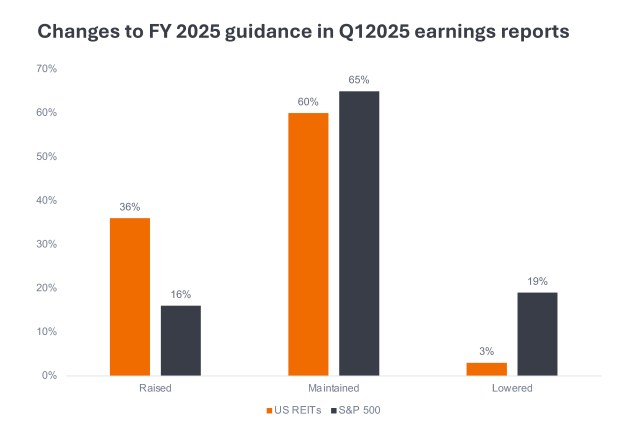

Listed REITs can offer lower volatility and better earnings visibility versus broader equities.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

How AI and accelerating technology adoption is disrupting sports.

Ali Dibadj, CEO, spoke with Richard Clode and Agustin Mohedas about AI’s potential to unlock opportunities in trillion-dollar markets.

How this year's Wimbledon championships are embracing AI.

A trip to this year’s Computex trade show in Taipei reinforced our team’s bullish view on AI.

Assessing the impact of higher mortgage rates on U.S. homeowners.

Our experts explore how the integration of financially-material ESG factors is essential for mining companies.

Companies may be staying private longer, but that doesn’t diminish opportunities to capture early-stage growth in the small-cap universe.

Scrubbing in to watch multiple pulse field ablation procedures, we learned about the benefits and risks of this exciting new treatment option for AFib patients.

The US dollar influences the EMD Hard Currency asset class, but the relationship is complicated. What are the underlying drivers of the relationship?

Low valuations, accommodative monetary policies, and fiscal spending initiatives are boosting the outlook for ex U.S. stocks.