Source: BofA and Citi research, Janus Henderson Investors analysis, as at 15 May 2025. Past performance does not predict future returns.

If a tree falls in the forest…

We believe the job of real estate investment trusts (REITs) in a portfolio is to provide healthy returns, income, and diversification from traditional equities. As with the philosophical question of whether a tree falling in a forest makes a sound if there is no-one there to hear it, REITS as an asset class seem to have been forgotten by many investors, but is the asset class back to ‘doing its job’?

We think most investors are still focused either on 2022, where listed REITs were downwardly repriced 30% in about six months in response to the Federal Reserve’s rapid-fire rate hikes. Or they conflate listed REITs, which ‘took the pain’ three years ago and are now ‘working’, with private REITs, some of which are still taking write downs or remain gated (limitations on redemptions). In fact, US REITs have delivered healthy returns in three of the four full post-COVID years, annualising 7.6% from 2021-2024.1

But how are REITs ‘working’ today? To give a couple of recent datapoints, US REITs have returned circa 9% over the 12 months ending 30 June 2025,2 which we believe is very healthy and is in line with the long-term performance of the asset class. The past twelve months have seen some volatility, but over this time frame, US REITs have delivered almost 200 bps lower volatility than the S&P 500 Index (16.5% vs 18.6%) and experienced a max drawdown of 14% vs nearly 17% for the broader equity market.3

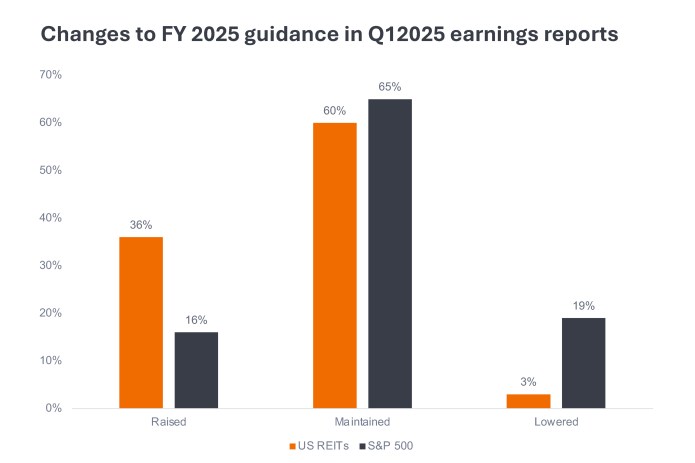

The ability of US REITs to navigate the turbulent Q1 2025 earnings season, speaks to the merits of the asset class. The Q1 2025 earnings reporting cycle immediately followed President Trump’s ‘Liberation Day.’ In the face of uncertainty, many companies in the broader equity market either lowered or removed their 2025 full-year guidance. REITs generate revenue from rent collection, which are typically tied to long leases, translating into steady and predictable income streams that can typically be forecast with a high level of confidence. The REIT model provides such strong visibility that around 36% of listed US REITs raised guidance vs only 3% that lowered. No REITs pulled guidance. We believe this speaks volumes as to the predictability of REIT cash flows vis-à-vis general equities.

1,2,3 Bloomberg. US REITs (FNRE) annualised total returns in USD from 2021 to 2024; FNRE vs broader equities (S&P 500) in USD terms 12 months to 30 June 2025. Past performance does not predict future returns. FTSE Nareit Equity REITs Index (FNRE): is representative of listed securities in the commercial real estate space across the US economy, excluding timber and infrastructure REITs. S&P 500® Index reflects US large-cap equity performance and represents broad U.S. equity market performance.

Basis point: one basis point equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Max drawdown: measures the most significant potential percentage decline (difference between the highest and lowest price) in the value of a portfolio or security over a specific period.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

Important Information

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.