After a decade defined by ultra‑low rates, markets have shifted decisively into a new regime. The cost of money is no longer close to zero; inflation, though moderating, remains a persistent variable; and correlations between equities and bonds have risen meaningfully. For absolute return investors, this is fertile ground.

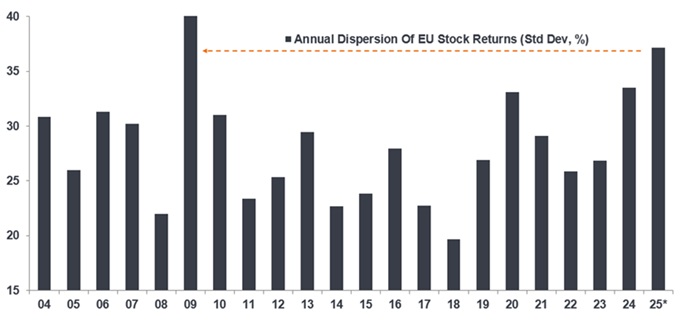

Two features stand out for us. First, stock pricing dispersion – the spread of returns between winners and losers – has widened across regions and sectors, now comparable with 2009 (Exhibit 1). That creates room for genuine stock selection on both the long and short side, rather than the blunt force of beta (the markets) doing the work.

Exhibit 1: Gone are the days of a rising tide lifting all boats

Source: FactSet, Morgan Stanley Alpha. * indicates the calendar-year dispersion for 2025 until 28th November 2025. Past performance does not predict future returns.

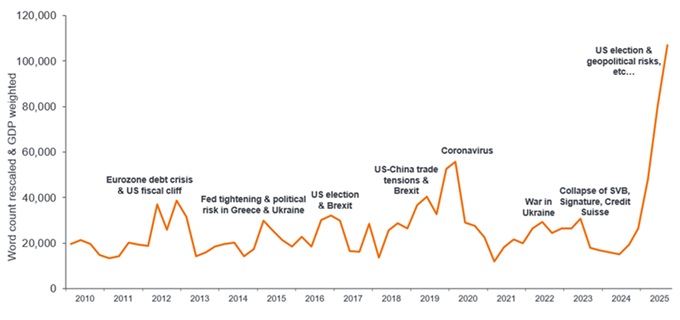

Second, volatility (and uncertainty – Exhibit 2) has moved higher and is less mono‑directional. While unnerving at an index level, that dynamism is a positive factor for absolute return investors, with the flexibility to take long positions in stocks where they see improving fundamentals at sensible valuations, and short positions where they see deteriorating fundamentals and stretched valuations.

Exhibit 2: Uncertainty is the new buzzword

Source: Ahir, H, N Bloom and D Furveri (2022), World Uncertainty Index, NBER Working Paper, at 30 September 2025.

Note: The index reflects the frequencies of the word ‘uncertainty’ (and its variants) in the Economist Intelligence Unit (EIU) quarterly country reports, rescaled by total word count and GDP weighted.

Why the regime shift matters for absolute return

During what was a very long cycle of record-low interest rates, broad economic factors and market sentiment (‘macro’) consistently had a much stronger impact on asset prices and investment returns than the specific, bottom-up fundamentals of individual companies (‘micro’). This was a period where industry and sector correlations were high, and low‑quality growth prospered on the cheap cost of borrowing.

In today’s more normalised interest rate environment, company fundamentals have regained primacy. This means that cash generation, balance sheet strength, return on invested capital, and good management discipline, are being rewarded where they improve, and penalised where they slip.

This is a toolkit that absolute return managers rely on, with three primary attributes that can potentially resonate with investors:

- Low beta, low correlation at an individual stock level: The potential to deliver positive absolute returns without leaning on macro factors helps when the performance of equities and fixed income become more synchronous.

- Downside risk mitigation: The ability to reposition quickly – for example, by taking a larger exposure to short positions – can help to cushion drawdowns during sharp market sell‑offs.

- Risk efficiency: Targeting equity‑like absolute returns, with historically much lower volatility, is a practical way to use risk budgets in periods of uncertainty.

Markets have felt like a ‘longs first’ hunting ground for much of the past decade or more, powered by secular growth prospects and ever-higher prices, particularly for a small sub-set of technology growth stocks. Now, we see opportunities on both the long and short side:

Long opportunities: where fundamentals and valuation align

- Financials have seen years of capital restructuring and operational improvement. We are now at a point where lower interest rates and depressed valuations look like a tailwind for select companies with robust balance sheets.

- Aerospace and defence stocks in Europe have enjoyed a period of strong gains, reflective of heightened geopolitical uncertainty and renewed focus on domestic security needs. In our view, these industries still offer prospects for investors positioned for any short-term pullbacks in price.

- Duration‑sensitive assets such as utilities, real estate investment, and quality housebuilders, are likely beneficiaries of lower interest rates, with a focus on firms with strong balance sheets and well-structured debt, in areas with transparent regulatory frameworks.

Short opportunities: deterioration and the end of pricing power

- Cost–price mismatches: Those companies facing cost inflation (rising wages, higher business rates, etc), with a diminishing ability to pass those costs on through higher prices. This includes hotels, leisure facilities, and select services with high fixed costs.

- US consumer names: Areas where pandemic stimulus and aggressive pricing structures temporarily boosted profits, where competition is growing, putting pressure on businesses to cut prices and offer promotions to defend their market share.

- Policy sensitivity: Positions with a greater exposure to budget uncertainty, tariff risks or procurement delays can work as effective tactical short positions when broader market risk factors dominate.

AI: beyond the headline winners

The AI super-cycle has been profoundly impactful on investment markets, acting as the primary driver of equity market performance since 2023. This is a serious conundrum for investors, given how crowded this area looks and the uncertain timescale for any return on investment.

We see more compelling opportunities in ‘AI‑adjacent’ areas – parts of the market that have either been overlooked, or associated services. This includes perceived ‘AI losers’ – high‑quality, data‑rich business-to-business providers that have been (in our view) harshly treated on fears that AI would undermine their business models.

We also see good prospects for those businesses that can benefit from greater integration of AI in assisting productivity, such as financial services, business services, and selected industrial support functions.

This intersects with another emerging theme – pockets of disinflation – where we see AI as acting as a potential ‘silent hand’, compressing costs in services, manufacturing, etc, which can potentially help to lower price pressures across the global economy.

What role can absolute return serve today?

In our view, the conditions now in place – wider stock dispersion, more rational pricing, and a healthier cost of capital – create an unusually constructive backdrop for absolute return investing. This is an environment that rewards selectivity, discipline, and flexibility rather than reliance on market direction. For investors seeking a diversifying source of returns, with the potential for downside resilience and efficient use of risk, absolute return strategies can potentially serve as a stable anchor in an increasingly unstable world. The regime has changed. The playbook should too.

Absolute return investing: A type of investment strategy that seeks to generate a positive return over time, regardless of market conditions or the direction of financial markets, typically with a low level of volatility.

Balance sheet:

Beta: The measure of the relationship that a portfolio or security has with the overall market. The beta of a market is always 1. A portfolio with a beta of 1 means that if the market rises 10%, so should the portfolio. A portfolio with a beta of more than 1 means it will likely move more than the market average (ie. more volatility). A beta of less than 1 means that a security is theoretically less volatile than the market.

Business to business (B2B): A firm that sells products or services to other businesses, rather than individual consumers, focusing on solving operational problems, providing raw materials, or offering specialized services like software, consulting, or manufacturing components.

Correlation: How far the price movements of two variables (e.g., equity or fund returns) move in relation to each other. A correlation of +1.0 means that both variables have a strong association in the direction they move. If they have a correlation of –1.0, they move in opposite directions. A figure near zero suggests a weak or non-existent relationship between the two variables.

Cost of capital: A measure of the average cost to a company to finance its assets, used to assess if new projects will add or destroy value. Weighted average cost of capital (WACC) can be used to assist with investment decisions, in valuing a business, or assessing its overall financial risk.

Disinflation: A fall in the rate of inflation.

Duration-sensitive assets: Investments or companies there the value is highly responsive to changes in prevailing interest rates.

Improving risk-reward prospects: An to investment scenarios where the potential for return (reward) has increased relative to the potential for loss (risk).

Long position: A security that is bought with the intention of holding over a long period in the expectation that it will rise in value.

Long/short investing: A strategy that can invest in both long and short positions. The intention is to profit from combining long positions in assets in the expectation that they will rise in value, with short positions in assets expected to fall in value. This type of investment strategy has the potential to generate returns regardless of moves in the wider market, although returns are not guaranteed.

Rational pricing: The concept that asset prices will reflect their true value over time. Where an asset is priced incorrectly, those investors who seek to benefit from mispricing opportunities will seek to buy or sell the asset. Over time, this should contribute to correcting the price. Also used to mean prices that reflect informed insight into the intrinsic value of an asset, rather than being influenced by a trend or overconfidence/fear.

Return on capital – ROI (also return on investment – ROI): A profitability ratio that measures a company’s net income relative to the total value of its equity and debts. It is used as an indicator of how effective a company is at turning its spending into profits.

Risk budget: A strategic allocation of an organisation’s total acceptable risk across different investments or portfolio components, ensuring risk is managed efficiently within defined limits, much like a financial budget allocates money.

Secular growth: Long-term, fundamental shifts in an industry or economy that create sustained growth over decades. This includes megatrends, driven by major societal or technological changes, such as AI, or e-commerce.

Short position: A strategy where investors borrow, then sell, what they believe are overvalued assets, with the intention of buying them back for less when the price falls. The position profits if the security falls in value. Within certain kinds of funds, derivatives can be used to simulate a short position without actually borrowing or selling a stock.

Stock dispersion: The extent to which a distribution of data points extends. Dispersion in stocks measures the range of returns for a group of stocks. Higher dispersion opens up opportunities for stock pickers to outperform by selecting the winners and avoiding the losers, given that stock returns are spread more widely on either side of the benchmark.

Tariff: A tax or duty imposed by a government on goods imported from other countries.

Volatility: The rate and extent at which the price of a portfolio, security, or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility, the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.