities have also drawn attention. Microsoft’s CEO reported that AI currently writes 20% to 30% of their code, with the company’s Chief Technology Officer projecting it would reach 95% by 2030. This development raises questions about whether enterprises might shift from “buy-first” to “build-first” approaches as AI makes software creation more accessible.

Additionally, established companies have shown limited direct AI revenue so far. One major company reported $100 million in AI-related recurring revenue, which is a fraction of its $40 billion revenue base. The lack of meaningful AI monetization has led to questions about whether incumbents can adapt quickly enough.

…but has built-in defenses

Despite these developments, we believe established software companies remain fundamentally well positioned and maintain several competitive advantages.

First, incumbents control proprietary data, customer relationships, and distribution channels. They already sit at the center of their customers’ workflows and have collected information over years that enables effective AI applications. This gives them a head start over new entrants trying to build AI solutions from scratch.

Second, production-grade AI remains limited in scope. Beyond code generation and customer service automation, many AI projects have not scaled into broad production use. Companies leading AI development have acknowledged that agent-based solutions are not ready for widespread deployment. This timeline allows incumbents to integrate AI features, adjust pricing models, and deliver value without surrendering their core franchises.

Core business systems – the software that manages customer relationships, enterprise resources, and human capital – are also very difficult to replace. Enterprises prioritize security, governance, and accountability when systems fail. These practical issues slow enterprise adoption of unproven AI alternatives in favor of established providers.

A selective approach

We think AI’s impact will vary across the software landscape, and as such, we are focusing our attention on areas where we see durable advantages and less immediate risk.

Areas of opportunity

Data infrastructure companies appear well positioned. Enterprises need clean, centralized data before AI can deliver reliable outcomes, whether they build internal solutions or use third-party services. Companies that help organize and manage information, plus those providing monitoring and observability services, may benefit. Their consumption-based pricing models align with AI-driven increases in data and compute usage.

Vertical software serving specific industries presents another area of interest. Companies addressing specialized industry needs – such as insurance claims processing or home service scheduling – possess domain expertise and workflows that generic AI solutions cannot easily replicate. These companies also maintain unique datasets and high switching costs that provide competitive defenses.

Design software for semiconductor development represents a specialized opportunity. These companies fulfill advanced chip design requirements and are positioned to benefit from AI advancement along with R&D spending in the semiconductor sector.

Areas requiring caution

Horizontal application software serving broad functions across industries may face more direct AI competition. For example, customer support platforms and creative software operate in large, standardized markets where new AI startups can compete more effectively.

Broadly speaking, point solutions focused on specific functions like email marketing or expense tracking may experience more competitive pressure than integrated platforms, given reduced barriers for new market entrants.

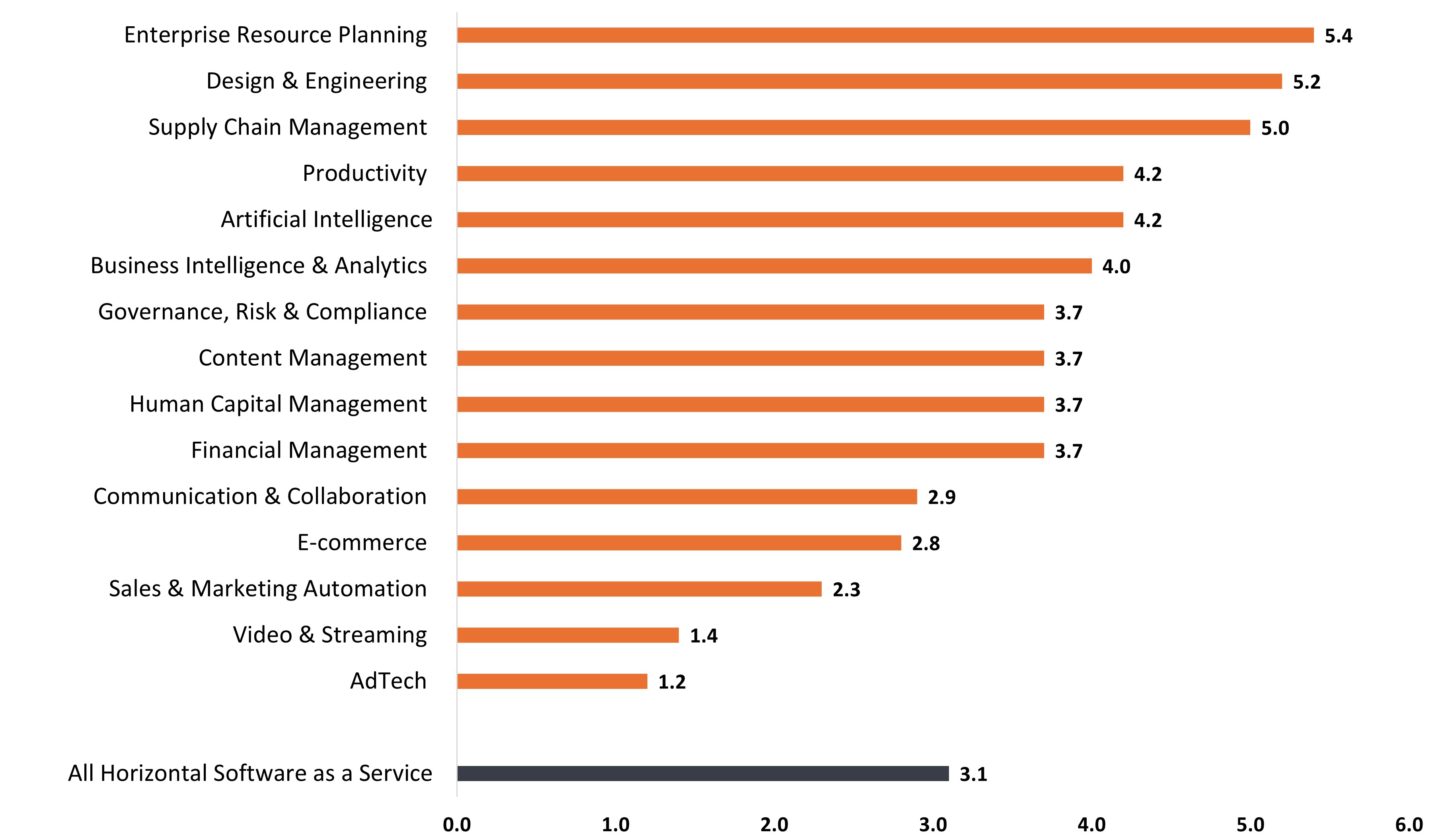

Figure 1: Median EV / NTM Revenue Multiples

The valuation differences among horizontal application software companies help illustrate investor views on the varying potential for AI disruption across segments.

Source: Multiples. Report: Software Valuation Multiples – September 2025. EV/NTM Revenue = Enterprise Value to Net Twelve Months Revenue.

What we’re monitoring

The AI transition and its impact on the software sector requires careful fundamental analysis. Key metrics we’re monitoring include direct AI revenue growth at established companies, adoption rates for new AI-powered products, and whether AI revenue supplements or replaces existing business lines.

We are also tracking how companies use AI internally to improve operations and margins, as well as product development velocity. Companies that leverage AI to accelerate their own development may expand into new markets more quickly, potentially offsetting competitive pressures in core businesses.

The outlook

The software sector faces a period of transition, but outcomes remain uncertain. While some disruption is inevitable, the wholesale replacement of established companies remains far from certain.

Like any major platform shift, there will be winners and losers. The next 18 months should provide clarity as software companies move from AI promises and development to actual product delivery and revenue generation.

We believe current valuations in many software segments appear reasonable relative to historical levels, but fundamental analysis and careful selection has become more important. In our view, the companies best positioned for this transition are those that can maintain defensible market positions, specialized expertise, or infrastructure that benefits from AI adoption rather than competing against it.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.