As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

US–EU tensions escalate as new US tariffs prompt European unity and raise market escalation risks.

Considering the impact on oil prices and energy stocks from the U.S. removal of Nicolás Maduro.

What are the implications for risk appetite, emerging markets and geopolitics after Trump’s ousting of Venezuela’s Maduro?

What will U.S. action and the presidential change in Venezuela mean for investors?

In their 2026 outlook, Lucas Klein and Marc Pinto discuss how AI and structural reforms, especially in Europe, present opportunities for selective investors.

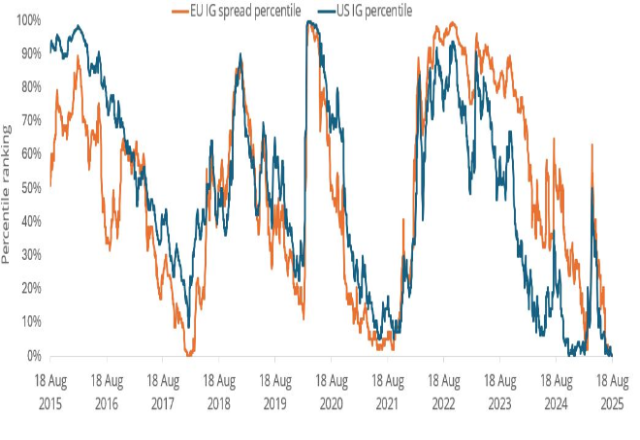

Alex Veroude explains why the credit cycle in fixed income still has further to run in 2026, but investors should build some resilience into their portfolios.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

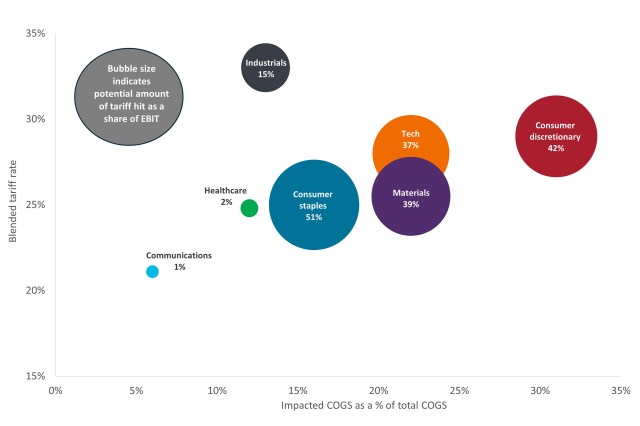

U.S. companies have thus far withstood the Trump administration’s barrage of tariffs, but signs of stress are emerging in the most exposed sectors.

Diverging economic trajectories in Europe provide fixed income investors an opportunity to tailor duration and credit exposure based on local conditions.

The grind tighter in credit spreads has continued unabated. How can investors navigate this environment as uncertainties remain?