Defining characteristics of our fund

Established investment portfolio built on a 30-year history of sustainable investing and innovative thought leadership

Established investment portfolio built on a 30-year history of sustainable investing and innovative thought leadership- High-conviction portfolio of companies selected for their potential to deliver compounding growth and their ability to contribute to the development of a more sustainable global economy

- Committed to provide clients with high standards of engagement, transparency and measurement

What we believe

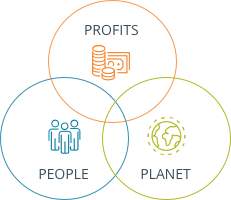

We believe there is a strong link between sustainable development, innovation and long-term compounding growth.

Read More

Our investment framework leads us to invest in companies that we believe contribute to the development of a more sustainable global economy, through their revenue alignment with ten environmental and social themes. At the same time, it helps us stay on the right side of disruption by seeking to avoid companies we consider to be involved in activities that are harmful to the environment and society.

We believe this approach will provide clients with a return source, deliver future compound growth and help mitigate downside risk.

The guiding principle of our investment philosophy evolves around: Is the world a better place because of this company?”

Hamish Chamberlayne, CFA

Head of Global Sustainable Equity |Portfolio Manager

Investment Considerations

Read Less

Investment objective

The Fund aims to provide capital growth over the long term by investing in companies whose products and services are considered by the Investment Manager as contributing to positive environmental or social change and thereby have an impact on the development of a sustainable global economy.

More

The Fund invests at least 80% of its assets in shares (also known as equities) of companies, of any size, in any industry, in any country. The Fund will avoid investing in companies that the investment manager considers to potentially have a negative impact on the development of a sustainable global economy.

Less