While we apply a bottom-up stock picking process it is important to have a macro view overlay to guide us on portfolio construction. The rate of change, whether it is societal, geopolitical, or technological continues to increase exponentially and this argues for active management over passive. There are three key macro topics that we are watching particularly closely as we move towards 2026. The first is everyone’s favorite topic of artificial intelligence (AI). The second is the overall health of the economy and what we expect to see from the Trump administration. And last but not least is private credit.

Why AI is not a bubble

First on AI, no, it is not a bubble. Yes, there will be some misallocation of capital and an ensuing market downturn sometime in the next five years just as we have seen with every new technology going back hundreds of years. We acknowledge the non-zero probability that large language models (LLMs) prove to be a dead end to true artificial general intelligence (AGI); however, we are also comforted by our meetings with companies that are citing use cases that are already driving significant costs savings.

We do not think AI is currently in a bubble, because ultimately it comes down to supply and demand. Unlike the commercial internet where you just dug a hole and laid some fiber, AI compute is infinitely more physically challenging to incrementally produce. To provide perspective, to produce a one-gigawatt (GW) data center that will run LLMs, it requires six football fields of land along with over 200,000 tons of equipment such as cables, heating, ventilation and air conditioning (HVAC), transformers, etc.1 There are legitimate questions around if we even have enough electricity and skilled tradespeople to address a fraction of the tens of GWs of data centers that have been announced.

On the demand side, anecdotes suggest a waiting list of 20 different customers for each newly installed Nvidia graphics processing unit (GPU) at a data center. We will continue to pay close attention to companies addressing key bottlenecks (such as Nvidia, Prysmian, Schneider) that are acting as a governor on the adoption of AI. Further, we will continue to remain vigilant to AI exposed companies where valuations may be implying too optimistic of a scenario while also taking advantage of any irrational selloffs in AI exposed names. We feel that we are still early in the AI capital expenditure (capex) cycle and there is still significant outperformance to be had by investing in this space.

Running the economy hot: fiscal and monetary support ahead

On the topic of the U.S. and global economy, while there are certainly some wobbles in the consumer spending and confidence (particularly the bottom 80%) we expect significant fiscal and monetary support taking hold over the next five months. Indications are that Trump is going to run the economy hot through the mid-term election a year from now. We should expect significant tax refunds both for individuals and corporations in the first few months of next year due to the One Big Beautiful Bill (OBBB). We should also expect other initiatives from the Trump administration focused on bringing down costs in housing and healthcare along with the possibility of some form of helicopter money (US$2,000 has been floated as a giveaway to those making US$100,000 or less). Finally, we expect the U.S. Federal Reserve and U.S. Treasury to work in coordination and independently in bringing down interest rates and Treasury bill price volatility. All of this should be supportive of the economy and asset prices.

For the stock market, in the short term, liquidity is one of the biggest drivers of performance and we should expect other countries to get involved as well. We are starting to see signs that China will implement further initiatives to support the local property market while Japan is proposing the most Federal spending since the pandemic. All of this is probably inflationary and one of the best defenses is to own finite assets like equities. We have a bias toward investing in companies that help to drive efficiencies in society and are thus deflationary. In our view, these companies should do well in an inflationary environment.

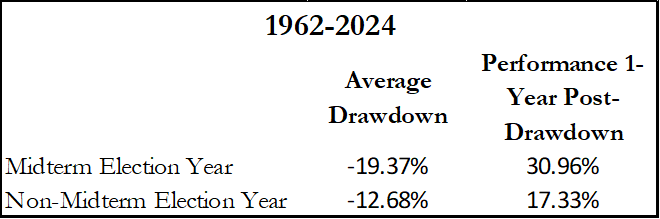

With all of that said, next year is a mid-term election year which has historically brought about greater equity market volatility. The average peak-to-trough decline within the S&P 500 during an election year has been almost 20% going back to 1962. The good news is that these declines represent great buying opportunities as the 1-year return following these market troughs has averaged 31%. We again look forward to taking advantage of this volatility.

Exhibit 1: S&P 500 price return 12-month period following a mid-term election

Source: Strategas, as at 25 November 2025.

Why we’re steering clear of leverage in an uncertain credit landscape

Regarding the last topic of private credit, this may not be a story specific to 2026, but it is worth noting given the events around the First Brands and TriColor scandals this year.

Having gone through a couple of credit cycles in our careers, we have started to get a sense of déjà vu. What is different this time is that it appears that more of the risk has moved to cashflow-driven direct lending private credit and away from the banks (although banks may not be immune as roughly 10% of their U.S. loans are now to non-bank financial institutions). Unfortunately, given not all private credit is transparent, this means that the market will have much less early warning if something is wrong.

Private credit is of course not all created equal. Some private credit and private equity houses have historically boasted about their high sharpe ratios and low volatility in underlying asset prices. But in certain instances, this was a function of and not having to worry about marked-to-market valuations.

Some private credit houses have also enlisted other questionable strategies such as payment in kind (PIK) and maturity extensions. Banks have never had that privilege and thus we started to see warning signs on credit in 2006 and 2007.

What we find concerning in pockets of private credit, along with the above tactics, is the potential conflict of interest as it is estimated that between 70% and 80% private credit loans have the same private equity sponsor. We are starting to see credit risk increase with a recent example of Renovo, a private equity backed home improvement contractor that went bankrupt and reported only US$50,000 in assets versus US$150 million in private credit loans.

In 2026 there will be a need to look beneath the bonnet at the robustness of private credit processes, particularly in the diverse direct lending arena. In a scenario where there is a downturn in credit, investors will be well served by avoiding excessive balance sheet leverage and owning companies with mission critical products and services that tend to be more immune to economic downturns.

Conclusion: Be prepared to benefit from disruption

In an environment defined by accelerating change and heightened uncertainty, we believe there will be a clear need for disciplined bottom-up stock selection, combined with a thoughtful macro-overlay. This should be focused on identifying companies that are both resilient and aligned with long-term structural trends.

By actively navigating opportunities in AI, remaining vigilant on economic policy shifts, and avoiding any hidden risks in private credit, our aim will be to capitalize on volatility rather than be constrained by it. History shows that periods of disruption create some of the most compelling investment opportunities – and investors should be prepared to seize them.

1Citrini, ‘Stargate: A Citrini Field Trip’, (7 November 2025).

Active investing: An investment management approach where a fund manager actively aims to outperform or beat a specific index or benchmark through research, analysis, and the investment choices they make. The opposite of passive investing.

Artificial General Intelligence (AGI): A form of AI with the ability to understand, learn, and apply knowledge in a way that is indistinguishable from a human.

Artificial Intelligence (AI): The simulation of human intelligence in machines that are programmed to think and learn.

Balance sheet leverage: The use of borrowed funds in addition to equity to finance the purchase of assets.

Bottom-Up stock picking: An investment strategy that focuses on analyzing individual stocks and their fundamentals rather than considering broader economic or market factors.

Capital expenditure: Money invested to acquire or upgrade fixed assets such as buildings, machinery, equipment, or vehicles in order to maintain or improve operations and foster future growth.

Helicopter money: A type of monetary policy that involves printing large sums of money and distributing it to the public to stimulate the economy.

Inflation: The rate at which the prices of goods and services are rising in an economy. The consumer price index (CPI) and retail price index (RPI) are two common measures; the opposite of deflation.

Large Language Models (LLMs): A type of AI model that is trained to understand and generate human language text.

Liquidity/Liquid assets: Liquidity is a measure of how easily an asset can be bought or sold in the market. Assets that can be easily traded in the market in high volumes (without causing a major price move) are referred to as ‘liquid’.

Midterm Election: An election that occurs in the middle of a president’s term, often leading to changes in the composition of Congress.

The One Big Beautiful Bill (OBBB) is a major U.S. federal statute enacted on 4 July 2025. The bill represents the centerpiece of President Donald Trump’s second-term legislative agenda and includes sweeping changes across tax policy, social programs, and federal spending priorities.

Passive investing: An investment approach that involves tracking a particular market or index. It is called passive because it seeks to mirror an index, either fully or partially replicating it, rather than actively picking or choosing stocks to hold. The primary benefit of passive investing is exposure to a particular market with generally lower fees than you might find on an actively-managed fund, the opposite of active investing.

Payment in Kind (PIK): A type of financing where interest payments are made in the form of additional debt rather than cash.

Pretend and Extend: A strategy used in credit markets where lenders extend the terms of a loan to delay recognising a problem loan as non-performing.

Private credit: Non-bank lending provided by private institutions, often involving loans to small and medium-sized businesses.

Sharpe ratio: This measures a portfolio’s risk-adjusted performance for the purpose of measuring how far a portfolio’s return can be attributed to fund manager skill as opposed to excessive risk taking. A high Sharpe ratio indicates a better risk-adjusted return.

Treasuries/US Treasury securities: Debt obligations issued by the US government. With government bonds, the investor is a creditor of the government. Treasury bills and US government bonds are guaranteed by the full faith and credit of the US government. They are generally considered to be free of credit risk and typically carry lower yields than other securities.

Valuation metrics: Metrics used to gauge a company’s performance, financial health, and expectations for future earnings, e.g. P/E ratio and ROE.

Volatility: The rate and extent at which the price of a portfolio, security, or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility, the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- The Fund follows a growth investment style that creates a bias towards certain types of companies. This may result in the Fund significantly underperforming or outperforming the wider market.