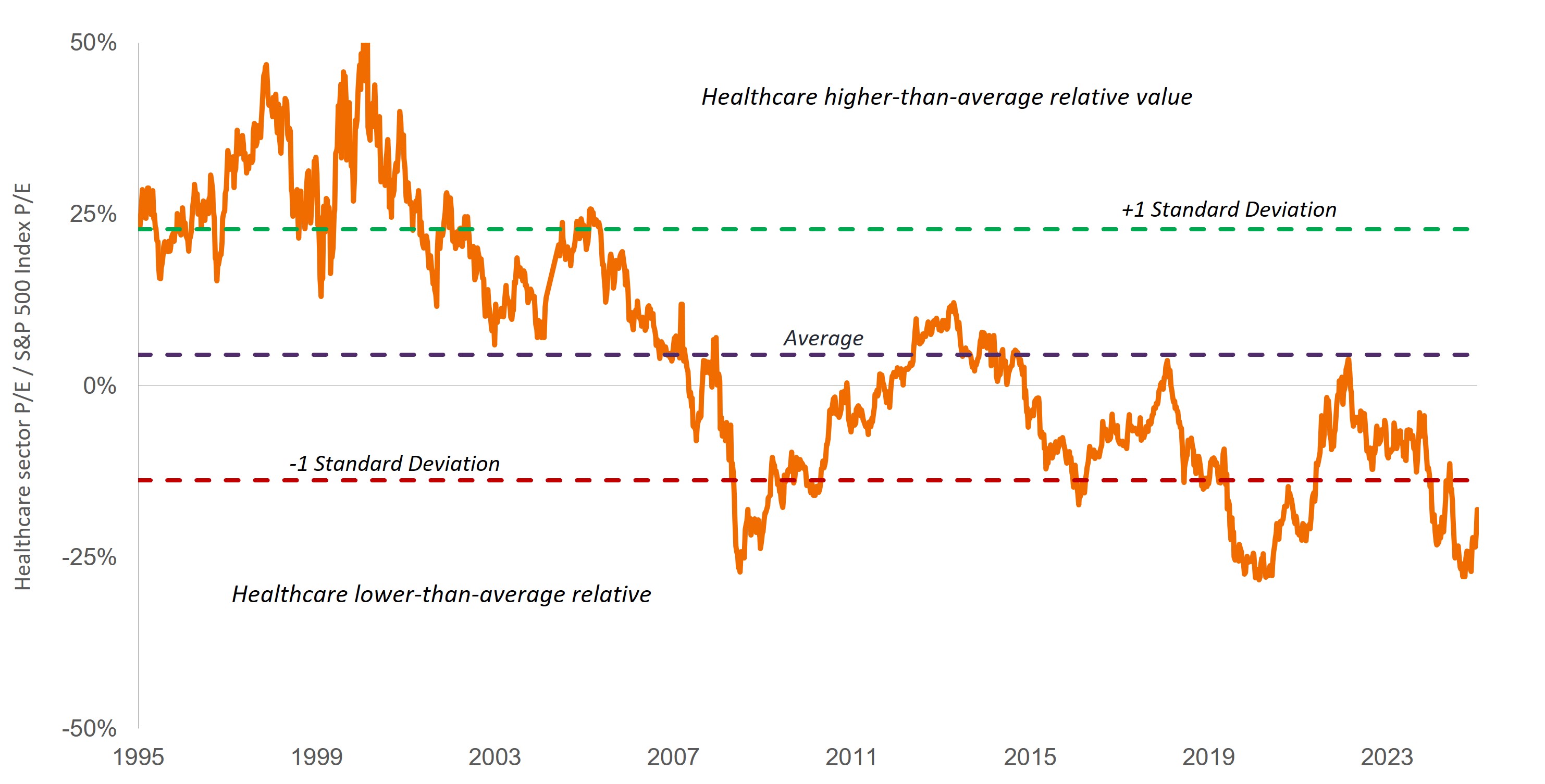

For much of the past year, policy uncertainty has dominated the healthcare sector, leading to a period of underperformance that has resulted in some of the lowest relative price-to-earnings (P/E) ratios in the sector’s history (Exhibit 1).

But as we turn the page on a new year, some regulatory risks have started to ease. Investors, for one, now see a way around onerous pharmaceutical tariffs and have better clarity on drug pricing reform. The Food and Drug Administration (FDA) has also proven its support for a strong U.S. biopharma industry, having largely met review deadlines in 2025 and introduced new programs for accelerating drug approvals.

On top of that, medical advances have continued, benefitting from innovative new drug modalities and technologies. It’s a setup that we believe could lead to strong risk/reward opportunities for certain areas of healthcare in 2026. Here’s where we think investors should look.

Exhibit 1: Healthcare stocks have become deeply discounted, creating room for potential upside

Relative price-to-earnings (P/E) ratio of healthcare stocks to the S&P 500® Index

Source: Bloomberg, data from 10 November 1995 to 14 November 2025. P/Es are based on forward, 12-month estimated earnings. Healthcare represents the S&P 500 Health Care Sector, which comprises those companies included in the S&P 500 that are classified as members of the GICS health care sector.

Emerging biotech

Small- and mid-cap biotech companies bore the brunt of policy concerns for most of 2025, as worries mounted about the future direction of the FDA and the potential for steep pharmaceutical tariffs and most favored nation drug pricing (which would align U.S. drug prices with those of other wealthy nations). Stocks of emerging biotech stocks sold off, with one index of small- and mid-cap biotechs declining by more than -40% in the first part of the year.1

But since early April, the subsector has been rebounding and is now on track to finish 2025 with double-digit gains. Aiding in that recovery is evidence that despite budget and staffing cuts, the FDA has generally managed to function as usual and has even introduced new programs to fast-track drug development. In addition, a deal reached between Pfizer and the White House – in which Pfizer committed to additional capital spending and discounting select drugs in the U.S. – showed that options were available for the industry to avoid the most draconian tariff and drug pricing proposals.

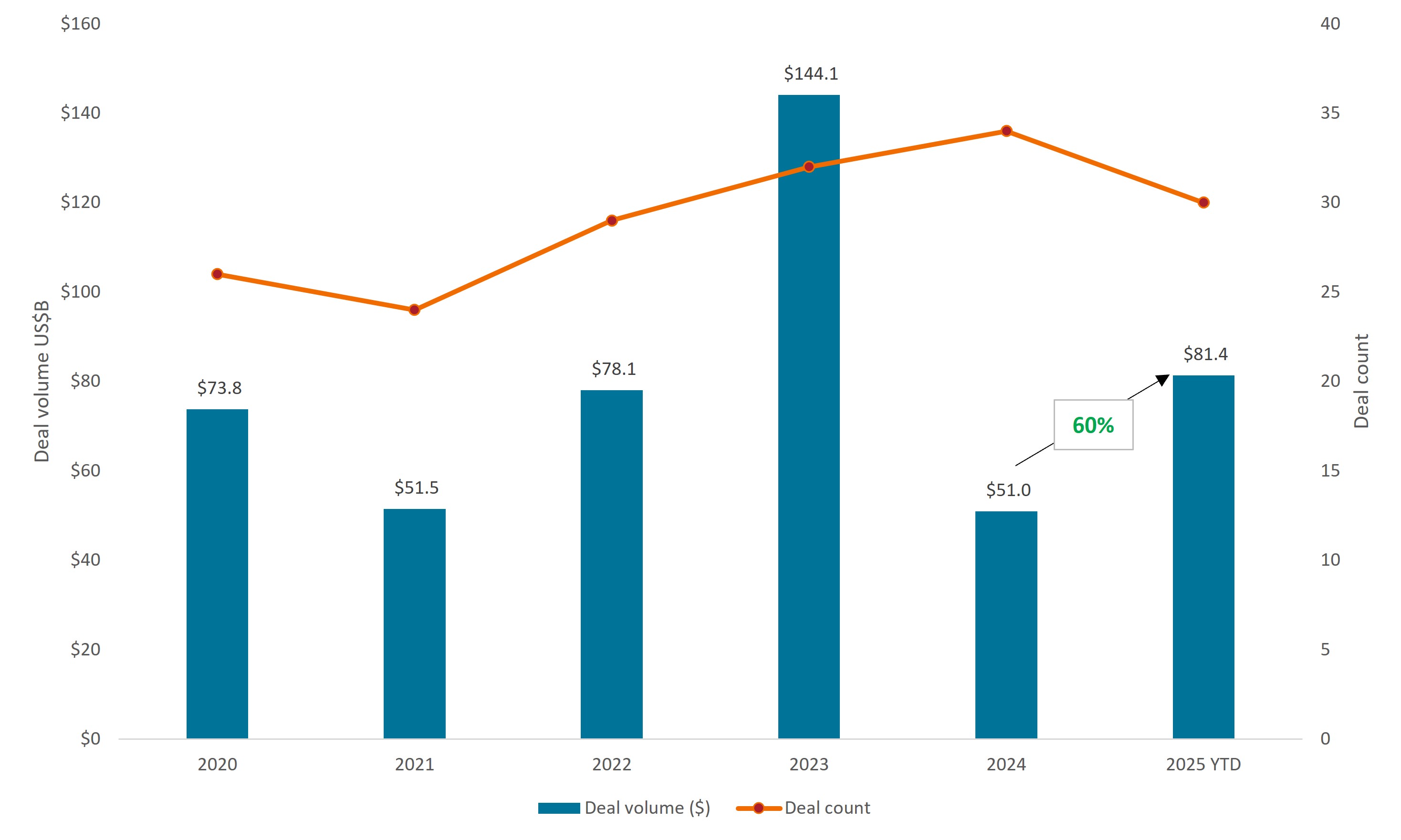

We think the momentum could continue into next year. Even as biotech stocks have recovered, the sector remains a long way from retracing highs hit in early 2021. Declining interest rates could also boost investors’ appetite for longer-duration assets, such as biotech, as well as make mergers and acquisitions (M&A) easier to finance. Indeed, for 2025, M&A activity in biotech has already surpassed that of 2024 (Exhibit 2) and could maintain its pace into 2026, as large-cap pharma faces pressure to replace hundreds of billions of dollars in drug revenues that will lose patent protection in the coming years.

Exhibit 2: M&A activity on the rise in biotech

Source: LifeSci Capital, as of 30 September 2025.

Small- and mid-cap biotech companies could be outsized beneficiaries of that M&A. Today, these firms are developing most new breakthrough medicines, and in 2025, made up 57% of the sector’s acquisition targets.1

Tight capital markets have also made for a leaner, more disciplined industry. There were 21% fewer public biotechs in 2025 than almost four years ago. Companies that remain have survived by focusing on innovative science and delivering positive clinical data. In fact, 82% of public biotech companies are now estimated to have “very good” drug pipelines, or therapies under development that hold the potential to meaningfully improve the standard of care in their disease category. In 2022, that figure was only 47%.2

Evidence of this innovation was seen throughout the past year, including the first new mechanism of action to be approved in decades for schizophrenia, the first-ever treatments for MASH (fatty liver disease) and Prader-Willi syndrome (a rare genetic disease that impairs children’s development), novel drugs for cardiomyopathy caused by TTR amyloidosis, and the first approved treatment for the lung disease bronchiectasis.

This improvement in pipeline development is translating into higher potential earnings, as more and more therapies see strong uptake by patients. Between 2017 and 2024, only about 20% of companies in the S&P Biotechnology Select Industry Index3 were profitable, according to one industry report. By 2027, that figure could nearly double to 38%4 – a fact that could become increasingly hard for the market to ignore.

Diversified pharmaceutical firms

As with biotech, pharmaceutical stocks have rallied in recent months as the scope of drug pricing reform and tariffs have become clearer. Overall, the impact to pharma profit margins from these new policies appears manageable so far, especially in cases where lower prices could be offset by higher sales volumes.

Eli Lilly and Novo Nordisk, for example, recently agreed to lower the cost of their market-leading GLP-1 weight loss drugs for government insurance programs and direct out-of-pocket sales to consumers. The new list prices will range from roughly $149 to $350 per month, down from as much as $1,000-plus. But in return, the therapies will become eligible for coverage by Medicare and Medicaid, the government health programs that insure roughly 120 million people in the U.S. In addition, Eli Lilly and Novo received new “Commissioner’s National Priority Vouchers” from the FDA for oral versions of their GLP-1s currently under development, which could accelerate their launches into the first half of 2026.

With pricing pressures likely to persist in 2026 and some $300 billion in drug revenues facing patent expirations between now and 2030,6 we believe it is important to focus on pharmaceutical firms that are building diversified pipelines of new and advanced medicines. Companies that are doing so have, in our view, an opportunity to take market share – especially in rapidly growing end markets, such as oncology, obesity, and other chronic conditions – and to protect profit margins by leveraging their sizable manufacturing capabilities. We also believe these firms’ robust balance sheets and strong free cash flow generation could increasingly stand out should rising stock valuations and an uncertain economic outlook drive investors to diversify into more defensive areas of the market.

Insurers repositioning for earnings growth

Managed care companies have also faced regulatory hurdles, including uncertainty around reimbursement rates in Medicare Advantage (a private version of the government program for seniors), patient eligibility for Medicaid, and concerns about affordability in the individual marketplace (with subsidies for Affordable Care Act (ACA) plans the main sticking point in the recent U.S. government shutdown). Rising medical costs have also weighed on insurers’ profit margins, as medical utilization rebounded more than expected following the Covid pandemic.

As a result, valuations for managed care stocks have fallen to some of their lowest levels in decades. We think that creates an opportunity for long-term investors who can be selective. While uncertainty around federal funding for Medicaid and the ACA creates near-term risks for companies in these markets, insurers levered to Medicare Advantage have more positive tailwinds. For one, these firms have repriced their policies for 2026 and adjusted benefit offerings in response to higher costs and lower reimbursement rates. Cost-cutting has also been a focus and contributed to several insurers raising earnings guidance for 2026.

We believe valuations have yet to fully reflect these efforts and are overlooking other long-term growth drivers, such as value-based care initiatives and rising Medicare Advantage enrollment. In our view, that makes for a compelling risk/reward opportunity for investors, especially those with a multiyear time horizon.

Medtech and tools firms with new product cycles, revived orders

Medical device makers have not dodged tariff uncertainty, with the Trump administration announcing in late September that it was launching a study of medtech supply chains before potentially introducing industry-specific tariffs. Supply chain disruptions and higher input costs have also been headwinds for the group in 2025.

But if the experience of the pharma industry is any guide, we believe investors should not rush to conclusions and that regulatory compromises can be reached. Meanwhile, many firms within the industry are seeing double-digit revenue growth from new product launches in cardiovascular disease and diabetes, two large and growing end markets. In addition, life sciences tools firms have benefited from rising orders as its biggest customer – the pharmaceutical industry – returns to a positive operating environment amid tariff and drug pricing clarity. Once again, we think it is a compelling risk/reward balance for investors who can be selective.

1 Bloomberg, from 31 December 2024 to 8 April 2025. Based on the LifeSci Biotechnology Clinical Trials Index, which tracks the performance of select clinical trials stage biotechnology companies.

2 J.P. Morgan, as of 30 September 2025.

3 Stifel, as of 16 September 2025.

4 The S&P Biotechnology Select Industry Index represents the biotechnology sub-industry portion of the S&P Total Markets Index.

5 Cantor, The XBI may FINALLY be poised to Deliver—Here’s why, as of 27 August 2025.

6 Evaluate, Portfolio tactics to scale the $300bn patent cliff, as of 13 October 2025.

Free cash flow (FCF) yield is a financial ratio that measures how much cash flow a company has in case of its liquidation or other obligations by comparing the free cash flow per share with the market price per share and indicates the level of cash flow the company will earn against its share market value.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

The S&P Biotechnology Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS Biotechnology sub-industry.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.