AI monetization today: Infrastructure leads

The AI investment landscape is evolving as a transition to application-layer innovation unfolds. Today, however, the clearest signs of AI monetization appear at the infrastructure level. Hyperscale cloud providers – notably Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP) – have reported substantial AI contributions to their growth rates.

AWS, for example, sees a multi-billion-dollar contribution in AI revenue that is reportedly growing more than 100% year over year based on their most recent quarterly results. While still a small portion of overall sales, the growth trajectory is meaningful.

Beyond cloud providers, companies like Datadog have benefited from the infrastructure boom. As an observability platform, Datadog monitors AI operations in the cloud by tracking performance each time a model generates content. This creates a revenue stream that scales directly with AI usage growth.

Meta also monetizes AI indirectly. The company has limited disclosure but uses internal AI capabilities to improve ad placement, targeting, and auction density, which the company says contributes to advertising growth and scale.

Early signs in software: The application layer

The application layer remains early stage but shows signs of monetization potential, particularly for enterprise software companies enhancing their offerings with AI.

ServiceNow stands out as an example of a company successfully integrating AI with its workflow automation solutions. At its recent investor day, the company announced expectations to reach $1 billion in annual contracted revenue by 2026, a significant milestone for a pure software company.

Other examples of enterprise software companies rolling out AI features include Salesforce’s AI-powered “Agentforce” and HubSpot’s AI-driven marketing tools. However, these remain in the adoption phase, with limited revenue generation to date. Both Salesforce and HubSpot are focused on driving user engagement first to gain traction, then layering in pricing.

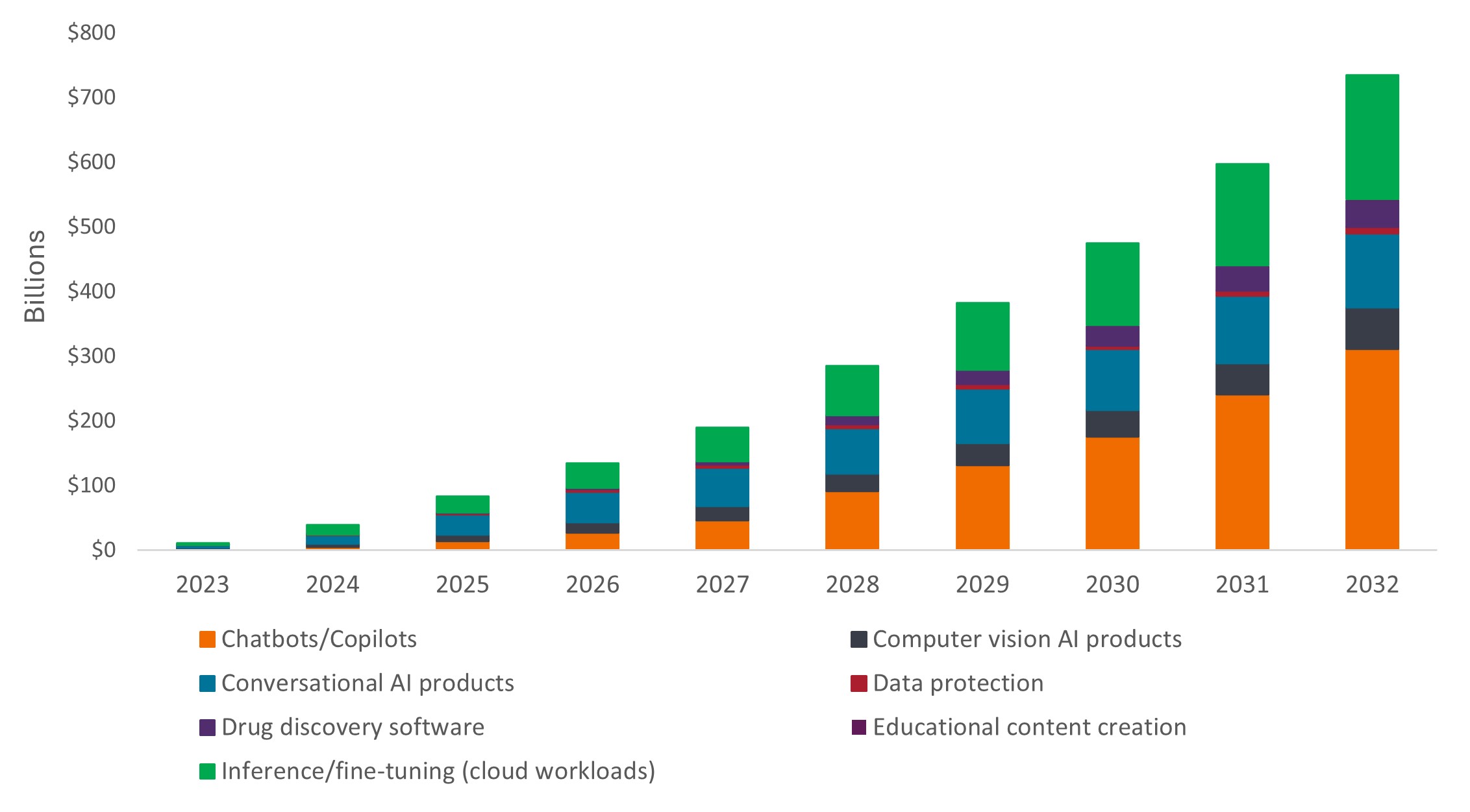

Figure 1: GenAI inference revenue forecast

Looking across a range of Generative AI (GenAI) inference software applications and devices, revenue projections are strongest for chatbots, but robust growth is expected broadly.

Source: Bloomberg Intelligence, as at 6 May 2025. No forecasts can be guaranteed.

Improving monetization frameworks

B2C versus B2B

Currently, most near-term AI monetization is concentrated in business-to-business (B2B) use cases. The consumer space is led through subscription offerings by companies like OpenAI, though we’re watching how public companies like Alphabet (Google Gemini) and Microsoft (Copilot) evolve their consumer-facing AI offerings. Thus far, the revenue impact is small relative to their overall business.

B2B applications currently offer a wide variety of investment opportunities. Companies of various sizes and industries are integrating AI capabilities into their core offerings. For example, Axon – known for tasers and body cameras – uses AI to optimize recording decisions and incident reviews, showing how AI monetization extends beyond traditional software into specialized industrial applications.

Platform versus point solutions

Single-feature AI firms face pressure from both established competitors and startups that could replicate their functionality. Platform companies, on the other hand, could benefit from multiple monetization paths, stronger moats, and existing customer relationships that enable faster adoption of new AI features. As such, we believe broad platform companies have competitive advantages over point solutions.

Pricing strategies

Pricing strategies are evolving, too. Hybrid models now combine consumption-based pricing and subscription fees. ServiceNow, for instance, charges additional fees for AI capabilities, with some customers spending 60% more for upgraded AI features. This hybrid approach allows companies to capture value from AI features without overhauling existing revenue models.

We expect this hybrid pricing structure to continue as more companies integrate AI capabilities into existing platforms, providing a sustainable path to monetize AI investments while maintaining established customer relationships.

Untapped potential: Data-rich companies

As the AI opportunity expands from facilitators to users, data-rich companies have the potential to distinguish their business models. We believe companies with significant data assets could translate their scale into structural revenue benefits. For instance, with their comprehensive customer data, organizations like Booking Holdings and Amazon could create more personalized and valuable AI experiences, but execution is key. Also, with increasing concerns around data privacy, large first-person datasets are gaining importance.

Careful selection as AI monetization develops

While revenue streams are emerging, the market trajectory of AI monetization remains unclear, requiring patience and selective investment as opportunities mature. We are excited about the broadening of investment opportunities, and we see value in companies with clear competitive advantages that can turn AI capabilities into durable revenue.

As with past tech cycles, eventual winners will likely include established players that successfully adapt, as well as new entrants not yet known. As the AI opportunity expands across the ecosystem, investors gain more pathways to capture secular growth from what we believe will be an enduring technological shift.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- The Fund follows a growth investment style that creates a bias towards certain types of companies. This may result in the Fund significantly underperforming or outperforming the wider market.