The US non-farm payrolls figure released on 5 September reinforces expectations of a cut in interest rates by the US Federal Reserve (Fed). The net monthly rise in jobs for August was 22,000, below market expectations. The figure might not have been so bad on its own, but the breadth of job gains was narrow (predominantly healthcare, with manufacturing showing losses) and was accompanied by yet more negative revisions.

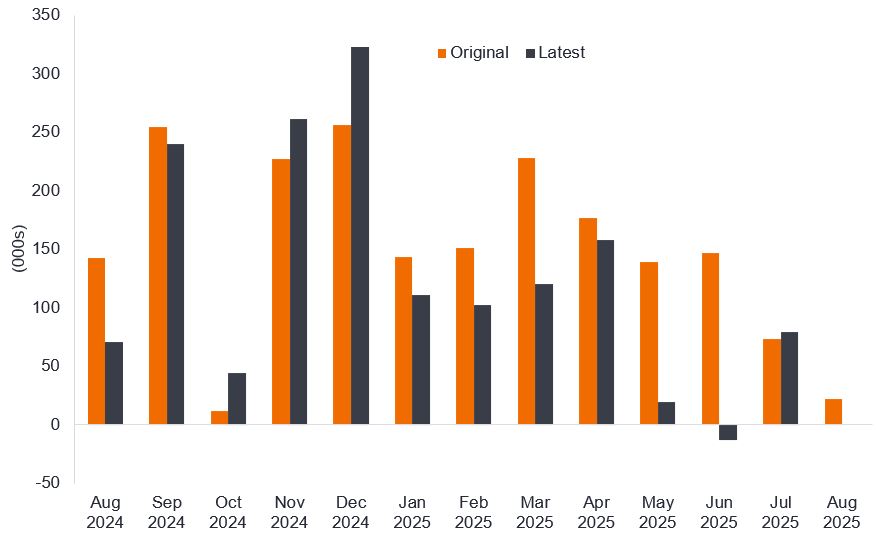

Looking at US payrolls releases from original first estimate to the latest revised figures, all but one of the months in 2025 have been revised lower this year (see Figure 1). Perhaps more significantly, we have now seen a negative print for June post revisions, so if the pattern of revisions persists then this could be true for the last three months in aggregate.

Figure 1: US payrolls monthly net change (original first estimate and latest revised figure)

Source: LSEG Datastream, BLS, original first estimate and latest revised figure, seasonally adjusted, 31 August 2024 to 31 August 2025. Note: data as at 8 September 2025. On 9 September BLS released a preliminary revision for the 12 months to March 2025, suggesting payrolls would be 911,000 lower than reported. They do not yet provide the monthly breakdown to be able to alter the chart above.

This has sparked concerns that whilst the US economy itself may continue to expand, it could be facing a ‘jobs recession’. It may be coincidence, but job gains have been weak since April’s aggressive US tariff policy. Ultimately, someone is paying the extra $94 billion that the US government has collected in tariff revenue so far this year compared with 2024.1 It is not inconceivable, therefore, that US businesses are turning to the labour market as a source of cost-cutting, or at least dialling back on hiring while they await the legalities of the tariffs.

In recent weeks, Fed Chair Jerome Powell has pivoted somewhat, moving away from the primary focus on inflation and highlighting the risks to employment, the other part of the Fed’s dual mandate. With the Fed also facing political pressure to cut rates from the White House, a window for interest rate cuts has opened, with the market anticipating the Fed policy interest rate could fall from 4.25%-4.5% at the start of September 2025 to 3%-3.25% by July 2026.2

We have already seen yields on US shorter-dated bonds (both government and corporate bonds) begin to come down and rates on cash savings and money market funds will continue to decline as rates are cut.

Will the ECB follow the Fed?

Of course, the Fed does not dictate monetary policy globally. Central banks elsewhere chart their own course, but directionally it can have a bearing. The Fed cutting rates will narrow the gap between US and European rates. A weaker US labour market may ring alarm bells about the resilience of growth more globally, even if for now that seems to be holding up.

The European Central Bank (ECB), in our view, is most likely to keep rates on pause at its September meeting, with the deposit rate staying at 2%. European government and defence spending is providing some support for European economies, but the costs of tariffs on exporters and inflation close to its 2% target mean the ECB will want to retain the option to cut interest rates in coming months should risks to growth emerge.

Locking in yields

In our view, this seems like an opportune time for investors to lock in yields on short-dated global corporate bonds, ahead of further interest cuts in the US and potentially elsewhere. We see the additional yield that investment grade corporates pay over government bonds of the same maturity as being attractive and worth harvesting. Corporates have, in the main, been resilient – earnings increased by 13.3% in the US and by 4.3% in Europe in the second quarter of 2025 compared with the same period a year earlier.3 Most companies are therefore in a strong position to meet their payments to bondholders.

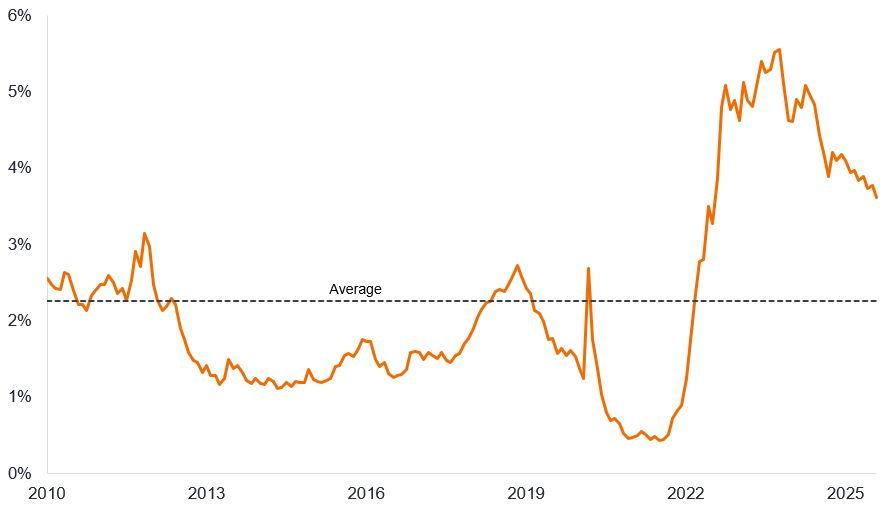

We recognise that inflation could yet be a problem and the Fed faces treading a fine line between cutting rates to support the labour market while avoiding reigniting inflation. Investors who want to avoid speculating on the direction of yields further along the yield curve should consider less rate-sensitive shorter-dated bonds. Shorter-dated investment grade corporate bonds, i.e. those with maturities of one to three years carry relatively low interest rate risk (price sensitivity to changes in interest rates), yet are on average offering yields of around 3.5%, which is well above the average of the last 15 years (see Figure 2).

Figure 2: Yield on the ICE BofA 1-3 Year Global Corporate Index

Source: Bloomberg, ICE BofA 1-3 year Global Corporate Index, 31 January 2010 to 31 August 2025. The yield shown is the yield to worst, which is the lowest yield a bond with a special feature (such as a call option) can achieve provided the issuer does not default. When used to describe an index, this statistic represents the weighted average across all the underlying bonds held. Yields may vary over time and are not guaranteed. Past performance does not predict future returns.

Investors could seek to lock in today’s yield by buying an individual bond, but we think that a fixed maturity bond fund could be a less risky route. Just like an individual bond it has a regular coupon and fixed maturity date but comes with the added benefit of diversification across a portfolio of bonds. Furthermore, credit selection is undertaken by a team of experts, who will monitor the portfolio throughout its fixed term, helping to avoid default risk and maximise the yield.

1Source: Politico, “Trump tariff income tracker”, cumulative year to date total versus 2024, 3 September 2025.

2Source: Bloomberg, World Interest Rate Probability, 8 September 2025. There is no guarantee that past trends will continue, or forecasts will be realised.

3Source: LSEG I/B/E/S, US S&P 500 earnings rose 13.3% in Q2 2025 v Q2 2024 with 496 out of 500 companies having reported at 5 September 2025. European STOXX 600 earnings rose 4.3% in Q2 2025 v Q2 2024, with 280 out of 600 companies having reported at 2 September 2025.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Please note that diversification neither assures a profit nor eliminates the risk of experiencing losses.

The ICE BofA 1-3 Year Global Corporate Bond Index tracks the performance of investment grade corporate debt publicly issued in the major domestic and Eurobond markets, with a remaining term to final maturity less than 3 years.

Corporate bond: A bond issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue on the maturity date.

Credit rating: A score given by a credit rating agency such as S&P Global Ratings, Moody’s and Fitch on the creditworthiness of a borrower. For example, S&P (Moody’s) ranks investment grade bonds from the highest AAA (Aaa) down to BBB (Baa3) and high yields bonds from BB (Ba1) through B (B1) down to CCC (Caa1) in terms of declining quality and greater risk, i.e. CCC rated borrowers carry a greater risk of default.

Credit spread: The difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario.

Federal Reserve (Fed): The central bank of the US which determines its monetary policy.

High yield bond: Also known as a sub-investment grade bond, or ‘junk’ bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Inflation: The rate at which prices of goods and services are rising in the economy.

Interest rate risk or Duration: A measure of the sensitivity of a bond’s price to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa. Bond prices rise when their yields fall and vice versa.

Investment grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Maturity: The maturity date of a bond is the date when the principal investment (and any final coupon) is paid to investors. Shorter-dated bonds generally mature within 5 years, medium-term bonds within 5 to 10 years, and longer-dated bonds after 10+ years.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money.

Tariff: A tax or duty imposed by the government of one country on the import of goods from another country.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate.

Yield curve:A graph that plots the yields of government bonds against their maturities. Normally, the yield curve is upward sloping, where yields for shorter-maturity bonds are lower than yields for bonds with a longer maturity.

Yield to worst: The lowest yield a bond (index) can achieve provided the issuer(s) does not default; it takes into account special features such as call options (that give issuers the right to call back, or redeem, a bond at a specified date).

Volatility measures risk using the dispersion of returns for a given investment. The rate and extent at which the price of a portfolio, security or index moves up and down.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Non vi è alcuna garanzia che le tendenze passate continuino o che le previsioni si realizzino.

Comunicazione di Marketing.

Important information

Please read the following important information regarding funds related to this article.

- Gli emittenti di obbligazioni (o di strumenti del mercato monetario) potrebbero non essere più in grado di pagare gli interessi o rimborsare il capitale, ovvero potrebbero non intendere più farlo. In tal caso, o qualora il mercato ritenga che ciò sia possibile, il valore dell'obbligazione scenderebbe.

- L’aumento (o la diminuzione) dei tassi d’interesse può influire in modo diverso su titoli diversi. Nello specifico, i valori delle obbligazioni si riducono di norma con l'aumentare dei tassi d'interesse. Questo rischio risulta di norma più significativo quando la scadenza di un investimento obbligazionario è a più lungo termine.

- Il Fondo investe in obbligazioni ad alto rendimento (non investment grade) che, sebbene offrano di norma un interesse superiore a quelle investment grade, sono più speculative e più sensibili a variazioni sfavorevoli delle condizioni di mercato.

- Alcune obbligazioni (obbligazioni callable) consentono ai loro emittenti il diritto di rimborsare anticipatamente il capitale o di estendere la scadenza. Gli emittenti possono esercitare tali diritti laddove li ritengano vantaggiosi e, di conseguenza, il valore del Fondo può esserne influenzato.

- Il Fondo potrebbe usare derivati al fine di conseguire il suo obiettivo d'investimento. Ciò potrebbe determinare una "leva", che potrebbe amplificare i risultati dell'investimento, e le perdite o i guadagni per il Fondo potrebbero superare il costo del derivato. I derivati comportano rischi aggiuntivi, in particolare il rischio che la controparte del derivato non adempia ai suoi obblighi contrattuali.

- Qualora il Fondo detenga attività in valute diverse da quella di base del Fondo o l'investitore detenga azioni o quote in un'altra valuta (a meno che non siano "coperte"), il valore dell'investimento potrebbe subire le oscillazioni del tasso di cambio.

- Se il Fondo, o una sua classe di azioni con copertura, intende attenuare le fluttuazioni del tasso di cambio tra una valuta e la valuta di base, la stessa strategia di copertura potrebbe generare un effetto positivo o negativo sul valore del Fondo, a causa delle differenze di tasso d’interesse a breve termine tra le due valute.

- I titoli del Fondo potrebbero diventare difficili da valutare o da vendere al prezzo e con le tempistiche desiderati, specie in condizioni di mercato estreme con il prezzo delle attività in calo, aumentando il rischio di perdite sull'investimento.

- Le spese correnti possono essere prelevate, in tutto o in parte, dal capitale, il che potrebbe erodere il capitale o ridurne il potenziale di crescita.

- Oltre al reddito, questa classe di azioni può distribuire plusvalenze di capitale realizzate e non realizzate e il capitale inizialmente investito. Sono dedotti dal capitale anche commissioni, oneri e spese. Entrambi i fattori possono comportare l’erosione del capitale e un potenziale ridotto di crescita del medesimo. Si richiama l’attenzione degli investitori anche sul fatto che le distribuzioni di tale natura possono essere trattate (e quindi imponibili) come reddito, secondo la legislazione fiscale locale.